Question: I NEED HELP. The company that I'm using is AMAZON because we have to refer to our week 1 paper which was AMAZON. PLEASE ONLY

I NEED HELP. The company that I'm using is AMAZON because we have to refer to our week 1 paper which was AMAZON. PLEASE ONLY USE AMAZON ONLY!!!!

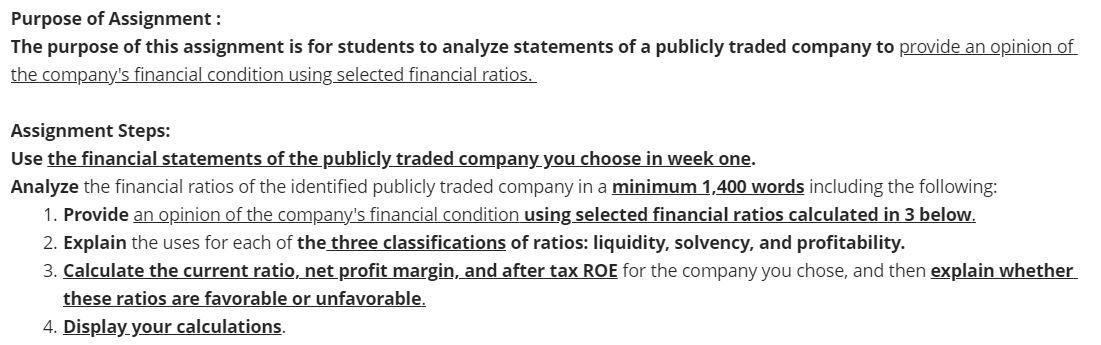

Purpose of Assignment : The purpose of this assignment is for students to analyze statements of a publicly traded company to provide an opinion of the company's financial condition using selected financial ratios. Assignment Steps: Use the financial statements of the publicly traded company you choose in week one. Analyze the financial ratios of the identified publicly traded company in a minimum 1,400 words including the following: 1. Provide an opinion of the company's financial condition using selected financial ratios calculated in 3 below. 2. Explain the uses for each of the three classifications of ratios: liquidity, solvency, and profitability. 3. Calculate the current ratio, net profit margin, and after tax ROE for the company you chose, and then explain whether these ratios are favorable or unfavorable. 4. Display your calculations. Purpose of Assignment : The purpose of this assignment is for students to analyze statements of a publicly traded company to provide an opinion of the company's financial condition using selected financial ratios. Assignment Steps: Use the financial statements of the publicly traded company you choose in week one. Analyze the financial ratios of the identified publicly traded company in a minimum 1,400 words including the following: 1. Provide an opinion of the company's financial condition using selected financial ratios calculated in 3 below. 2. Explain the uses for each of the three classifications of ratios: liquidity, solvency, and profitability. 3. Calculate the current ratio, net profit margin, and after tax ROE for the company you chose, and then explain whether these ratios are favorable or unfavorable. 4. Display your calculations

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts