Question: I need help, thanks QUESTION 5 = Same as previous question (Question 4), consider a sequential pay CMO that is backed by 100 mortgages with

I need help, thanks

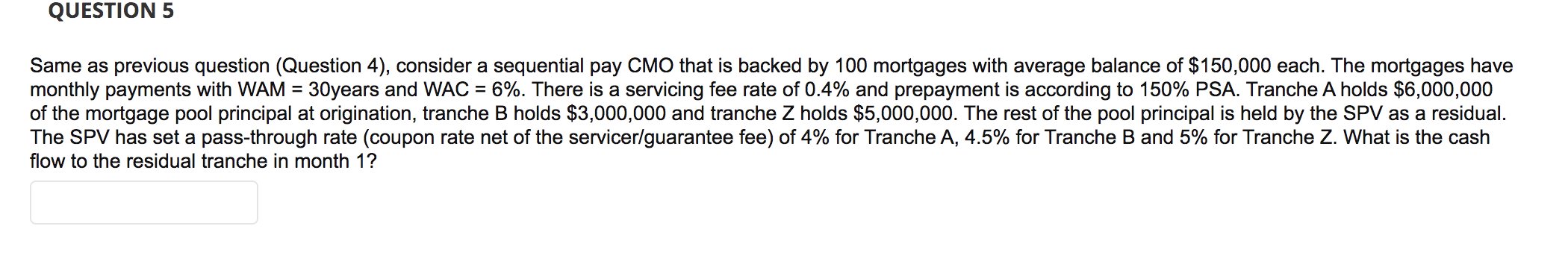

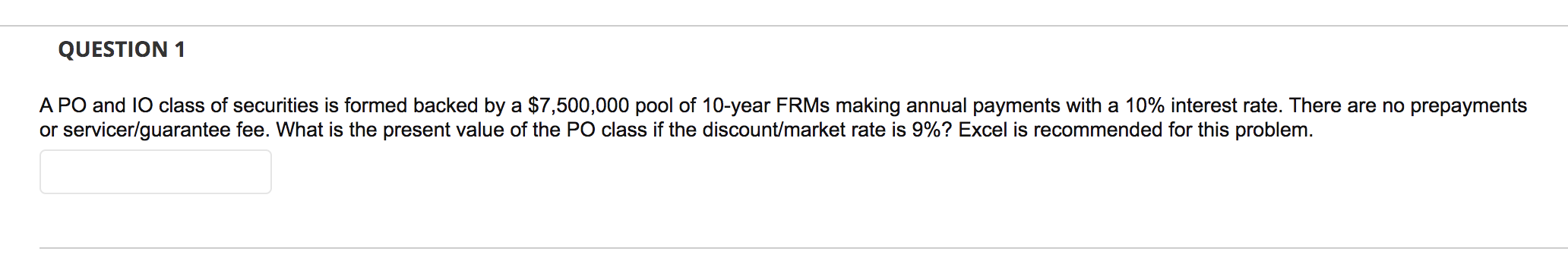

QUESTION 5 = Same as previous question (Question 4), consider a sequential pay CMO that is backed by 100 mortgages with average balance of $150,000 each. The mortgages have monthly payments with WAM = 30years and WAC = 6%. There is a servicing fee rate of 0.4% and prepayment is according to 150% PSA. Tranche A holds $6,000,000 of the mortgage pool principal at origination, tranche B holds $3,000,000 and tranche Z holds $5,000,000. The rest of the pool principal is held by the SPV as a residual. The SPV has set a pass-through rate (coupon rate net of the servicer/guarantee fee) of 4% for Tranche A, 4.5% for Tranche B and 5% for Tranche Z. What is the cash flow to the residual tranche in month 1? QUESTION 1 A PO and 10 class of securities is formed backed by a $7,500,000 pool of 10-year FRMs making annual payments with a 10% interest rate. There are no prepayments or servicer/guarantee fee. What is the present value of the PO class if the discount/market rate is 9%? Excel is recommended for this problem. QUESTION 5 = Same as previous question (Question 4), consider a sequential pay CMO that is backed by 100 mortgages with average balance of $150,000 each. The mortgages have monthly payments with WAM = 30years and WAC = 6%. There is a servicing fee rate of 0.4% and prepayment is according to 150% PSA. Tranche A holds $6,000,000 of the mortgage pool principal at origination, tranche B holds $3,000,000 and tranche Z holds $5,000,000. The rest of the pool principal is held by the SPV as a residual. The SPV has set a pass-through rate (coupon rate net of the servicer/guarantee fee) of 4% for Tranche A, 4.5% for Tranche B and 5% for Tranche Z. What is the cash flow to the residual tranche in month 1? QUESTION 1 A PO and 10 class of securities is formed backed by a $7,500,000 pool of 10-year FRMs making annual payments with a 10% interest rate. There are no prepayments or servicer/guarantee fee. What is the present value of the PO class if the discount/market rate is 9%? Excel is recommended for this

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts