Question: i need help solving this problem please!! Question 1 The following information was taken from the records of Sheffield Inc. for the year 2017: Income

i need help solving this problem please!!

i need help solving this problem please!!

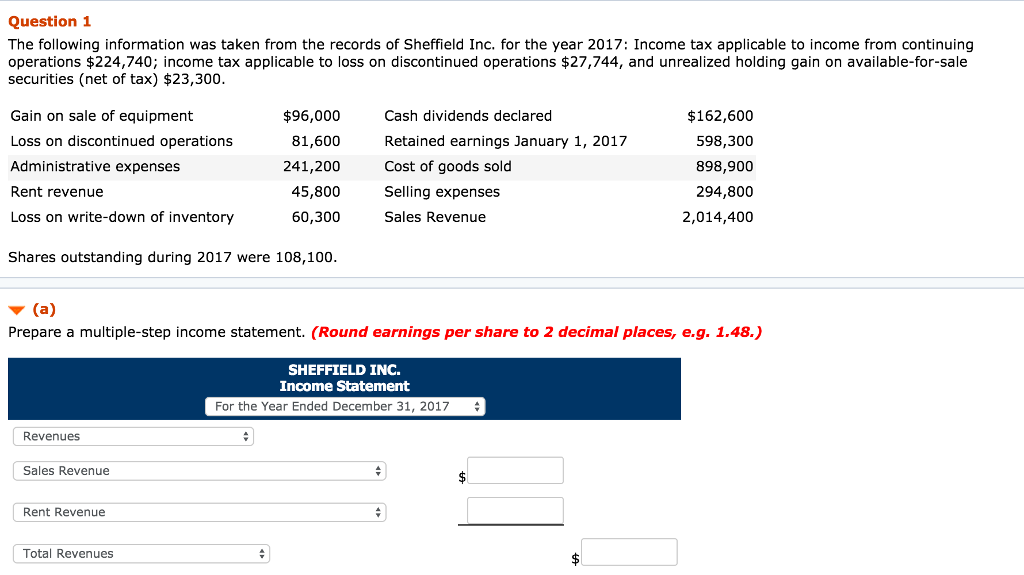

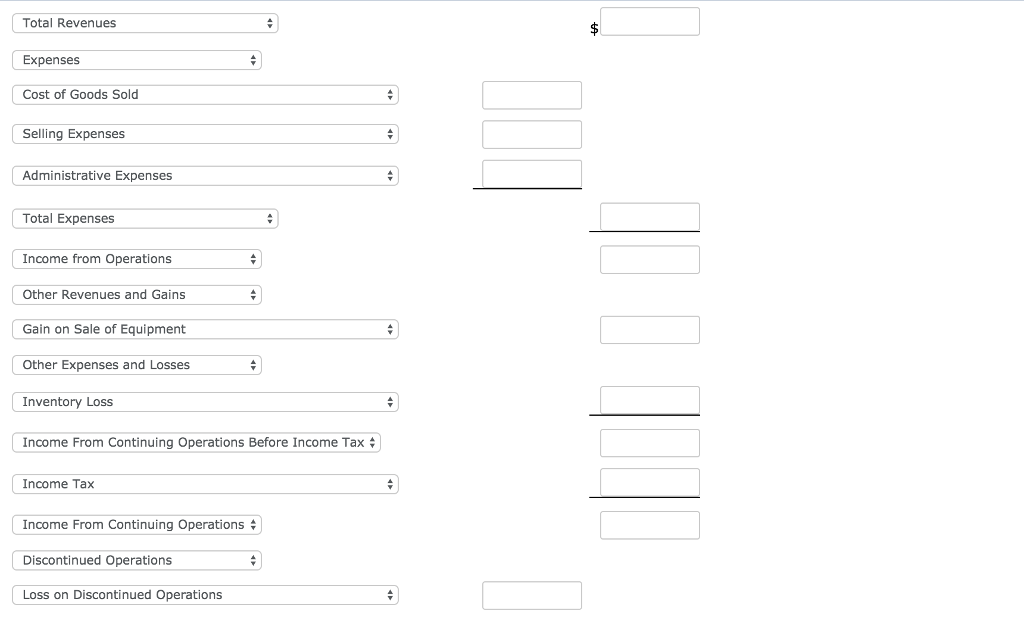

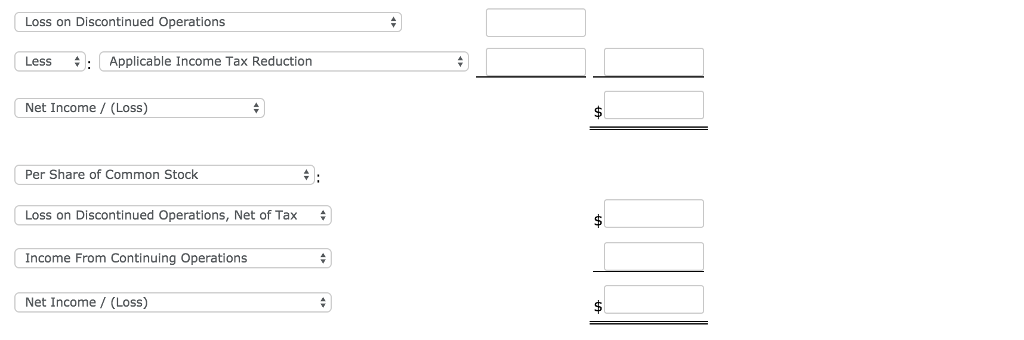

Question 1 The following information was taken from the records of Sheffield Inc. for the year 2017: Income tax applicable to income from continuing operations $224,740; income tax applicable to loss on discontinued operations $27,744, and unrealized holding gain on available-for-sale securities (net of tax) $23,300 $96,000 81,600 241,200 45,800 60,300 Cash dividends declared Retained earnings January 1, 2017 Cost of goods sold Selling expenses Sales Revenue $162,600 598,300 898,900 294,800 2,014,400 Gain on sale of equipment Loss on discontinued operations Administrative expenses Rent revenue Loss on write-down of inventory Shares outstanding during 2017 were 108,100 (a) Prepare a multiple-step income statement. (Round earnings per share to 2 decimal places, e.g. 1.48.) SHEFFIELD INC. Income Statement For the Year Ended December 31, 2017 Revenues Sales Revenue Rent Revenue Total Revenues

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts