Question: I NEED HELP TO IMPLEMENT THIS PROBLEM IN EXCEL AND USE THE SOLVER. Q: You have the opportunity to acquire a company in the ICT

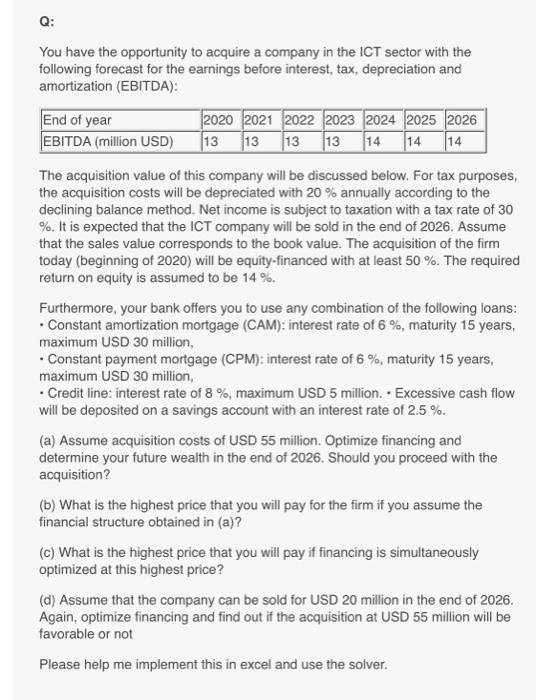

Q: You have the opportunity to acquire a company in the ICT sector with the following forecast for the earnings before interest, tax, depreciation and amortization (EBITDA): End of year 2020 2021 2022 2023 2024 2025 2026 EBITDA (million USD) 13 13 13 13 14 14 14 The acquisition value of this company will be discussed below. For tax purposes, the acquisition costs will be depreciated with 20 % annually according to the declining balance method. Net income is subject to taxation with a tax rate of 30 %. It is expected that the ICT company will be sold in the end of 2026. Assume that the sales value corresponds to the book value. The acquisition of the firm today (beginning of 2020) will be equity-financed with at least 50 %. The required return on equity is assumed to be 14%. Furthermore, your bank offers you to use any combination of the following loans: . Constant amortization mortgage (CAM): interest rate of 6 %, maturity 15 years, maximum USD 30 million, Constant payment mortgage (CPM): interest rate of 6 %, maturity 15 years, maximum USD 30 million, Credit line: interest rate of 8 %, maximum USD 5 million. Excessive cash flow will be deposited on a savings account with an interest rate of 2.5%. (a) Assume acquisition costs of USD 55 million. Optimize financing and determine your future wealth in the end of 2026. Should you proceed with the acquisition? (b) What is the highest price that you will pay for the firm if you assume the financial structure obtained in (a)? (c) What is the highest price that you will pay if financing is simultaneously optimized at this highest price? (d) Assume that the company can be sold for USD 20 million in the end of 2026. Again, optimize financing and find out if the acquisition at USD 55 million will be favorable or not Please help me implement this in excel and use the solver

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts