Question: i need help, thanks 7. Ann is looking for a fully amortizing 30-year Fixed Rate Mortgage with monthly payments for $1,250,000. Mortgage A has a

i need help, thanks

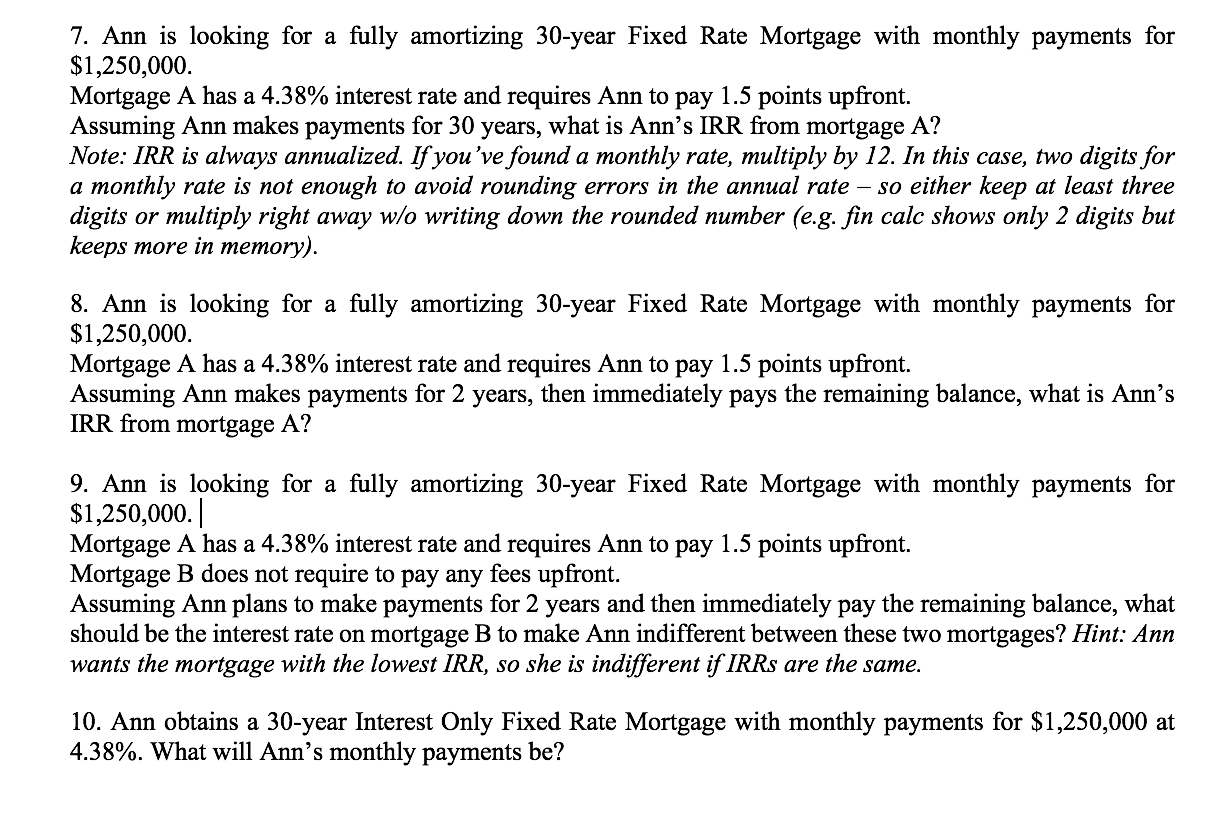

7. Ann is looking for a fully amortizing 30-year Fixed Rate Mortgage with monthly payments for $1,250,000. Mortgage A has a 4.38% interest rate and requires Ann to pay 1.5 points upfront. Assuming Ann makes payments for 30 years, what is Anns IRR from mortgage A? Note: IRR is always annualized. If you've found a monthly rate, multiply by 12. In this case, two digits for a monthly rate is not enough to avoid rounding errors in the annual rate so either keep at least three digits or multiply right away wlo writing down the rounded number (e.g. fin calc shows only 2 digits but keeps more in memory). 8. Ann is looking for a fully amortizing 30-year Fixed Rate Mortgage with monthly payments for $1,250,000. Mortgage A has a 4.38% interest rate and requires Ann to pay 1.5 points upfront. Assuming Ann makes payments for 2 years, then immediately pays the remaining balance, what is Ann's IRR from mortgage A? 9. Ann is looking for a fully amortizing 30-year Fixed Rate Mortgage with monthly payments for $1,250,000. Mortgage A has a 4.38% interest rate and requires Ann to pay 1.5 points upfront. Mortgage B does not require to pay any fees upfront. Assuming Ann plans to make payments for 2 years and then immediately pay the remaining balance, what should be the interest rate on mortgage B to make Ann indifferent between these two mortgages? Hint: Ann wants the mortgage with the lowest IRR, so she is indifferent if IRRs are the same. 10. Ann obtains a 30-year Interest Only Fixed Rate Mortgage with monthly payments for $1,250,000 at 4.38%. What will Ann's monthly payments be

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts