Question: I need help to solve this question with clear explaination... On April 1, 2022, Guy Comeau and Amelie Lavoi formed a partnership in Ontario. Net

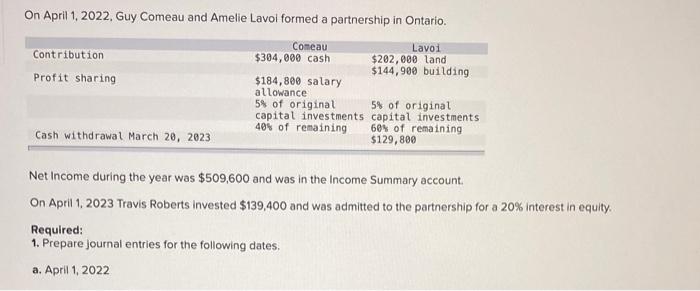

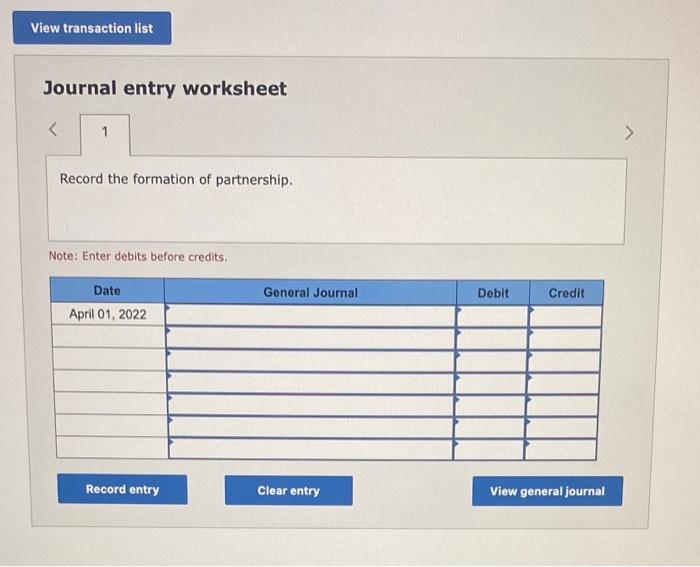

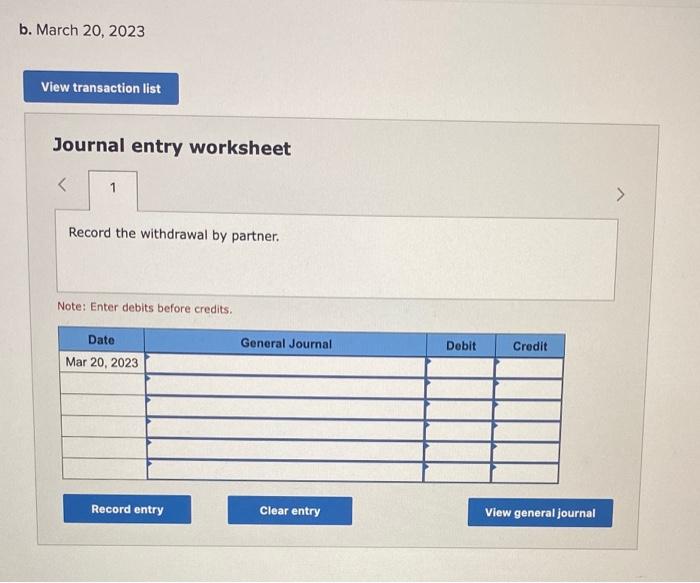

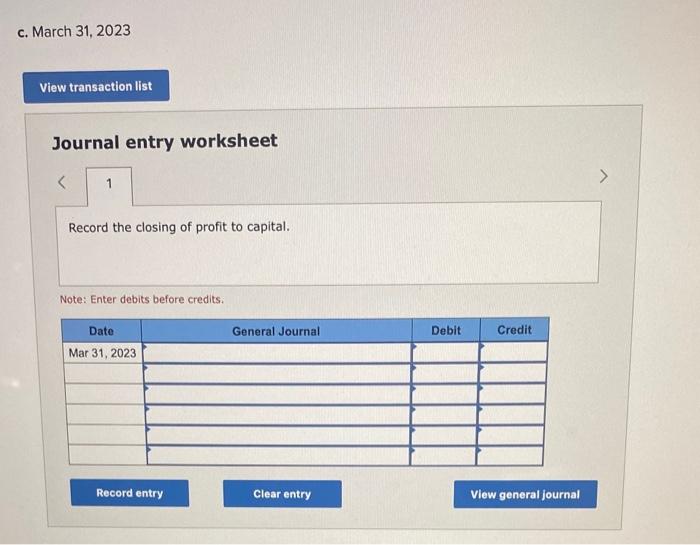

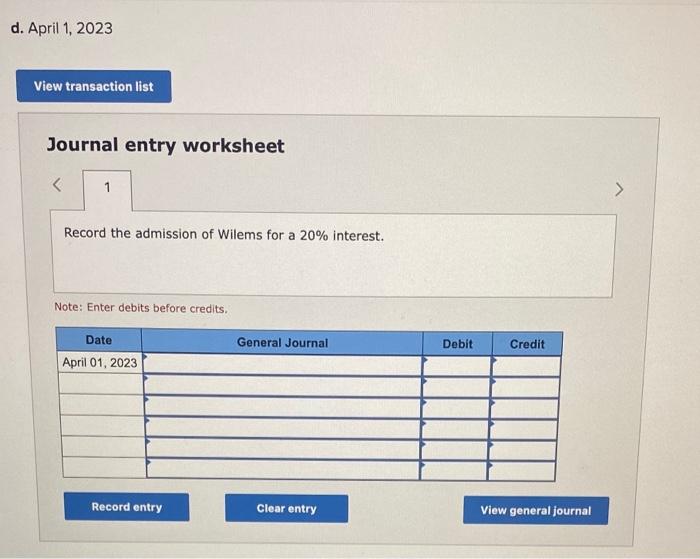

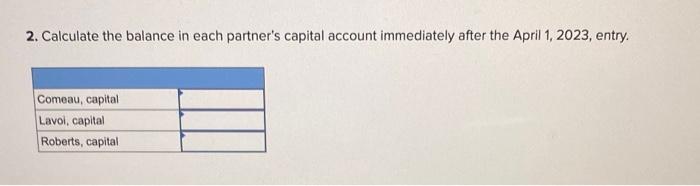

On April 1, 2022, Guy Comeau and Amelie Lavoi formed a partnership in Ontario. Net Income during the year was $509,600 and was in the Income Summary account. On April 1. 2023 Travis Roberts invested $139,400 and was admitted to the partnership for a 20% interest in equity. Required: 1. Prepare journal entries for the following dates. a. April 1,2022 Journal entry worksheet Note: Enter debits before credits. Journal entry worksheet Note: Enter debits before credits. Journal entry worksheet Note: Enter debits before credits: Journal entry worksheet Record the admission of Wilems for a 20% interest. Note: Enter debits before credits. 2. Calculate the balance in each partner's capital account immediately after the April 1, 2023, entry

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts