Question: I need help to solve this question with clear explaination... On June 1, 2023, Jill Bow and Aisha Adams formed a partnership to open a

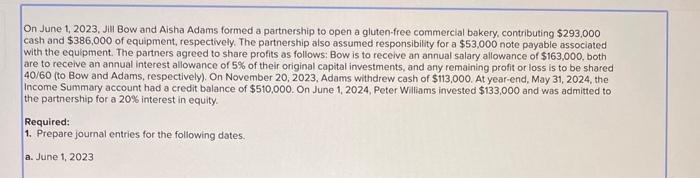

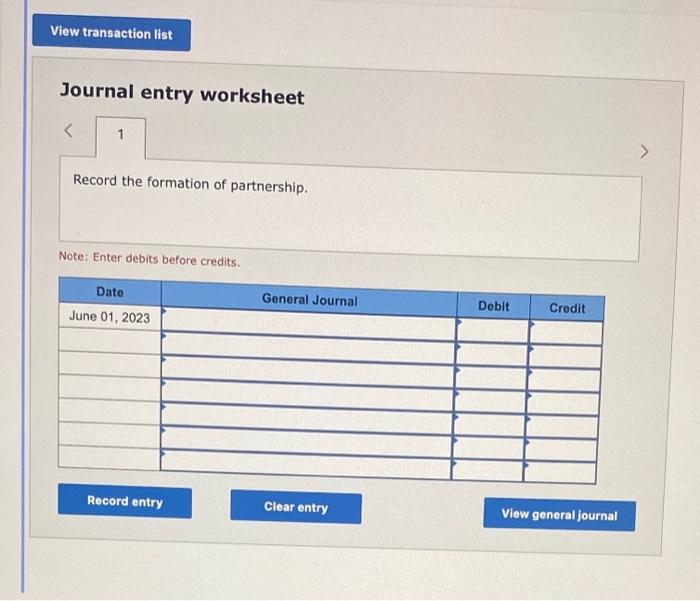

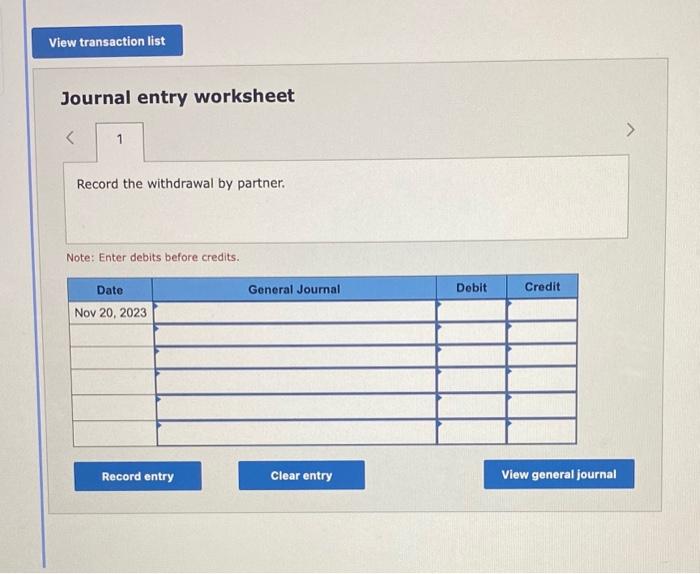

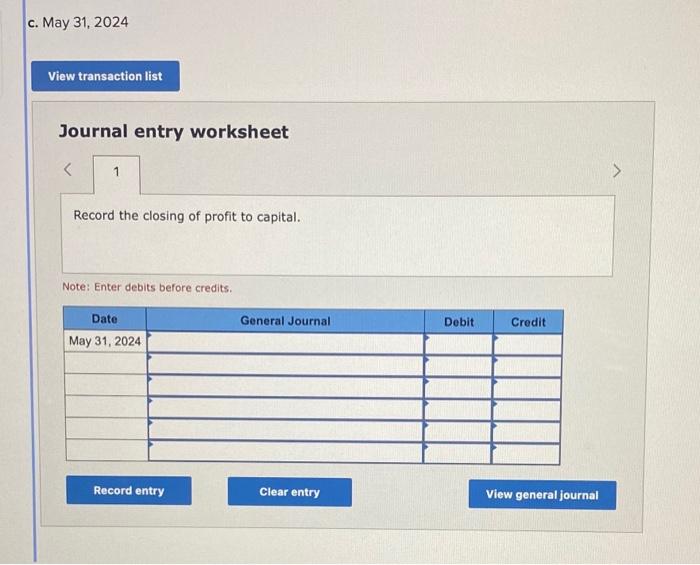

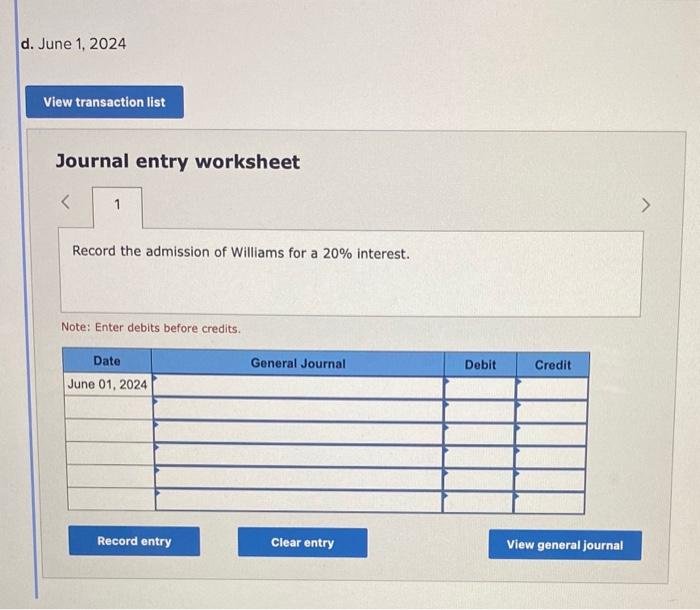

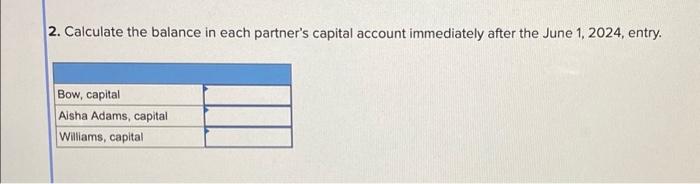

On June 1, 2023, Jill Bow and Aisha Adams formed a partnership to open a gluten-free commercial bakery, contributing $293,000 cash and $386,000 of equipment, respectively. The partnership also assumed responsibility for a $53,000 note payable associated with the equipment. The partners agreed to share profits as follows: Bow is to receive an annual salary allowance of $163,000, both are to recelve an annual interest allowance of 5% of their original capital investments, and any remaining profit or loss is to be shared 40/60 (to Bow and Adams, respectively). On November 20, 2023, Adams withdrew cash of $113,000. At year-end, May 31, 2024, the Income Summary account had a credit balance of $510,000. On June 1, 2024, Peter Williams invested $133,000 and was admitted to the partnership for a 20% interest in equity. Required: 1. Prepare journal entries for the foliowing dates. a. June 1, 2023 Journal entry worksheet Journal entry worksheet Note: Enter debits before credits. Journal entry worksheet Note: Enter debits before credits. Journal entry worksheet Record the admission of Williams for a 20% interest. Note: Enter debits before credits. 2. Calculate the balance in each partner's capital account immediately after the June 1, 2024, entry

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts