Question: I need help solving these problems. AutoSave OFF 58 W FIN 311_Team Exam Review 2 - Saved to my Mac Home Insert Draw Design Layout

I need help solving these problems.

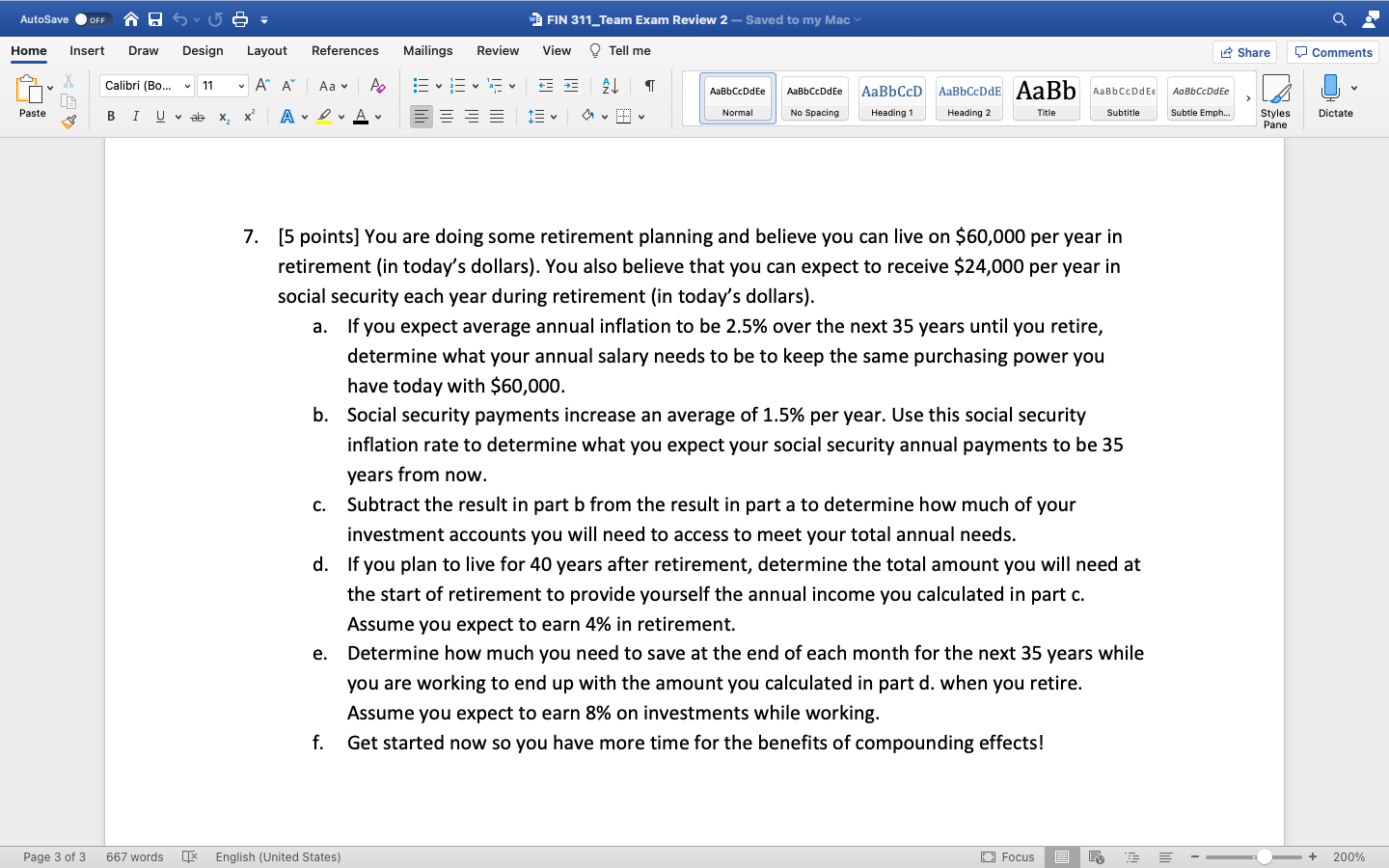

AutoSave OFF 58 W FIN 311_Team Exam Review 2 - Saved to my Mac Home Insert Draw Design Layout References Mailings Review View Tell me Share Comments Calibri (Bo... v 11 "A A AaBbCcDdEe AaBbCcDdEe AaBbCD AaBbCcDdE AaBb AaBb CcDd Ee Aa Bb CcDdEe Paste B U ab I x Normal ADA Title No Spacing x Heading 1 Heading 2 Subtitle Subtle Emph... Dictate Styles Pane a. 7. [5 points] You are doing some retirement planning and believe you can live on $60,000 per year in retirement (in today's dollars). You also believe that you can expect to receive $24,000 per year in social security each year during retirement in today's dollars). If you expect average annual inflation to be 2.5% over the next 35 years until you retire, determine what your annual salary needs to be to keep the same purchasing power you have today with $60,000. b. Social security payments increase an average of 1.5% per year. Use this social security inflation rate to determine what you expect your social security annual payments to be 35 years from now. C. Subtract the result in part b from the result in part a to determine how much of your investment accounts you will need to access to meet your total annual needs. d. If you plan to live for 40 years after retirement, determine the total amount you will need at the start of retirement to provide yourself the annual income you calculated in part c. Assume you expect to earn 4% in retirement. Determine how much you need to save at the end of each month for the next 35 years while you are working to end up with the amount you calculated in part d. when you retire. Assume you expect to earn 8% on investments while working. f. Get started now so you have more time for the benefits of compounding effects! e. Page 3 of 3 667 words English (United States) D Focus E + 200% AutoSave OFF 58 W FIN 311_Team Exam Review 2 - Saved to my Mac Home Insert Draw Design Layout References Mailings Review View Tell me Share Comments Calibri (Bo... v 11 "A A AaBbCcDdEe AaBbCcDdEe AaBbCD AaBbCcDdE AaBb AaBb CcDd Ee Aa Bb CcDdEe Paste B U ab I x Normal ADA Title No Spacing x Heading 1 Heading 2 Subtitle Subtle Emph... Dictate Styles Pane a. 7. [5 points] You are doing some retirement planning and believe you can live on $60,000 per year in retirement (in today's dollars). You also believe that you can expect to receive $24,000 per year in social security each year during retirement in today's dollars). If you expect average annual inflation to be 2.5% over the next 35 years until you retire, determine what your annual salary needs to be to keep the same purchasing power you have today with $60,000. b. Social security payments increase an average of 1.5% per year. Use this social security inflation rate to determine what you expect your social security annual payments to be 35 years from now. C. Subtract the result in part b from the result in part a to determine how much of your investment accounts you will need to access to meet your total annual needs. d. If you plan to live for 40 years after retirement, determine the total amount you will need at the start of retirement to provide yourself the annual income you calculated in part c. Assume you expect to earn 4% in retirement. Determine how much you need to save at the end of each month for the next 35 years while you are working to end up with the amount you calculated in part d. when you retire. Assume you expect to earn 8% on investments while working. f. Get started now so you have more time for the benefits of compounding effects! e. Page 3 of 3 667 words English (United States) D Focus E + 200%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts