Question: I need help solving this problem. Answer all question for problem P6-8A and show step by step solution, show your work. Thank you What minimum

I need help solving this problem. Answer all question for problem P6-8A and show step by step solution, show your work. Thank you

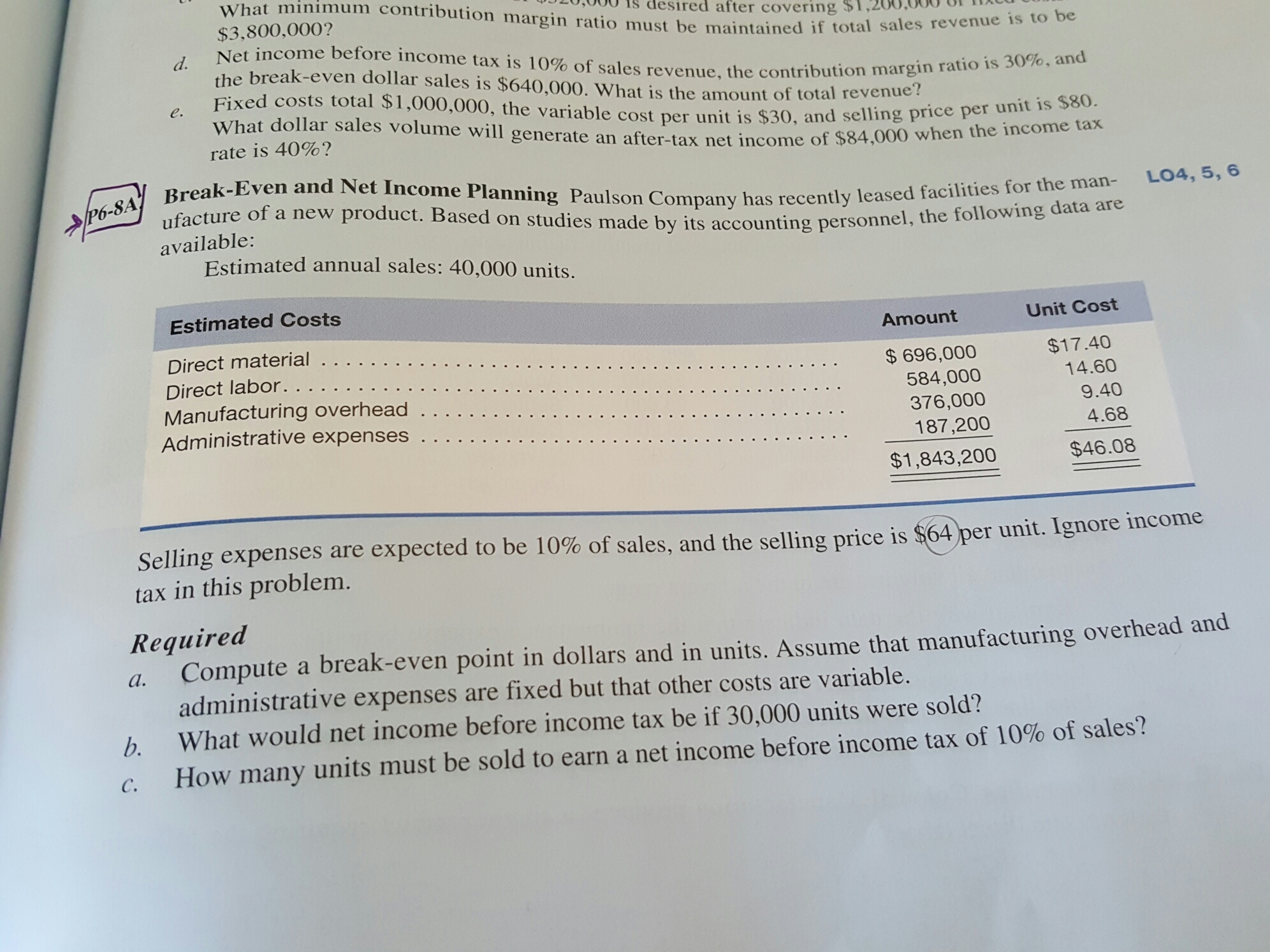

What minimum contribution margin ratio mu O,0o is desired after covering $1,200,00 $3,800,000? Net income before income tax is 10% of sales revenue, the contribution st be maintained if total sales revenue is to be Fixed costs total $1,000,000, the variable cost per unit is $30, and selling ntribution margin ratio is 30%, and t of total revenue? What dollar sales volume will generate an after-tax net income o rate is 40%? ak-Even and Net Income Planning Paulson Company has recently ure of a new product. Based on price per unit is $80. f $84,000 when the income tax SA Break-Even g Paulson Company has recently leased facilities for the man- studies made by its accounting personnel, the following data are LO4, 5, 6 ufacture of available 04, 5, 6 Estimated annual sales: 40,000 units. Estimated Costs Amount Unit Cost Direct material .. Direct labor Manufacturing Administrative expenses $17.40 $696,000 584,000 376,000 187,200 $1,843,200 14.60 overhead 9.40 4.68 $46.08 Selling expenses are expected to be 10% of sales, and the selling price is $64 per unit. Ignore income tax in this problem. Requirea a. Compute a break-even point in dollars and in units. Assume that manufacturing overhead and administrative expenses are fixed but that other costs are variable. What would net income before income tax be if 30,000 units were sold? How many units must be sold to earn a net income before income tax of 10% of sales? b. c

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts