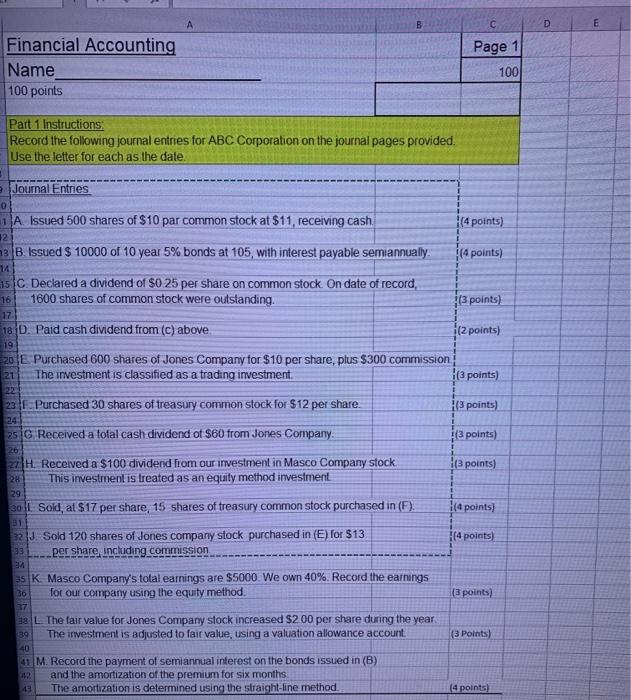

Question: i need help solving these, please add step by steps. D E Financial Accounting Name 100 points Page 1 100 Part 1 Instructions: Record the

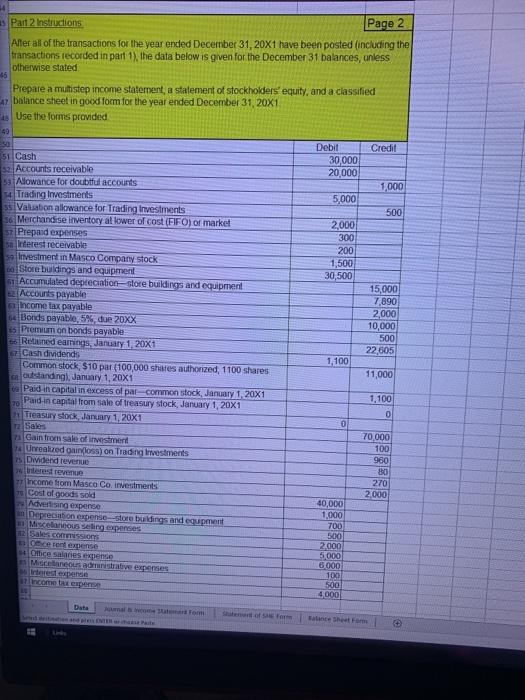

D E Financial Accounting Name 100 points Page 1 100 Part 1 Instructions: Record the following journal entries for ABC Corporation on the journal pages provided Use the letter for each as the date. Journal Entries 0 1A. Issued 500 shares of $10 par common stock at $11, receiving cash. (4 points) 2 14 16 17 19 3 B. Issued $ 10000 of 10 year 5% bonds at 105, with interest payable semiannually. (4 points) 15 c Declared a dividend of $0 25 per share on common stock. On date of record, 1600 shares of common stock were outstanding. (3 points) 18 D. Paid cash dividend from (C) above (2 points) 20 E Purchased 600 shares of Jones Company for $10 per share, plus $300 commission The investment is classified as a trading investment. (3 points) 22 23 E. Purchased 30 shares of treasury common stock for $12 per share (3 points) 25 G Received a fofal cash dividend of $60 from Jones Company. (3 points) H Received a $100 dividend from our investment in Masco Company stock (3 points) This investment is treated as an equity method investment 24 26 2H 29 (4 points 30 || Sold, at $17 per share, 15 shares of treasury common stock purchased in (F). 22 J. Sold 120 shares of Jones company stock purchased in (E) for $13 per share including commission (4 points) 33 M (3 points) 35 K Masco Company's total earnings are $5000 We own 40%. Record the earnings 36 for our company using the equity method. de L The fair value for Jones Company stock increased $200 per share during the year, The investment is adjusted to fair value, using a valuation allowance account 40 41 M. Record the payment of semiannual interest on the bonds issued in (B) and the amortization of the premium for six months 43 The amortization is determined using the straight-line method 39 (3 Points) 12 (4 points) Page 2 300 Part 2 Instructions After all of the transactions for the year ended December 31, 20X1 have been posted (including the transactions tecorded in part 1), the data below is given for the December 31 balances, unless otherwise stated 5 Prepare a multistep income statement, a statement of stockholders' equity, and a classified 47 balance sheet in good form for the year ended December 31, 20X1 Use the forms provided 49 Debit Credit 51 Cash 30,000 $2 Accounts receivable 20,000 flowance for doubtful accounts 1,000 Trading Investments 5,000 ss Valuabon allowance for Trading Investments 500 36 Merchandise inventory at lower of cost (FIFO) or market 2,000 s Prepaid expenses si Interest receivable 200 sa Investment in Masco Company stock 1,500 Store buldings and equipment 30,500 51 Accumulated depreciation store buildings and equipment 15,000 Accounts payable 7,890 Income tax payable 2,000 64 Bonds payable, 5% due 20XX 10,000 85 Premium on bonds payable 500 Relined earnings, January 1, 20X1 22,605 67 Cash dividends 1,100 Common stock, $10 par (100,000 shares authorized, 1100 shares 11,000 GoutstandingJanuary 1, 20X1 Paid in capital in excess of par common stock, January 1, 20X1 1.100 70 Paid-in capital from sale of treasury stock, January 1, 20X1 0 Treastry stock, January 1, 20X1 0 2 Sales 70 000 Gain from sale of investment 100 Uvealized in loss) on Trading Investments 960 75 Dividend revenue Interest revenue 80 270 Tl income from Masca Co. investments 75 Cost of goods sold 2.000 Advertising expense 40,000 1.000 Depreciation expense-store buildings and equipment Miscarousseling esperes 700 500 cert expense 2,000 4 Ohce salaries expense 5.000 6.000 100 500 4009

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts