Question: I need help solving this project. I need an explanation to understand the problem Project #8: Standard Costs (60 Points) product is shown below: Direct

I need help solving this project. I need an explanation to understand the problem

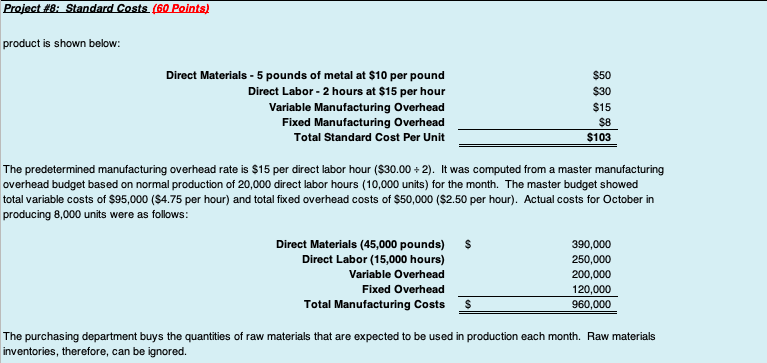

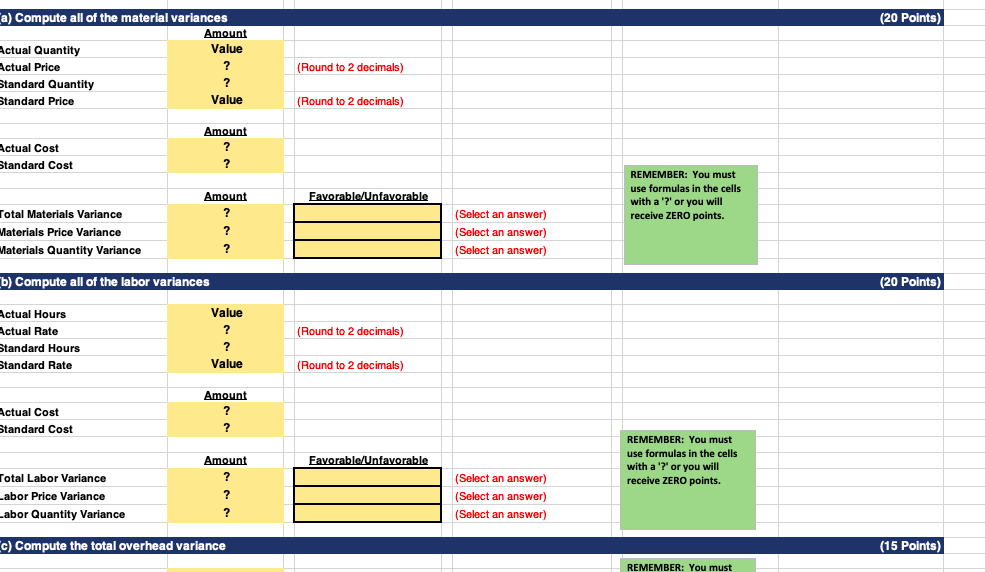

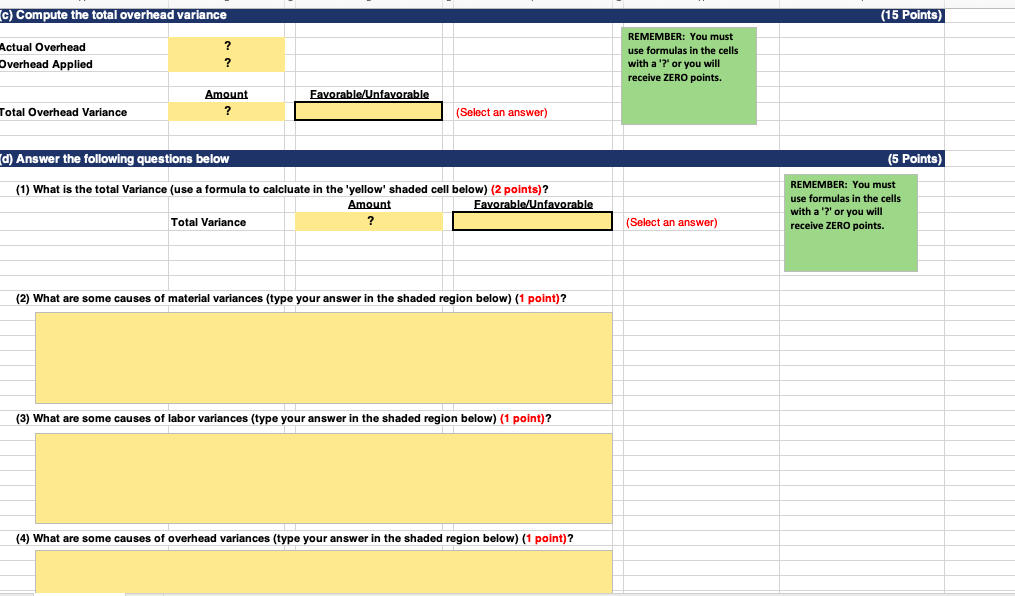

Project #8: Standard Costs (60 Points) product is shown below: Direct Materials - 5 pounds of metal at $10 per pound $50 Direct Labor - 2 hours at $15 per hour $30 Variable Manufacturing Overhead $15 Fixed Manufacturing Overhead $8 Total Standard Cost Per Unit $103 The predetermined manufacturing overhead rate is $15 per direct labor hour ($30.00 + 2). It was computed from a master manufacturing overhead budget based on normal production of 20,000 direct labor hours (10,000 units) for the month. The master budget showed total variable costs of $95,000 ($4.75 per hour) and total fixed overhead costs of $50,000 ($2.50 per hour). Actual costs for October in producing 8,000 units were as follows: $ Direct Materials (45,000 pounds) Direct Labor (15,000 hours) Variable Overhead Fixed Overhead Total Manufacturing Costs 390,000 250,000 200,000 120,000 960,000 $ The purchasing department buys the quantities of raw materials that are expected to be used in production each month. Raw materials inventories, therefore, can be ignored. (20 Points) a) Compute all of the material variances Amount Actual Quantity Value Actual Price ? Standard Quantity ? Standard Price Value (Round to 2 decimals) (Round to 2 decimals) Actual Cost Standard Cost Amount ? ? ? Favorable/Unfavorable REMEMBER: You must use formulas in the cells with a '?' or you will receive ZERO points. Amount ? ? ? Total Materials Variance Materials Price Variance Materials Quantity Variance (Select an answer) (Select an answer) ( (Select an answer) b) Compute all of the labor variances (20 Points) (Round to 2 decimals) Actual Hours Actual Rate Standard Hours Standard Rate Value ? ? Value (Round to 2 decimals) ) Actual Cost Standard Cost Amount ? ? Favorable/Unfavorable REMEMBER: You must use formulas in the cells with a '?' or you will receive ZERO points. Total Labor Variance abor Price Variance Labor Quantity Variance Amount ? ? ? ? (Select an answer) (Select an answer) (Select an answer) c) Compute the total overhead variance (15 Points) REMEMBER: You must c) Compute the total overhead variance (15 Points) Actual Overhead Overhead Applied ? ? REMEMBER: You must use formulas in the cells with a '?' or you will receive ZERO points. Favorable/Unfavorable Amount ? Total Overhead Variance (Select an answer) d) Answer the following questions below (5 Points) (1) What is the total Variance (use a formula to calcluate in the yellow' shaded cell below) (2 points)? Amount Favorable/Unfavorable Total Variance ? REMEMBER: You must use formulas in the cells with a '?' or you will receive ZERO points. (Select an answer) (2) What are some causes of material variances (type your answer in the shaded region below) (1 point)? (3) What are some causes of labor variances (type your answer in the shaded region below) (1 point)? (4) What are some causes of overhead variances (type your answer in the shaded region below) (1 point)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts