Question: i need help solving this and if u could explain thatd be great !! Return to que Rotorua Products, Ltd., of New Zealand markets agricultural

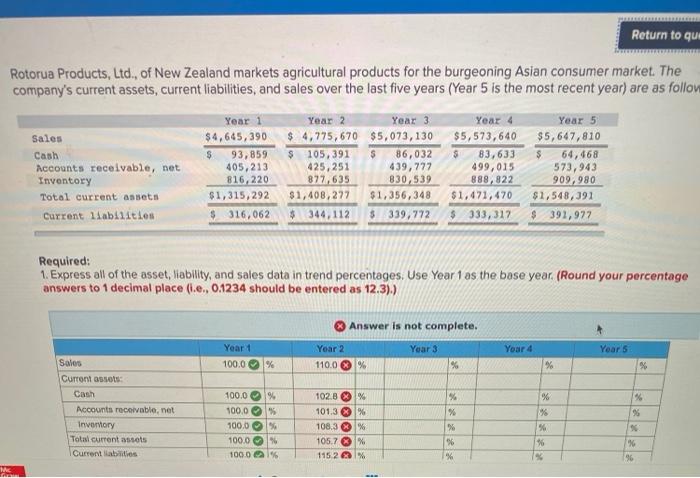

Return to que Rotorua Products, Ltd., of New Zealand markets agricultural products for the burgeoning Asian consumer market . The company's current assets, current liabilities, and sales over the last five years (Year 5 is the most recent year) are as follow Sales Cash Accounts receivable, net Inventory Total current asset Current liabilities Year 1 Year 2 Year 3 $4,645, 390 $ 4,775,670 $5,073,130 $ 93,859 $ 105,391 $ 86,032 405,213 425, 251 439,777 816,220 877,635 830,539 $1,315,292 $1,408,227 $1,356,348 $ 316,062 $ 344,112 $339,772 Year 4 $5,573,640 $ 83,633 499,015 888,822 $1,471,470 $ 333,317 Year 5 $5,647,810 $ 64,468 573,943 909,980 $1,548,391 $ 391,977 Required: 1. Express all of the asset, Hability, and sales data in trend percentages. Use Year 1 as the base year. (Round your percentage answers to 1 decimal place (1.0, 01234 should be entered as 12.3).) Answer is not complete. Year 3 Yoar 4 Year 5 Year 1 100.0 % Year 2 110.0 % % % % % % Sales Current : Cash Accounts receivable, net Invemory Total current assots Current abilis 6 % 100.0% 100,0 % 100.0% 100.0 % 100.0 % 102.8 % % 101.3 % 108.3 % 105.73% 1152 % * % % % % 36 96 96 M

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts