Question: i need help to answer these i cant seem to find it Question 6: What is the yield curve? Question 7: What is the significance

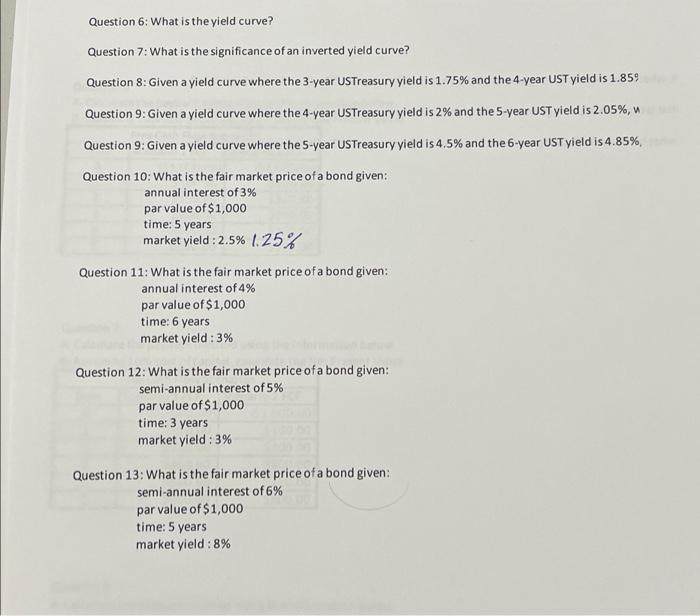

Question 6: What is the yield curve? Question 7: What is the significance of an inverted yield curve? Question 8: Given a yield curve where the 3-year USTreasury yield is 1.75% and the 4-year UST yield is 1.859 Question 9: Given a yield curve where the 4-year US Treasury yield is 2% and the 5-year UST yield is 2.05%, Question 9: Given a yield curve where the 5-year US Treasury yield is 4.5% and the 6-year UST yield is 4.85% Question 10: What is the fair market price ofa bond given: annual interest of 3% par value of $1,000 time: 5 years market yield: 2.5% 1.25% Question 11: What is the fair market price of a bond given: annual interest of 4% par value of $1,000 time: 6 years market yield: 3% Question 12: What is the fair market price ofa bond given: semi-annual interest of 5% par value of $1,000 time: 3 years market yield: 3% Question 13: What is the fair market price of a bond given: semi-annual interest of 6% par value of $1,000 time: 5 years market yield: 8%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts