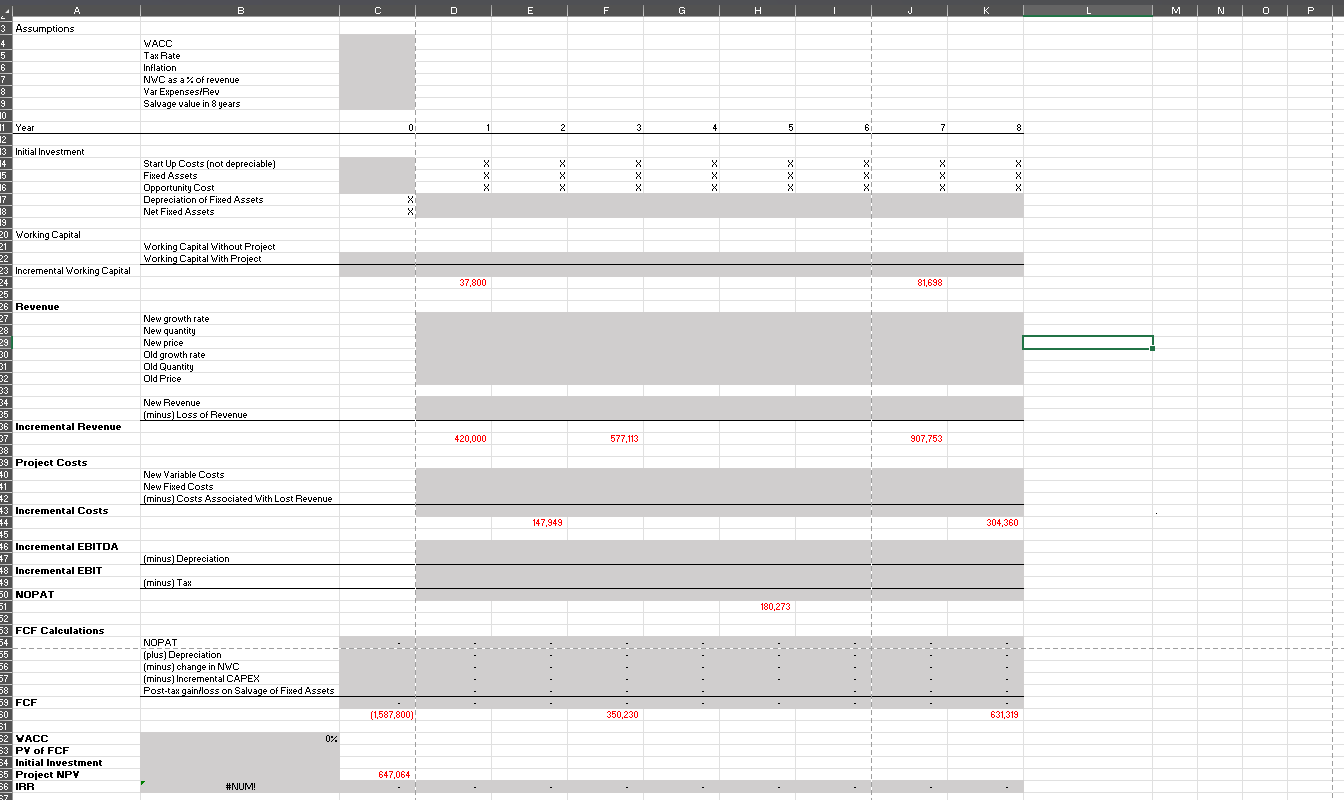

Question: I need help solving this excel problem. These are the assumptions: WACC ( nominal ) = 8 % Tax Rate = 3 0 % A

I need help solving this excel problem. These are the assumptions:

WACC nominal

Tax Rate

A firm is considering a capital budgeting project with a projected fixed asset cost of $

The projected cost will be depreciated via the straight line method over years.

The company has existing land they could use to develop this project, the land could be sold today for $

The project will last for a total of years, and the equipment involved will be salvagable for $ at the end of the years.

In the first year, the firm projects sales of units of the new product at a cost of $ per unit. However there will be a negative impact on the firm's existing products of units and these units sell for $ per unit.

Inflation on the sales price of both the existing and new product is expected to be starting in year

Growth in quantity sold for the new product will be for the first two years and for the remainder of the project.

Quantity sold for the existing product was expected to grow at each year.

The project will require an initial investment year in working capital equivalent to of year revenues net of cannibalized salesThe ongoing working capitalrevenue ratio will also be

All working capital will be recovered at the end of the project's life.

Variable expenses for both the new product and the existing product are of revenue.

Fixed expenses in year are anticipated to be $ and zero afterwards. begintabularr

hline

hline

hline

hline

hline

hline

hline

hline

hline

hline

hline

hline

hline

hline

hline

hline

hline

hline

hline

hline

hline

hline

hline

hline

hline

hline

hline

hline

hline

hline

hline

hline

hline

hline

hline

hline

hline

hline

hline

hline

hline

hline

hline

hline

hline

hline

hline

hline

hline

hline

hline

hline

hline

hline

hline

hline

hline

hline

hline

hline

hline

endtabular

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock