Question: I need help to show the steps for this question. Thanks Crane Company purchased equipment on March 31,2021 , at a cost of $252,000. Management

I need help to show the steps for this question. Thanks

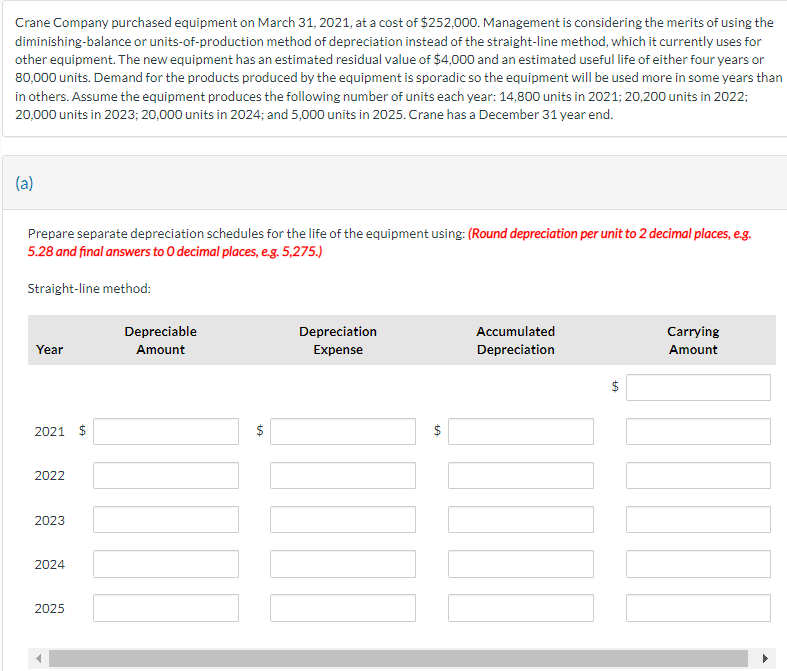

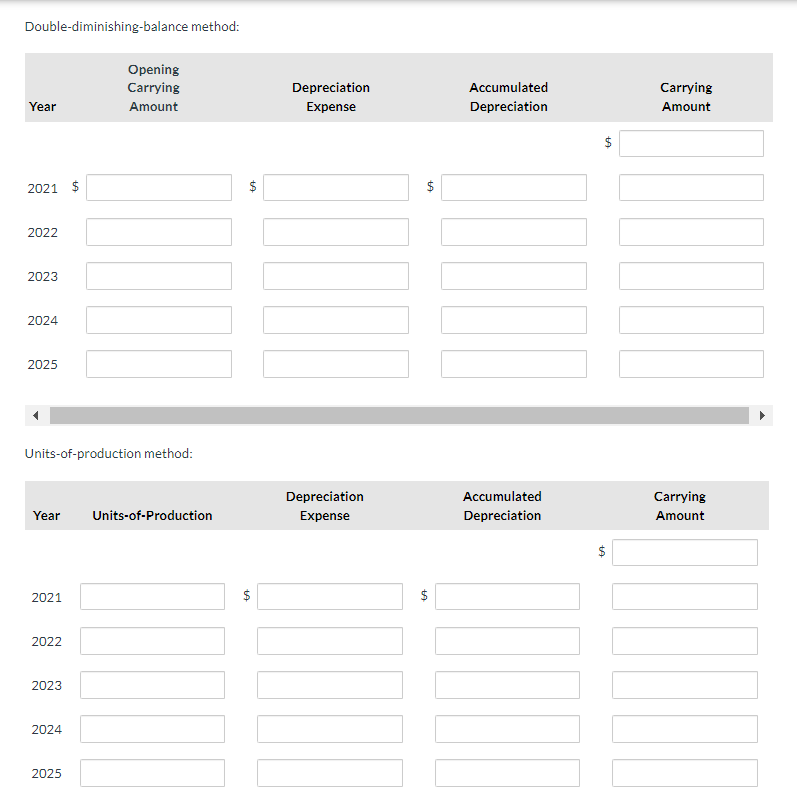

Crane Company purchased equipment on March 31,2021 , at a cost of $252,000. Management is considering the merits of using the diminishing-balance or units-of-production method of depreciation instead of the straight-line method, which it currently uses for other equipment. The new equipment has an estimated residual value of $4,000 and an estimated useful life of either four years or 80,000 units. Demand for the products produced by the equipment is sporadic so the equipment will be used more in some years thar in others. Assume the equipment produces the following number of units each year: 14,800 units in 2021;20,200 units in 2022; 20,000 units in 2023; 20,000 units in 2024; and 5,000 units in 2025. Crane has a December 31 year end. (a) Prepare separate depreciation schedules for the life of the equipment using: (Round depreciation per unit to 2 decimal places, e.g. 5.28 and final answers to 0 decimal places, e.g. 5,275.) Double-diminishing-balance method: Units-of-production method

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts