Question: I need help solving this question Thanks! d) Preferred shares of A Corp. currently sell for $22 per share and offer a dividend of $2

I need help solving this question Thanks!

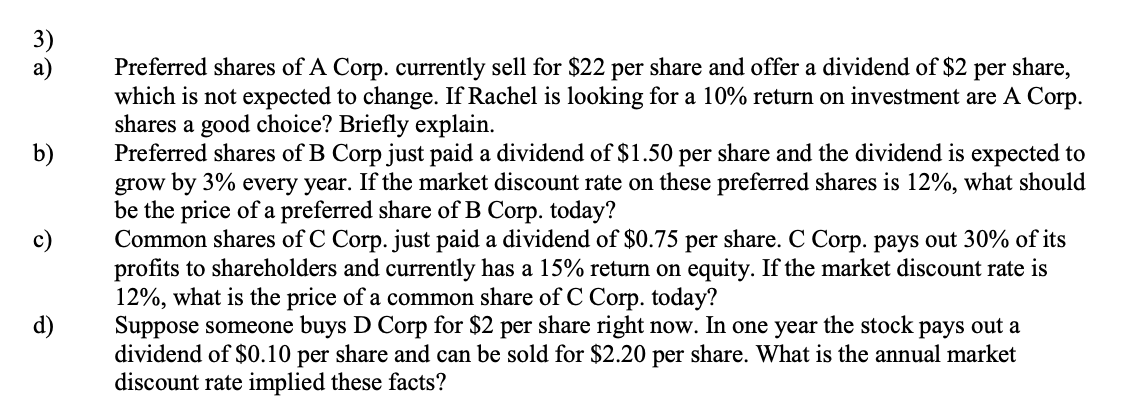

d) Preferred shares of A Corp. currently sell for $22 per share and offer a dividend of $2 per share, which is not expected to change. IfRachel is looking for a 10% return on investment are A Corp. shares a good choice? Briey explain. Preferred shares of B Corp just paid a dividend of $1.50 per share and the dividend is expected to grow by 3% every year. Ifthe market discount rate on these preferred shares is 12%, what should be the price of a preferred share of B Corp. today? Common shares of C Corp. just paid a dividend of $0.75 per share. C Corp. pays out 30% of its prots to shareholders and currently has a 15% return on equity. If the market discount rate is 12%, what is the price of a common share of C Corp. today? Suppose someone buys D Corp for $2 per share right now. In one year the stock pays out a dividend of $0.10 per share and can be sold for $2.20 per share. What is the annual market discount rate implied these facts

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts