Question: I need help to finish this... Writing Assignment for Managerial Accounting Introduction: Business executives, managers, analysts, and accountants must be able to effectively communicate. It

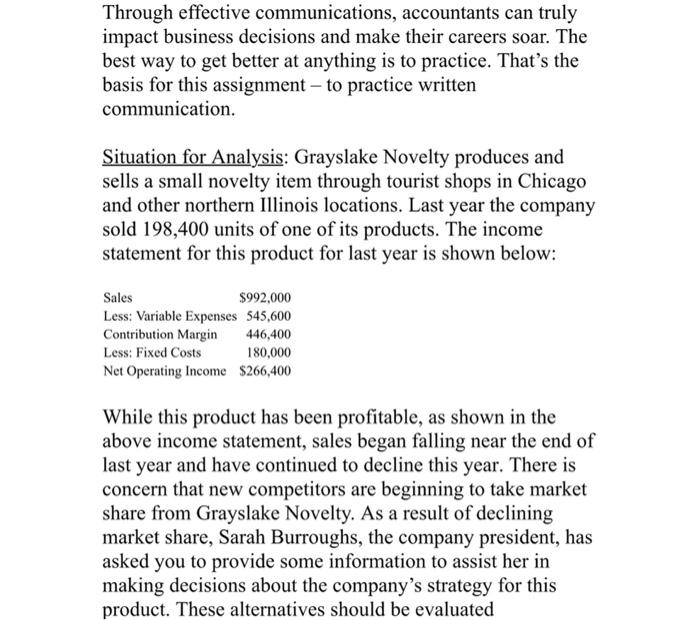

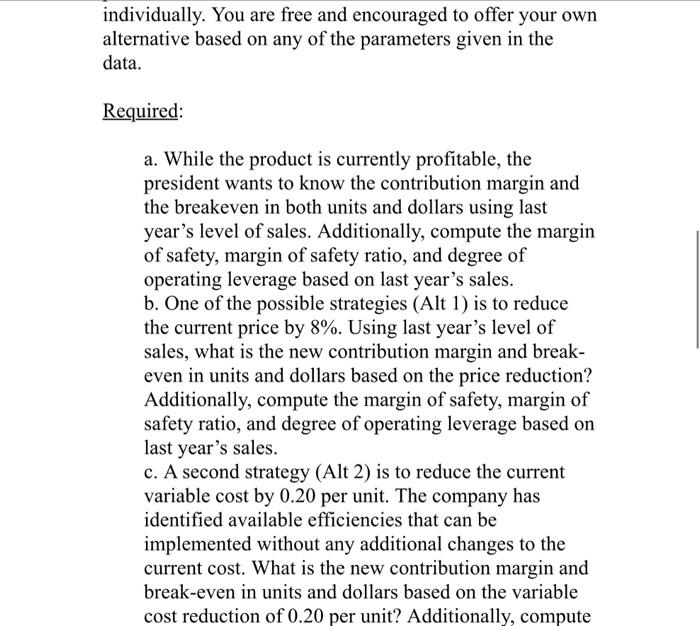

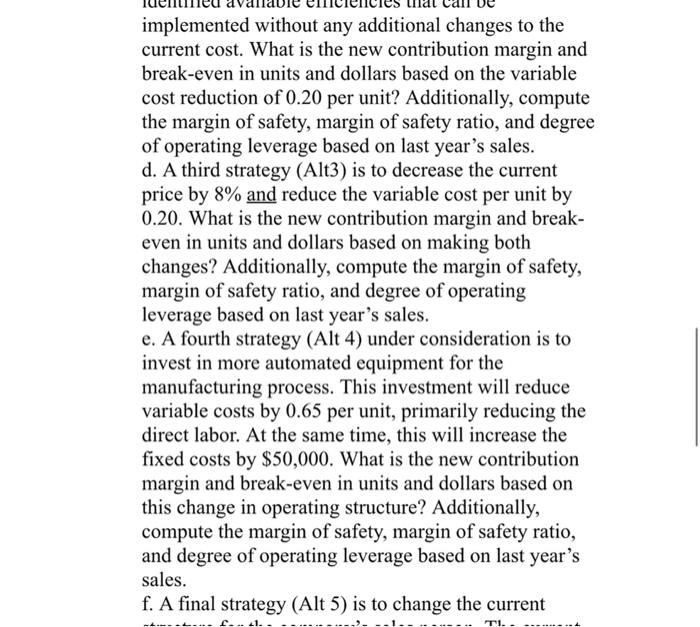

Writing Assignment for Managerial Accounting Introduction: Business executives, managers, analysts, and accountants must be able to effectively communicate. It is one of the most important skills a business executive can possess. As French businesswoman and author Mirelle Guilliano has said, "Intelligence, knowledge or experience are important and might get you a job, but strong communication skills are what will get you promoted. My own business experience supports this statement. By the time individuals have a few years of business experience, they have developed great technical skills and can assemble, analyze, and categorize data to make solid business decisions. In the end, however, they are often unable to communicate the results of their analysis effectively. When I speak to senior executives and inquire about educational needs, the conversation invariably turns to communications. In accounting, by necessity, we focus on financial and quantitative data, but it is important to remember that as accountants we must be able to present the results of our analysis or studies to management. Through effective communications, accountants can truly imnnnt business deninions and mola thair anraars ennr The individually. You are free and encouraged to offer your own alternative based on any of the parameters given in the data. Required: a. While the product is currently profitable, the president wants to know the contribution margin and the breakeven in both units and dollars using last year's level of sales. Additionally, compute the margin of safety, margin of safety ratio, and degree of operating leverage based on last year's sales. b. One of the possible strategies (Alt 1) is to reduce the current price by 8%. Using last year's level of sales, what is the new contribution margin and break- even in units and dollars based on the price reduction? Additionally, compute the margin of safety, margin of safety ratio, and degree of operating leverage based on last year's sales. c. A second strategy (Alt 2) is to reduce the current variable cost by 0.20 per unit. The company has identified available efficiencies that can be implemented without any additional changes to the current cost. What is the new contribution margin and break-even in units and dollars based on the variable cost reduction of 0.20 per unit? Additionally, compute implemented without any additional changes to the current cost. What is the new contribution margin and break-even in units and dollars based on the variable cost reduction of 0.20 per unit? Additionally, compute the margin of safety, margin of safety ratio, and degree of operating leverage based on last year's sales. d. A third strategy (Alt3) is to decrease the current price by 8% and reduce the variable cost per unit by 0.20. What is the new contribution margin and break- even in units and dollars based on making both changes? Additionally, compute the margin of safety, margin of safety ratio, and degree of operating leverage based on last year's sales. e. A fourth strategy (Alt 4) under consideration is to invest in more automated equipment for the manufacturing process. This investment will reduce variable costs by 0.65 per unit, primarily reducing the direct labor. At the same time, this will increase the fixed costs by $50,000. What is the new contribution margin and break-even in units and dollars based on this change in operating structure? Additionally, compute the margin of safety, margin of safety ratio, and degree of operating leverage based on last year's sales. f. A final strategy (Alt 5) is to change the current TI. f. A final strategy (Alt 5) is to change the current structure for the company's sales person. The current fixed cost includes the salary of Grayslake's one sales person at $60,000 per year. The company's marketing study suggests that sales could be increased by 20% if the company hired an additional sales person; paid both individuals $40,000 fixed salaries, and a 0.25 commission per unit sold. What is the new contribution margin and break-even in units and dollars based on this change? Additionally, compute the margin of safety, margin of safety ratio, and degree of operating leverage based on last year's sales as the starting point for this change. Submission Instructions: Write a business memo addressed to the president recommending the best course of action based on your analysis. In your memo, discuss changes in break-even points, and impacts to the operating leverage. Including a table summarizing your findings would be appropriate. The company's long-range plan is to grow sales to 250,000 units in the next two to three years. In your memo, summarize the advantages and disadvantages of each of the alternatives. Critically evaluate the alternatives based on current market conditions and any impact each alternative Write a business memo addressed to the president recommending the best course of action based on your analysis. In your memo, discuss changes in break-even points, and impacts to the operating leverage. Including a table summarizing your findings would be appropriate. The company's long-range plan is to grow sales to 250,000 units in the next two to three years. In your memo, summarize the advantages and disadvantages of each of the alternatives. Critically evaluate the alternatives based on current market conditions and any impact each alternative may have on the long-range plan. Clearly state your recommended course of action explaining why your recommendation is the best for the company. Your memo should be at least one page, but no longer than two full pages. You should also attach an Excel spreadsheet that documents all your calculations. The calculations supporting your data and analysis must be included. 1 Writing Assignment for Managerial Accounting Introduction: Business executives, managers, analysts, and accountants must be able to effectively communicate. It is one of the most important skills a business executive can possess. As French businesswoman and author Mirelle Guilliano has said, "Intelligence, knowledge or experience are important and might get you a job, but strong communication skills are what will get you promoted. My own business experience supports this statement. By the time individuals have a few years of business experience, they have developed great technical skills and can assemble, analyze, and categorize data to make solid business decisions. In the end, however, they are often unable to communicate the results of their analysis effectively. When I speak to senior executives and inquire about educational needs, the conversation invariably turns to communications. In accounting, by necessity, we focus on financial and quantitative data, but it is important to remember that as accountants we must be able to present the results of our analysis or studies to management. Through effective communications, accountants can truly imnnnt business deninions and mola thair anraars ennr The individually. You are free and encouraged to offer your own alternative based on any of the parameters given in the data. Required: a. While the product is currently profitable, the president wants to know the contribution margin and the breakeven in both units and dollars using last year's level of sales. Additionally, compute the margin of safety, margin of safety ratio, and degree of operating leverage based on last year's sales. b. One of the possible strategies (Alt 1) is to reduce the current price by 8%. Using last year's level of sales, what is the new contribution margin and break- even in units and dollars based on the price reduction? Additionally, compute the margin of safety, margin of safety ratio, and degree of operating leverage based on last year's sales. c. A second strategy (Alt 2) is to reduce the current variable cost by 0.20 per unit. The company has identified available efficiencies that can be implemented without any additional changes to the current cost. What is the new contribution margin and break-even in units and dollars based on the variable cost reduction of 0.20 per unit? Additionally, compute implemented without any additional changes to the current cost. What is the new contribution margin and break-even in units and dollars based on the variable cost reduction of 0.20 per unit? Additionally, compute the margin of safety, margin of safety ratio, and degree of operating leverage based on last year's sales. d. A third strategy (Alt3) is to decrease the current price by 8% and reduce the variable cost per unit by 0.20. What is the new contribution margin and break- even in units and dollars based on making both changes? Additionally, compute the margin of safety, margin of safety ratio, and degree of operating leverage based on last year's sales. e. A fourth strategy (Alt 4) under consideration is to invest in more automated equipment for the manufacturing process. This investment will reduce variable costs by 0.65 per unit, primarily reducing the direct labor. At the same time, this will increase the fixed costs by $50,000. What is the new contribution margin and break-even in units and dollars based on this change in operating structure? Additionally, compute the margin of safety, margin of safety ratio, and degree of operating leverage based on last year's sales. f. A final strategy (Alt 5) is to change the current TI. f. A final strategy (Alt 5) is to change the current structure for the company's sales person. The current fixed cost includes the salary of Grayslake's one sales person at $60,000 per year. The company's marketing study suggests that sales could be increased by 20% if the company hired an additional sales person; paid both individuals $40,000 fixed salaries, and a 0.25 commission per unit sold. What is the new contribution margin and break-even in units and dollars based on this change? Additionally, compute the margin of safety, margin of safety ratio, and degree of operating leverage based on last year's sales as the starting point for this change. Submission Instructions: Write a business memo addressed to the president recommending the best course of action based on your analysis. In your memo, discuss changes in break-even points, and impacts to the operating leverage. Including a table summarizing your findings would be appropriate. The company's long-range plan is to grow sales to 250,000 units in the next two to three years. In your memo, summarize the advantages and disadvantages of each of the alternatives. Critically evaluate the alternatives based on current market conditions and any impact each alternative Write a business memo addressed to the president recommending the best course of action based on your analysis. In your memo, discuss changes in break-even points, and impacts to the operating leverage. Including a table summarizing your findings would be appropriate. The company's long-range plan is to grow sales to 250,000 units in the next two to three years. In your memo, summarize the advantages and disadvantages of each of the alternatives. Critically evaluate the alternatives based on current market conditions and any impact each alternative may have on the long-range plan. Clearly state your recommended course of action explaining why your recommendation is the best for the company. Your memo should be at least one page, but no longer than two full pages. You should also attach an Excel spreadsheet that documents all your calculations. The calculations supporting your data and analysis must be included. 1

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts