Question: i need help to get these two amortization tables started and the scenario 2 questions. at least 15 rows to help me see how and

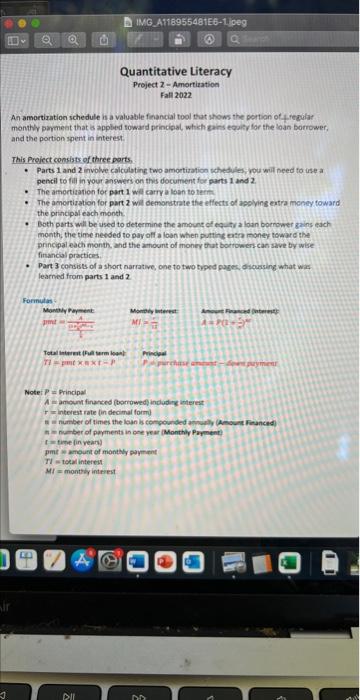

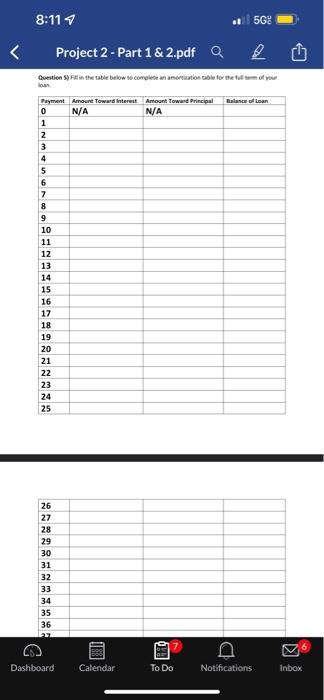

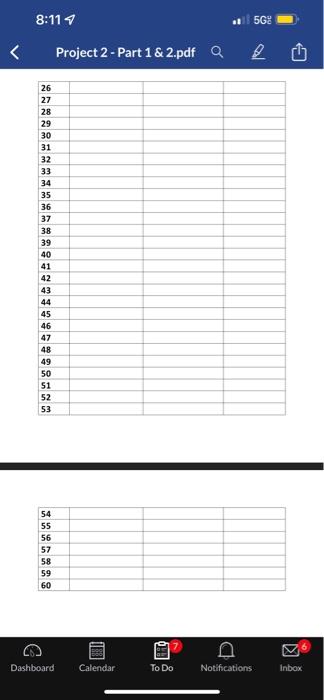

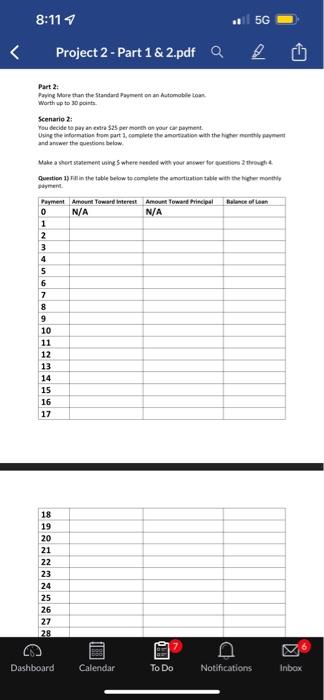

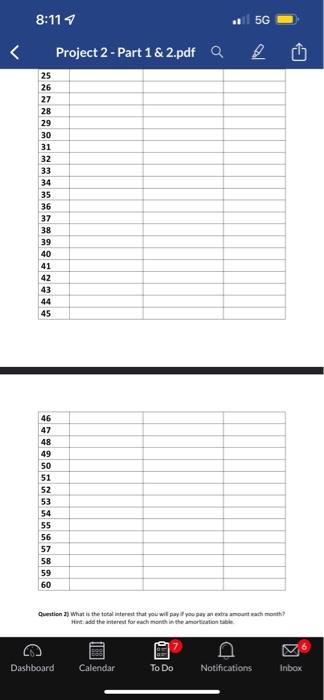

An amortization sche dule is a valuable financial tool that shows the portion of _recular monthy parmeat that is appled toward prindisal, which gats equity for the loan bomower, and the portion spert in interest. This Proiect consists of three ports, - Parts 1 and 2 involve calculating two amortization scheslites, vou wil need to iste a pencil to fill in yout answers on this document for parts 1 and 2. - The amortiation for part 1 wil carry a loan to tern - The amortization for part 2 will demonstrate the effectr of acolvins ertra money toward the principal esch month. - Both parts will be used to determine the amount of equ ty a loan boerower gains each month, the time needed to pay off a losn when puttine eatra money toward the principal each month, and the athount of money that botrowers can save by wise fittancal practices, - Part 3 consists of a short narrative, one to two typed pages, dicursing what wis learned from parts 1 and 2 Formulas Note: P= Principal A= amount finaters (bonrowed) indudire imterest r= interest rate (in decimal form) n = number of times the loan is congounded arivully (Amount Firanced) in = nuatber of poyments in one vear (Monthly Payment) t = time (in veart) pme we anount of monthy payment TI= toeal interest Mr= montely interest lown. Part 2: Paying Mare than the 5tandark Payment on an A.tomable toat. Worth sp to 30 soints. Scenario 2: Tsu decide bo pay an evlta 325 per morth on your car peyme-t. Uhing the information trom part 1 , complete the anortanion with the higher northly puymevi and arwwer the puevisont below. Make a shert satement ining 5 where seeded whit your anwer for eueition 2 theouch 4. Question 1) Fillin the table below te complete the angrtization tatif aith the higter nonttly puymemL. Quention 1) What it the toted interest that pou wil pay if poo pay an exira amount wath month? thint add the interest for ewch month in the amort dalion takin. An amortization sche dule is a valuable financial tool that shows the portion of _recular monthy parmeat that is appled toward prindisal, which gats equity for the loan bomower, and the portion spert in interest. This Proiect consists of three ports, - Parts 1 and 2 involve calculating two amortization scheslites, vou wil need to iste a pencil to fill in yout answers on this document for parts 1 and 2. - The amortiation for part 1 wil carry a loan to tern - The amortization for part 2 will demonstrate the effectr of acolvins ertra money toward the principal esch month. - Both parts will be used to determine the amount of equ ty a loan boerower gains each month, the time needed to pay off a losn when puttine eatra money toward the principal each month, and the athount of money that botrowers can save by wise fittancal practices, - Part 3 consists of a short narrative, one to two typed pages, dicursing what wis learned from parts 1 and 2 Formulas Note: P= Principal A= amount finaters (bonrowed) indudire imterest r= interest rate (in decimal form) n = number of times the loan is congounded arivully (Amount Firanced) in = nuatber of poyments in one vear (Monthly Payment) t = time (in veart) pme we anount of monthy payment TI= toeal interest Mr= montely interest lown. Part 2: Paying Mare than the 5tandark Payment on an A.tomable toat. Worth sp to 30 soints. Scenario 2: Tsu decide bo pay an evlta 325 per morth on your car peyme-t. Uhing the information trom part 1 , complete the anortanion with the higher northly puymevi and arwwer the puevisont below. Make a shert satement ining 5 where seeded whit your anwer for eueition 2 theouch 4. Question 1) Fillin the table below te complete the angrtization tatif aith the higter nonttly puymemL. Quention 1) What it the toted interest that pou wil pay if poo pay an exira amount wath month? thint add the interest for ewch month in the amort dalion takin

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts