Question: I need help, thanks. QUESTION 5 A borrower is interested in comparing the monthly payments of two 30 year FRMs. The loans characteristics are: Loan

I need help, thanks.

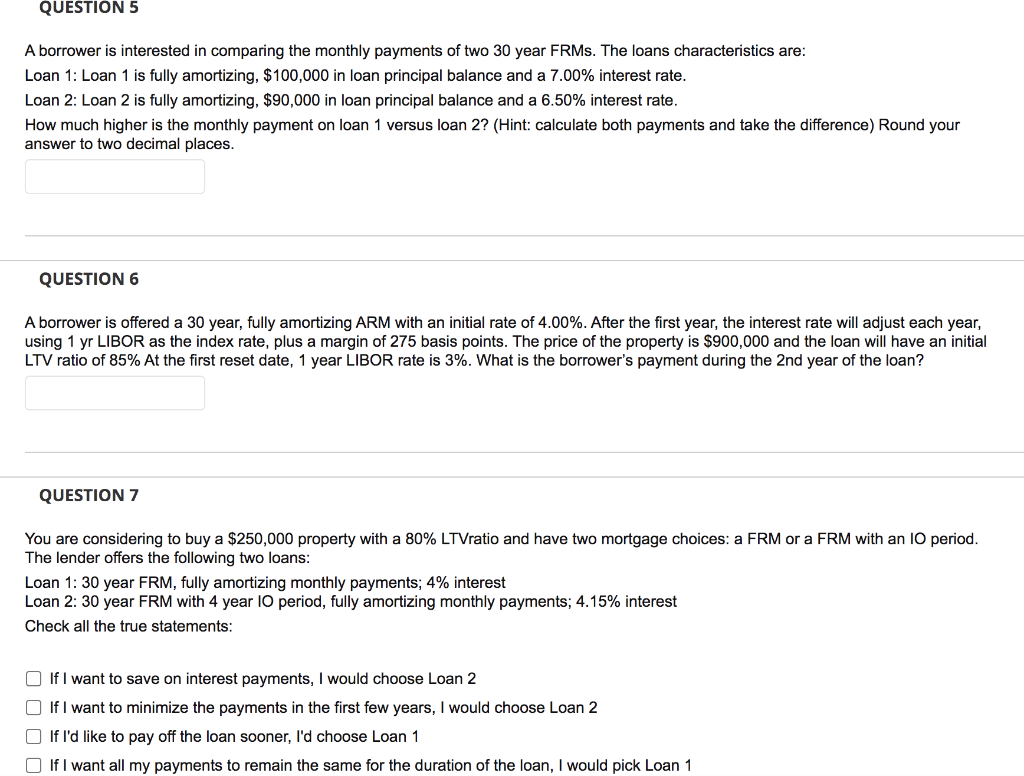

QUESTION 5 A borrower is interested in comparing the monthly payments of two 30 year FRMs. The loans characteristics are: Loan 1: Loan 1 is fully amortizing, $100,000 in loan principal balance and a 7.00% interest rate. Loan 2: Loan 2 is fully amortizing, $90,000 in loan principal balance and a 6.50% interest rate. How much higher is the monthly payment on loan 1 versus loan 2? (Hint: calculate both payments and take the difference) Round your answer to two decimal places. QUESTION 6 A borrower is offered a 30 year, fully amortizing ARM with an initial rate of 4.00%. After the first year, the interest rate will adjust each year, using 1 yr LIBOR as the index rate, plus a margin of 275 basis points. The price of the property is $900,000 and the loan will have an initial LTV ratio of 85% At the first reset date, 1 year LIBOR rate is 3%. What is the borrower's payment during the 2nd year of the loan? QUESTION 7 You are considering to buy a $250,000 property with a 80% LTVratio and have two mortgage choices: a FRM or a FRM with an 10 period. The lender offers the following two loans: Loan 1: 30 year FRM, fully amortizing monthly payments; 4% interest Loan 2: 30 year FRM with 4 year 10 period, fully amortizing monthly payments; 4.15% interest Check all the true statements: If I want to save on interest payments, I would choose Loan 2 If I want to minimize the payments in the first few years, I would choose Loan 2 If I'd like to pay off the loan sooner, I'd choose Loan 1 If I want all my payments to remain the same for the duration of the loan, I would pick Loan 1

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts