Question: I need help solving this problem please Exercise 21A-17 a-c (Part Level Submission) On January 1, 2017, Tamarisk Co. leased a building to Carla Vista

I need help solving this problem please

I need help solving this problem please

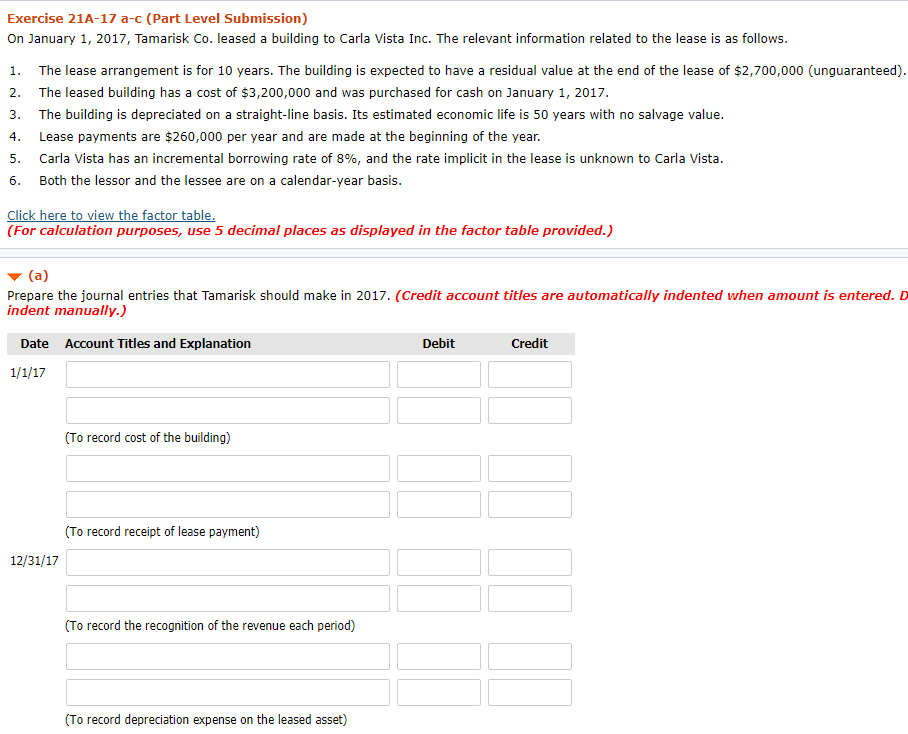

Exercise 21A-17 a-c (Part Level Submission) On January 1, 2017, Tamarisk Co. leased a building to Carla Vista Inc. The relevant information related to the lease is as follows 1. The lease arrangement is for 10 years. The building is expected to have a residual value at the end of the lease of $2,700,000 (unguaranteed) 2. The leased building has a cost of $3,200,000 and was purchased for cash on January 1, 2017. 3. The building is depreciated on a straight-line basis. Its estimated economic life is 50 years with no salvage value. 4. Lease payments are $260,000 per year and are made at the beginning of the year. 5. Carla Vista has an incremental borrowing rate of 8%, and the rate implicit in the lease is unknown to Carla Vista. 6. Both the lessor and the lessee are on a calendar-year basis. Click here to view the factor table For calculation purposes, use 5 decimal places as displayed in the factor table provided.) Prepare the journal entries that Tamarisk should make in 2017. (Credit account titles are automatically indented when amount is entered. D indent manually. Date Account Titles and Explanation Debit Credit (To record cost of the building) (To record receipt of lease payment) 12/31/17 (To record the recognition of the revenue each period) To record depreciation expense on the leased asset)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts