Question: I need help understanding both requirements 1 & 2 from the image posted here in Excel format. Aging of accounts receivable allowance method Learning Objective

I need help understanding both requirements 1 & 2 from the image posted here in Excel format.

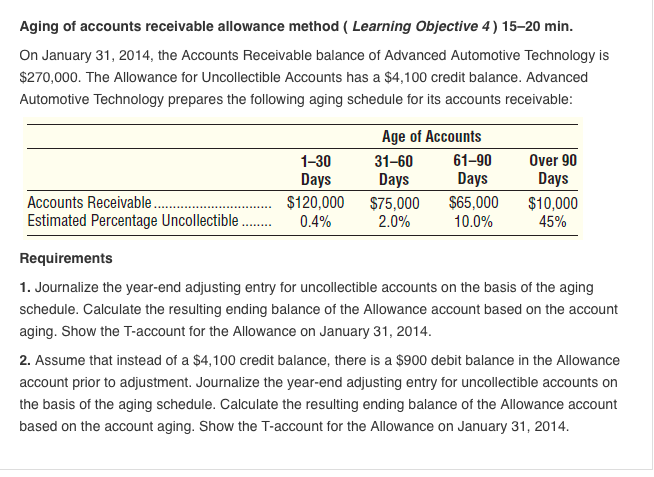

Aging of accounts receivable allowance method Learning Objective 4) 15-20 min. On January 31, 2014, the Accounts Receivable balance of Advanced Automotive Technology is $270,000. The Allowance for Uncollectible Accounts has a $4,100 credit balance. Advanced Automotive Technology prepares the following aging schedule for its accounts receivable: Age of Accounts 1-30 31-60 61-90 Over 90 Days Days Days Days Accounts Receivable $120,000 $75,000 $65,000 $10,000 Estimated Percentage Uncollectible 0.4% 2.0% 10.0% 45% Requirements 1. Journalize the year-end adjusting entry for uncollectible accounts on the basis of the aging schedule. Calculate the resulting ending balance of the Allowance account based on the account aging. Show the T-account for the Allowance on January 31, 2014 2. Assume that instead of a $4,100 credit balance, there is a $900 debit balance in the Allowance account prior to adjustment. Journalize the year-end adjusting entry for uncollectible accounts on the basis of the aging schedule. Calculate the resulting ending balance of the Allowance account based on the account aging. Show the T-account for the Allowance on January 31, 2014

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts