Question: I need help! Thank you Problem Set 2 Page 5 of 17 Scenario #4: Laboratori Research Associates (6 points) On August 1, 2021, Laboratori Research

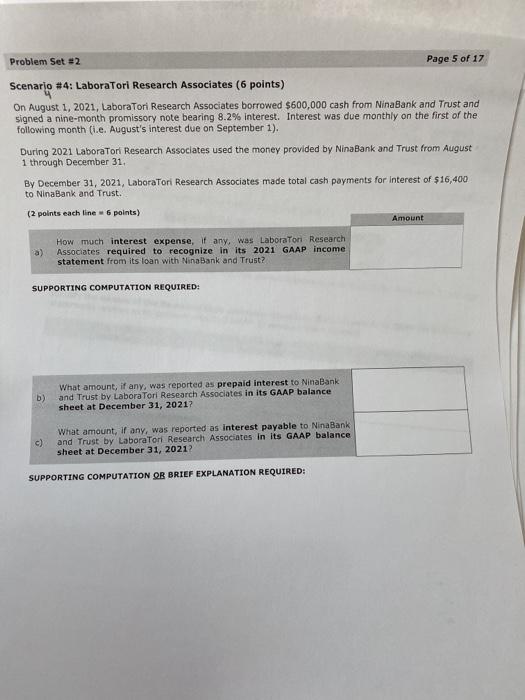

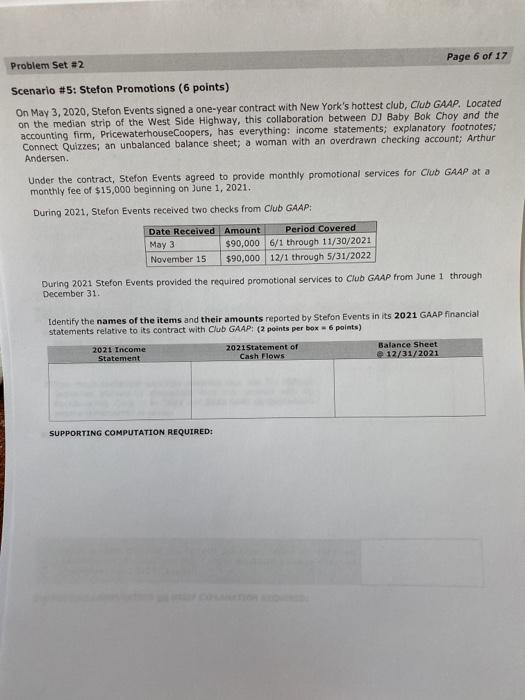

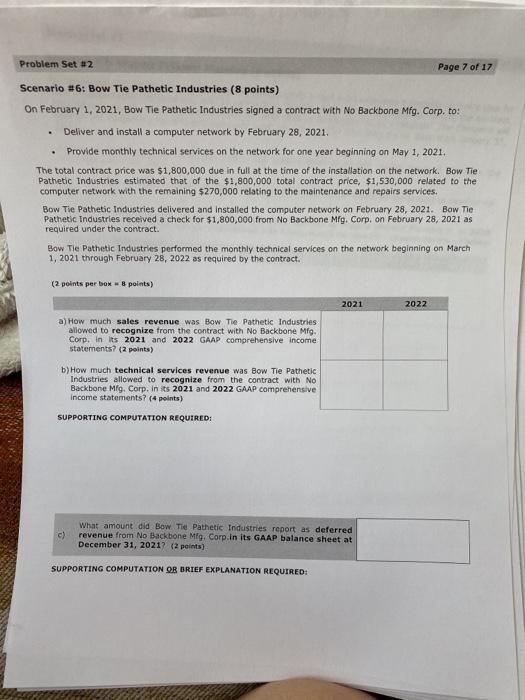

Problem Set 2 Page 5 of 17 Scenario #4: Laboratori Research Associates (6 points) On August 1, 2021, Laboratori Research Associates borrowed $600,000 cash from NinaBank and Trust and signed a nine-month promissory note bearing 8.2% interest. Interest was due monthly on the first of the following month (ie. August's interest due on September 1). During 2021 Laboratori Research Associates used the money provided by Nina Bank and Trust from August 1 through December 31 By December 31, 2021, Laboratori Research Associates made total cash payments for interest of $16,400 to NinaBank and Trust. (2 points each line 6 points) Amount How much interest expense, if any, was Laboratori Research Associates required to recognize in its 2021 GAAP income statement from its loan with Ninabank and Trust? SUPPORTING COMPUTATION REQUIRED: b) What amount, if any, was reported as prepaid interest to NinaBank and Trust by Laboratori Research Associates in its GAAP balance sheet at December 31, 2021? c) What amount, if any, was reported as interest payable to Nina Bank and Trust by Laboratori Research Associates in its GAAP balance sheet at December 31, 2021 SUPPORTING COMPUTATION OR BRIEF EXPLANATION REQUIRED: Page 6 of 17 Problem Set 82 Scenario #5: Stefon Promotions (6 points) On May 3, 2020, Stefon Events signed a one-year contract with New York's hottest club, Club GAAP. Located on the median strip of the West Side Highway, this collaboration between DJ Baby Bok Choy and the accounting firm, PricewaterhouseCoopers, has everything: income statements, explanatory footnotes; Connect Quizzes; an unbalanced balance sheet; a woman with an overdrawn checking account; Arthur Andersen. Under the contract, Stefon Events agreed to provide monthly promotional services for Club GAAP at a monthly fee of $15,000 beginning on June 1, 2021. During 2021. Stefon Events received two checks from Club GAAP: Date Received Amount Period Covered May 3 $90,000 6/1 through 11/30/2021 November 15 $90,000 12/1 through 5/31/2022 During 2021 Stefon Events provided the required promotional services to Club GAAP from June 1 through December 31. Identify the names of the items and their amounts reported by Stefon Events in its 2021 GAAP financial statements relative to its contract with Club GAAP: (2 points per box = 6 points) 2021 Income Statement 2021 Statement of Cash Flows Balance Sheet 12/31/2021 SUPPORTING COMPUTATION REQUIRED: Problem Set #2 Page 7 of 17 Scenario #6: Bow Tie Pathetic Industries (8 points) On February 1, 2021, Bow Tie Pathetic Industries signed a contract with No Backbone Mfg. Corp. to: . Deliver and install a computer network by February 28, 2021. Provide monthly technical services on the network for one year beginning on May 1, 2021. The total contract price was $1,800,000 due in full at the time of the installation on the network. Bow Tie Pathetic Industries estimated that of the $1,800,000 total contract price, $1,530,000 related to the computer network with the remaining $270,000 relating to the maintenance and repairs services. Bow Tie Pathetic Industries delivered and installed the computer network on February 28, 2021. Bow Tie Pathetic Industries received a check for $1,800,000 from No Backbone Mfg. Corp. on February 28, 2021 as required under the contract. Bow Tie Pathetic Industries performed the monthly technical services on the network beginning on March 1, 2021 through February 28, 2022 as required by the contract. (2 points per box 8 points) 2021 2022 a) How much sales revenue was Bow Tie Pathetic Industries allowed to recognize from the contract with No Backbone Mfg. Corp. in its 2021 and 2022 GAAP comprehensive income statements? (2 points) b) How much technical services revenue was Bow Tie Pathetic Industries allowed to recognize from the contract with No Backbone Mfg. Corp. In its 2021 and 2022 GAAP comprehensive Income statements? (4 points) SUPPORTING COMPUTATION REQUIRED: c) What amount did Bow The Pathetic Industries report as deferred revenue from No Backbone Mfg. Corp.in its GAAP balance sheet at December 31, 2021? (2 points) SUPPORTING COMPUTATION OR BRIEF EXPLANATION REQUIRED

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts