Question: I need help solving this problem, I got some answers but I am not sure is correct. helpp On the basis of this information, calculate

I need help solving this problem, I got some answers but I am not sure is correct. helpp

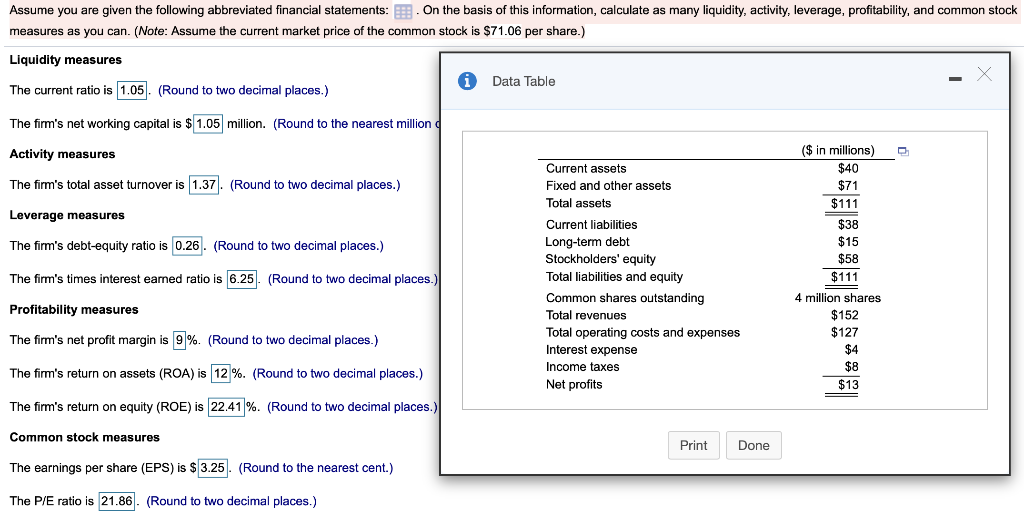

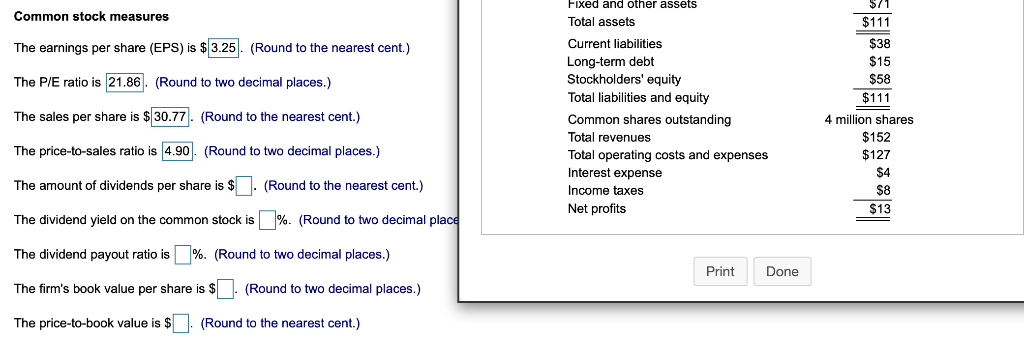

On the basis of this information, calculate as many liquidity, activity, leverage, profitability, and common stock Assume you are given the following abbreviated financial statements: measures as you can. (Note: Assume the current market price of the common stock is $71.06 per share.) Liquidity measures Data Table The current ratio is 1.05 (Round to two decimal places.) The firm's net working capital is $1.05 million. (Round to the nearest million ($in millions) Activity measures Current assets $40 The firm's total asset turnover is 1.37.(Round to two decimal places.) Fixed and other assets $71 Total assets $111 Leverage measures Current liabilities $38 oce Long-term debt Stockholders' equity Total liabilities and equity $15 The firm's debt-equity ratio is 0.26 (Round to two decimal places.) $58 The firm's times interest earmed ratio is 6.25. (Round to two decimal places.) $111 million shares $152 Common shares outstanding Total revenues Profitability measures Total operating costs and expenses $127 The firm's net profit margin is 9% (Round to two decimal places.) Interest expense $4 $8 Income taxes The firm's return on assets (ROA) is 12%. (Round to two decimal places.) $13 Net profits The firm's return on equity (ROE) is 22.41%. (Round to two decimal places.) Common stock measures Print Done The earnings per share (EPS) is $3.25(Round to the nearest cent.) The P/E ratio is 21.86. (Round to two decimal places.) $71 Fixed and other assets Common stock measures Total assets $111 $38 Current liabilities The earnings per share (EPS) is $ 3.25 (Round to the nearest cent.) Long-term debt Stockholders' equity Total liabilities and equity $15 $58 The P/E ratio is 21.86. (Round to two decimal places.) $111 The sales per share is $30.77 the nearest cent.) (Round Common shares outstanding 4 million shares Total revenues $152 $127 The price-to-sales ratio is 4.90 (Round to two decimal places.) Total operating costs and expenses Interest expense $4 dividends per share is $(Round The amount the nearest cent.) Income taxes $8 Net profits $13 The dividend yield on the common stock is %. (Round to two decimal place %. (Round to two decimal places.) The dividend payout ratio is Print Done book value per share is $ Th (Round to two decimal places.) The price-to-book value is $ the nearest cent.) (Round FE

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts