Question: I need help solving this problem 2. Record the sale of the machine on January 1, 2019 E7-29A. (Learning Objectives 3, 4: Measure DDB depreciation;

I need help solving this problem

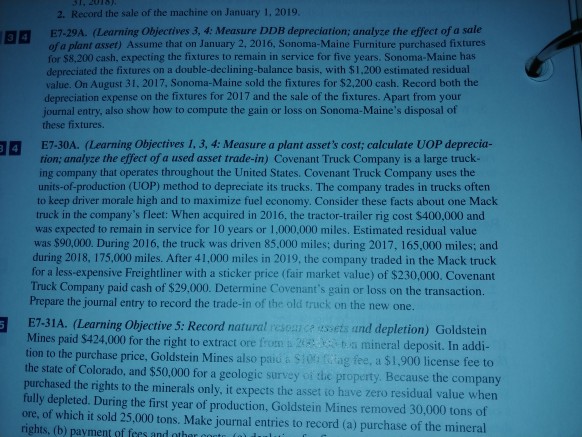

2. Record the sale of the machine on January 1, 2019 E7-29A. (Learning Objectives 3, 4: Measure DDB depreciation; analyze the effect of a sale 34 set) Assume that on January 2, 2016, Sonoma-Maine Furniture purchased fixtures for $8,200 cash, expecting the fixtures to remain in service for five years. Sonoma-Maine has reciated the fixtures on a double-declining-balance basis, with $1,200 estimated residual value. On August 31, 2017, Sonoma-Maine sold the fixtures for $2,200 cash. Record both the depreciation expense on the fixtures for 2017 and the sale of the fixtures. Apart from your journal entry, also show how to compute the gain or loss on Sonoma-Maine's disposal of these fixtures. 4 E7-30A. (Learning Objectives 1, 3, 4: Measure a plant asset's cost; calculate UOP deprecia- tion; analyze the effect of a used asset trade-in) Covenant Truck Company is a large truck ing company that operates throughout the United States. Covenant Truck Company uses the units-of-production (UOP) method to depreciate its trucks. The company trades in trucks ofter to keep driver morale high and to maximize fuel economy. Consider these facts about one Mack truck in the company's fleet: When acquired in 2016, the tractor-trailer rig cost $400,000 and was expected to remain in service for 10 years or 1,000,000 miles. Estimated residual value $90,000. During 2016, the truck was driven 85.000 miles; during 2017, 165,000 miles; and during 2018, 175,000 miles. After 41,000 miles in 2019, the company traded in the Mack truck for a less-expensive Freightliner with a sticker price (fair market value) of $230,000. Covenant Truck Company paid cash of $29,000. Determine Covenant's gain or loss on the transaction. Prepare the journal entry to record the trade-in of the old truck on the new one E7-31A. (Learning Objective 5: Record natural Mines paid $424,000 for the right to extract ore from tion to the purchase price, Goldstein Mines also paid a Si0 g fee, a ind depletion) Goldstein t -a mineral deposit. In addi- $1,900 license fee to the state of Colorado, and $50,000 for a geologic survey oi die property. Because the company purchased the rights to the minerals only, it expects the asset to have fully depleted. During the first year of production, Goldstein Mines removed 30,000 tons zero residual value when of e, of which it sold 25,000 tons. Make journal entries to record (a) purchase of the mineral rights, (b) payment of fres and other ront

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts