Question: I need help to solve this problem. Kamada: CIA Japan (A). Takeshi Kamada, a foreign exchange trader at Credit Suisse (Tokyo), is exploring covered interest

I need help to solve this problem.

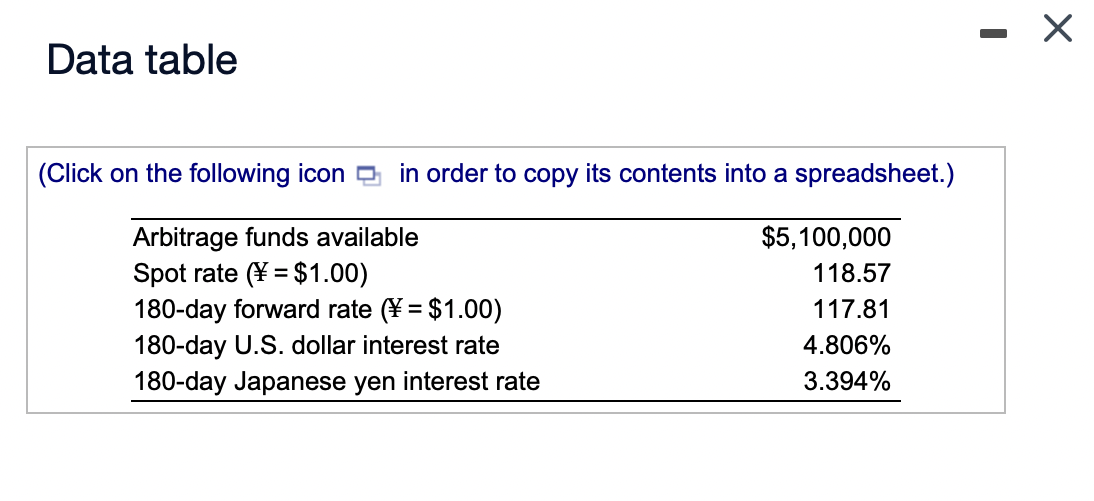

Kamada: CIA Japan (A). Takeshi Kamada, a foreign exchange trader at Credit Suisse (Tokyo), is exploring covered interest arbitrage possibilities. He wants to invest $5,100,000 or its yen equivalent, in a covered interest arbitrage between U.S. dollars and Japanese yen. He faced the following exchange rate and interest rate quotes: . Is CIA profit possible? If so, how? The CIA profit potential is %, which tells Takeshi Kamada that he should borrow arbitrage (CIA) profit. (Round to three decimal places and select from the drop-dow and invest in the higher yielding currency, to lock in a covered interest Kamada: CIA Japan (A). Takeshi Kamada, a foreign exchange trader at Credit Suisse (Tokyo), is exploring covered interest arbitrage possibilities. He wants to invest $5,100,000 or its yen equivalent, in a covered interest arbitrage between U.S. dollars and Japanese yen. He faced the following exchange rate and interest rate quotes: . Is CIA profit possible? If so, how? The CIA profit potential is %, which tells Takeshi Kamada that he should borrow arbitrage (CIA) profit. (Round to three decimal places and select from the drop-down menus.) and invest in the higher yielding currency, , to lock in a covered interes Data table (Click on the following icon in order to copy its contents into a spreadsheet.) Kamada: CIA Japan (A). Takeshi Kamada, a foreign exchange trader at Credit Suisse (Tokyo), is exploring covered interest arbitrage possibilities. He wants to invest $5,100,000 or its yen equivalent, in a covered interest arbitrage between U.S. dollars and Japanese yen. He faced the following exchange rate and interest rate quotes: . Is CIA profit possible? If so, how? The CIA profit potential is %, which tells Takeshi Kamada that he should borrow arbitrage (CIA) profit. (Round to three decimal places and select from the drop-dow and invest in the higher yielding currency, to lock in a covered interest Kamada: CIA Japan (A). Takeshi Kamada, a foreign exchange trader at Credit Suisse (Tokyo), is exploring covered interest arbitrage possibilities. He wants to invest $5,100,000 or its yen equivalent, in a covered interest arbitrage between U.S. dollars and Japanese yen. He faced the following exchange rate and interest rate quotes: . Is CIA profit possible? If so, how? The CIA profit potential is %, which tells Takeshi Kamada that he should borrow arbitrage (CIA) profit. (Round to three decimal places and select from the drop-down menus.) and invest in the higher yielding currency, , to lock in a covered interes Data table (Click on the following icon in order to copy its contents into a spreadsheet.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts