Question: I need help solving these step by step with the labels, thank you! Required information (The following information applies to the questions displayed below) Cane

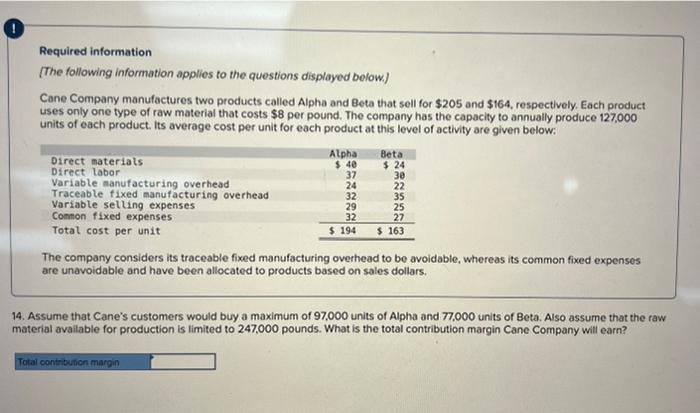

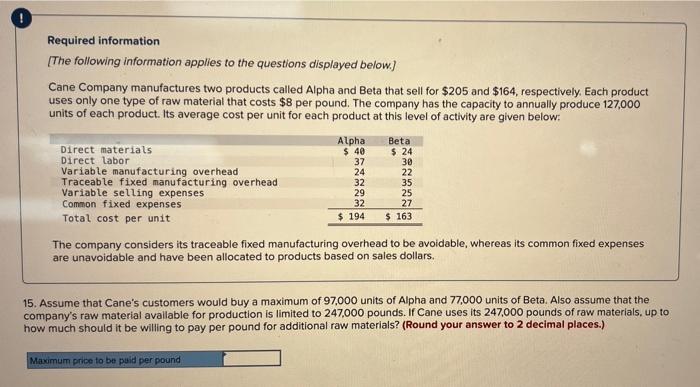

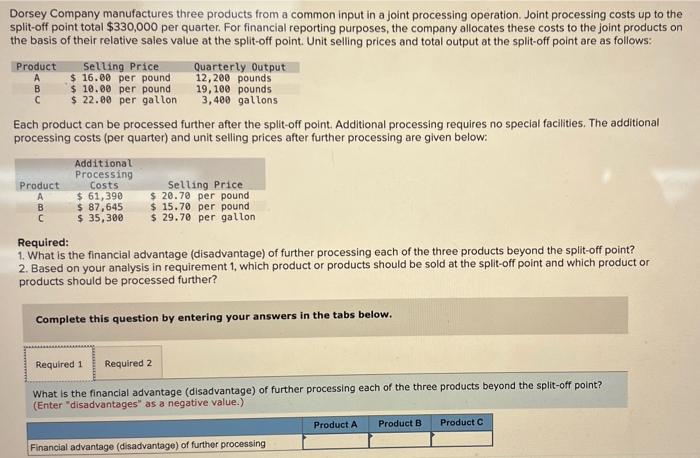

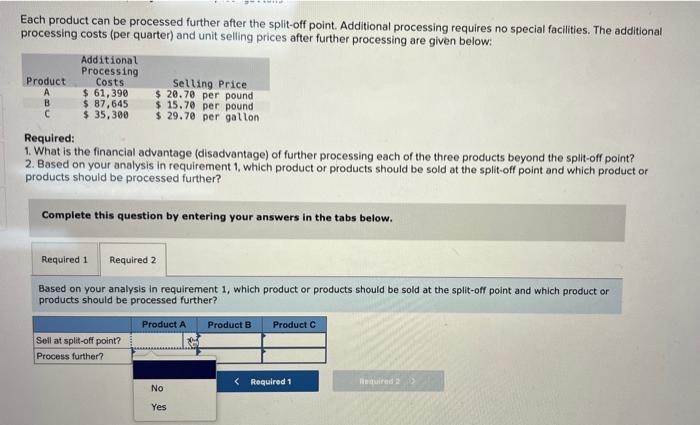

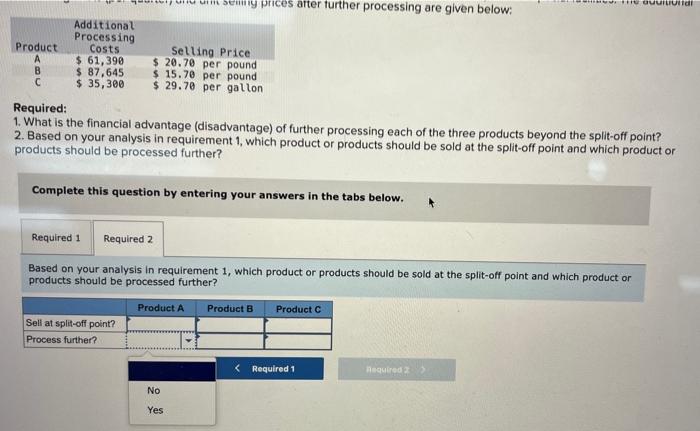

Required information (The following information applies to the questions displayed below) Cane Company manufactures two products called Alpha and Beta that sell for $205 and $164, respectively. Each product uses only one type of raw material that costs $8 per pound. The company has the capacity to annually produce 127,000 units of each product. Its average cost per unit for each product at this level of activity are given below: Alpha Beta Direct materials $ 24 Direct labor Variable sanufacturing overhead 22 Traceable fixed manufacturing overhead 35 Variable selling expenses Common fixed expenses Total cost per unit $ 163 The company considers its traceable fixed manufacturing overhead to be avoidable, whereas its common fixed expenses are unavoidable and have been allocated to products based on sales dollars. 30 $ 40 37 24 32 29 32 $ 194 25 27 14. Assume that Cane's customers would buy a maximum of 97,000 units of Alpha and 77,000 units of Beta. Also assume that the raw material available for production is limited to 247,000 pounds. What is the total contribution margin Cane Company will earn? Tatal contribution margin Required information [The following information applies to the questions displayed below.) Cane Company manufactures two products called Alpha and Beta that sell for $205 and $164, respectively. Each product uses only one type of raw material that costs $8 per pound. The company has the capacity to annually produce 127,000 units of each product. Its average cost per unit for each product at this level of activity are given below: Alpha Beta Direct materials $ 40 $ 24 Direct labor 37 30 Variable manufacturing overhead 24 22 Traceable fixed manufacturing overhead 32 35 Variable selling expenses 29 25 Common fixed expenses 32 27 Total cost per unit $ 194 $ 163 The company considers its traceable fixed manufacturing overhead to be avoidable, whereas its common fixed expenses are unavoidable and have been allocated to products based on sales dollars. 15. Assume that Cane's customers would buy a maximum of 97,000 units of Alpha and 77,000 units of Beta. Also assume that the company's raw material available for production is limited to 247,000 pounds. If Cane uses its 247,000 pounds of raw materials, up to how much should it be willing to pay per pound for additional raw materials? (Round your answer to 2 decimal places.) Maximum price to be paid per pound A Dorsey Company manufactures three products from a common input in a joint processing operation. Joint processing costs up to the split-off point total $330,000 per quarter. For financial reporting purposes, the company allocates these costs to the joint products on the basis of their relative sales value at the split-off point. Unit selling prices and total output at the split-off point are as follows: Product Selling Price Quarterly Output $ 16.00 per pound 12,200 pounds B $ 10.00 per pound 19, 100 pounds $ 22.00 per gallon 3,400 gallons Each product can be processed further after the split-off point. Additional processing requires no special facilities. The additional processing costs (per quarter) and unit selling prices after further processing are given below: Additional Processing Product Costs Selling Price A $ 61,390 $ 20.70 per pound B $ 87,645 $15.70 per pound C $ 35,300 $ 29.70 per gallon Required: 1. What is the financial advantage (disadvantage) of further processing each of the three products beyond the split-off point? 2. Based on your analysis in requirement 1, which product or products should be sold at the split-off point and which product or products should be processed further? Complete this question by entering your answers in the tabs below. Required 1 Required 2 What is the financial advantage (disadvantage) of further processing each of the three products beyond the split-off point? (Enter "disadvantages" as a negative value.) Product A Product B Product C Financial advantage (disadvantage) of further processing Costs Each product can be processed further after the split-off point. Additional processing requires no special facilities. The additional processing costs (per quarter) and unit selling prices after further processing are given below: Additional Processing Product Selling Price A $ 61,390 $ 20.70 per pound $ 87,645 $15.70 per pound $ 35,300 $29.70 per gallon Required: 1. What is the financial advantage (disadvantage) of further processing each of the three products beyond the split-off point? 2. Based on your analysis in requirement 1, which product or products should be sold at the split-off point and which product or products should be processed further? B Complete this question by entering your answers in the tabs below. Required 1 Required 2 Based on your analysis in requirement 1, which product or products should be sold at the split-off point and which product or products should be processed further? Product A Product B Product C Sell at split-off point? Process further?

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts