Question: I need help to answer B and C Ol the firm's sales, 50 percent are for cash and the remaining 50 percent are on credit.

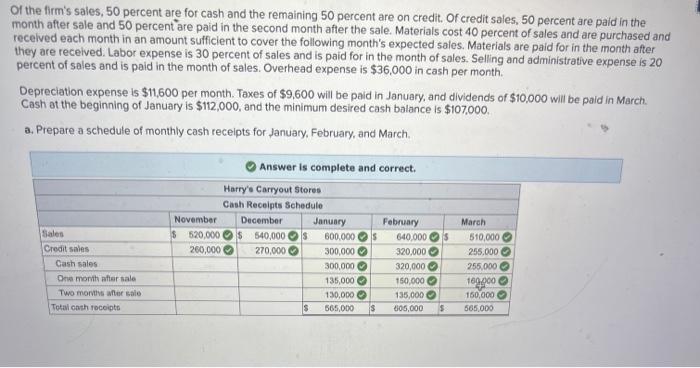

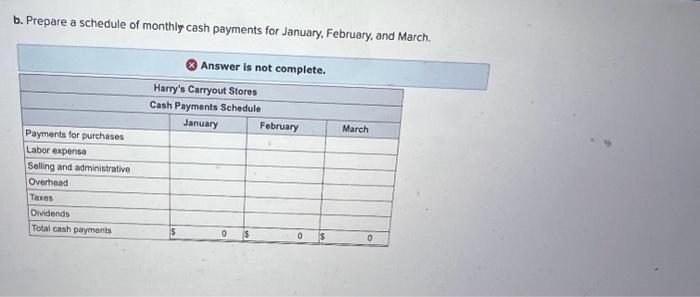

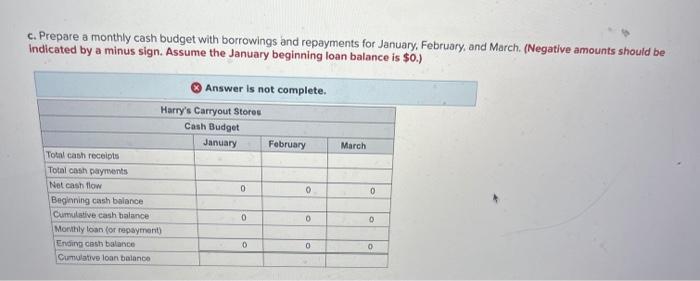

Ol the firm's sales, 50 percent are for cash and the remaining 50 percent are on credit. Of credit sales, 50 percent are paid in the month after sale and 50 percent are paid in the second month after the sale. Materials cost 40 percent of sales and are purchased and recelved each month in an amount sufficient to cover the following month's expected sales. Materials are paid for in the month after they are received. Labor expense is 30 percent of sales and is paid for in the month of sales. Selling and administrative expense is 20 percent of sales and is paid in the month of sales. Overhead expense is $36,000 in cash per month. Depreciation expense is $11,600 per month. Taxes of $9,600 will be paid in January, and dividends of $10,000 will be paid in March. Cash at the beginning of January is $112,000, and the minimum desired cash balance is $107,000. a. Prepare a schedule of monthly cash receipts for January, February, and March. b. Prepare a schedule of monthly cash payments for January, February, and March. c. Prepare a monthly cash budget with borrowings and repayments for January, February, and March. (Negative amounts should be Indicated by a minus sign. Assume the January beginning loan balance is $0.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts