Question: I need help ( This is a different question from the other i posted) Sunshine Pets Ltd. holds beginning inventory of 16 bags of health

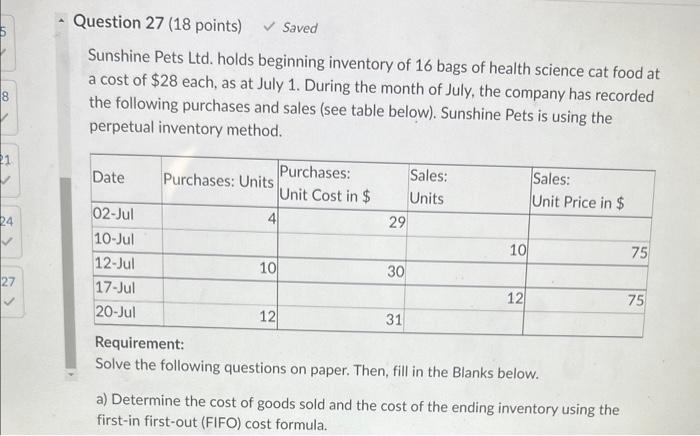

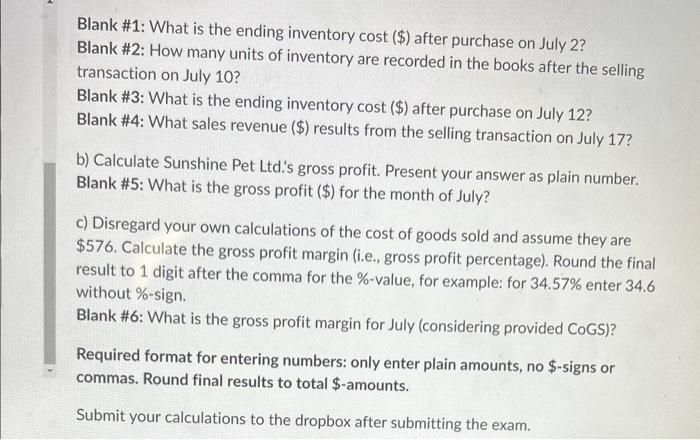

Sunshine Pets Ltd. holds beginning inventory of 16 bags of health science cat food at a cost of $28 each, as at July 1 . During the month of July, the company has recorded the following purchases and sales (see table below). Sunshine Pets is using the perpetual inventory method. Kequirement: Solve the following questions on paper. Then, fill in the Blanks below. a) Determine the cost of goods sold and the cost of the ending inventory using the first-in first-out (FIFO) cost formula. Blank \#1: What is the ending inventory cost (\$) after purchase on July 2 ? Blank \#2: How many units of inventory are recorded in the books after the selling transaction on July 10 ? Blank \#3: What is the ending inventory cost (\$) after purchase on July 12 ? Blank \#4: What sales revenue ($) results from the selling transaction on July 17 ? b) Calculate Sunshine Pet Ltd.'s gross profit. Present your answer as plain number. Blank \#5: What is the gross profit (\$) for the month of July? c) Disregard your own calculations of the cost of goods sold and assume they are $576. Calculate the gross profit margin (i.e., gross profit percentage). Round the final result to 1 digit after the comma for the \%-value, for example: for 34.57% enter 34.6 without %-sign. Blank \#6: What is the gross profit margin for July (considering provided CoGS)? Required format for entering numbers: only enter plain amounts, no $-signs or commas. Round final results to total \$-amounts. Submit your calculations to the dropbox after submitting the exam

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts