Question: I need help to solve this below. Thank you. On April 1st 2014, AqcuirerCo acquired TargetCo's 100% shares. The M&A deal that took place between

I need help to solve this below. Thank you.

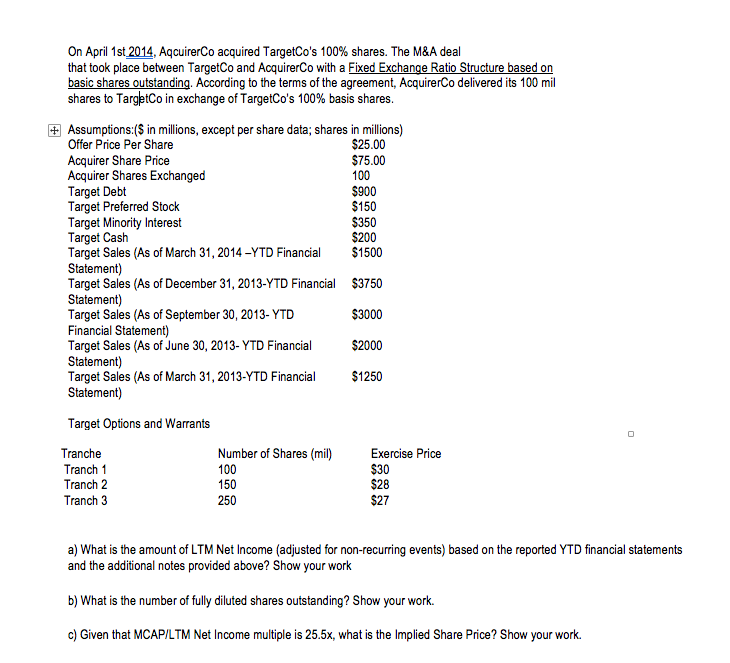

On April 1st 2014, AqcuirerCo acquired TargetCo's 100% shares. The M&A deal that took place between TargetCo and AcquirerCo with a Fixed Exchange Ratio Structure based on basic shares outstanding. According to the terms of the agreement, AcquirerCo delivered its 100 mil shares to TargetCo in exchange of TargetCo's 100% basis shares. Assumptions:($ in millions, except per share data; shares in millions) $25.00 $75.00 100 Offer Price Per Share Acquirer Share Price Acquirer Shares Exchanged Target Debt Target Preferred Stock Target Minority Interest Target Cash Target Sales (As of March 31, 2014-YTD Financial Statement) Target Sales (As of December 31, 2013-YTD Financial Statement) Target Sales (As of September 30, 2013- YTD Financial Statement) Target Sales (As of June 30, 2013- YTD Financial Statement) Target Sales (As of March 31, 2013-YTD Financial Statement) $900 $150 $350 $200 $1500 $3750 $3000 $2000 $1250 Target Options and Warrants Number of Shares (mil) Tranche Exercise Price Tranch 1 Tranch 2 Tranch 3 100 150 $30 $28 $27 250 a) What is the amount of LTM Net Income (adjusted for non-recurring events) based on the reported YTD financial statements and the additional notes provided above? Show your work b)What is the number of fully diluted shares outstanding? Show your work. c) Given that MCAP/LTM Net Income multiple is 25.5x, what is the Implied Share Price? Show your work. On April 1st 2014, AqcuirerCo acquired TargetCo's 100% shares. The M&A deal that took place between TargetCo and AcquirerCo with a Fixed Exchange Ratio Structure based on basic shares outstanding. According to the terms of the agreement, AcquirerCo delivered its 100 mil shares to TargetCo in exchange of TargetCo's 100% basis shares. Assumptions:($ in millions, except per share data; shares in millions) $25.00 $75.00 100 Offer Price Per Share Acquirer Share Price Acquirer Shares Exchanged Target Debt Target Preferred Stock Target Minority Interest Target Cash Target Sales (As of March 31, 2014-YTD Financial Statement) Target Sales (As of December 31, 2013-YTD Financial Statement) Target Sales (As of September 30, 2013- YTD Financial Statement) Target Sales (As of June 30, 2013- YTD Financial Statement) Target Sales (As of March 31, 2013-YTD Financial Statement) $900 $150 $350 $200 $1500 $3750 $3000 $2000 $1250 Target Options and Warrants Number of Shares (mil) Tranche Exercise Price Tranch 1 Tranch 2 Tranch 3 100 150 $30 $28 $27 250 a) What is the amount of LTM Net Income (adjusted for non-recurring events) based on the reported YTD financial statements and the additional notes provided above? Show your work b)What is the number of fully diluted shares outstanding? Show your work. c) Given that MCAP/LTM Net Income multiple is 25.5x, what is the Implied Share Price? Show your work

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts