Question: I need help understanding how bonds work and how to fill this. Bond Valuation Solve for the Yield Frequency Semi If Held to Maturity 2

I need help understanding how bonds work and how to fill this.

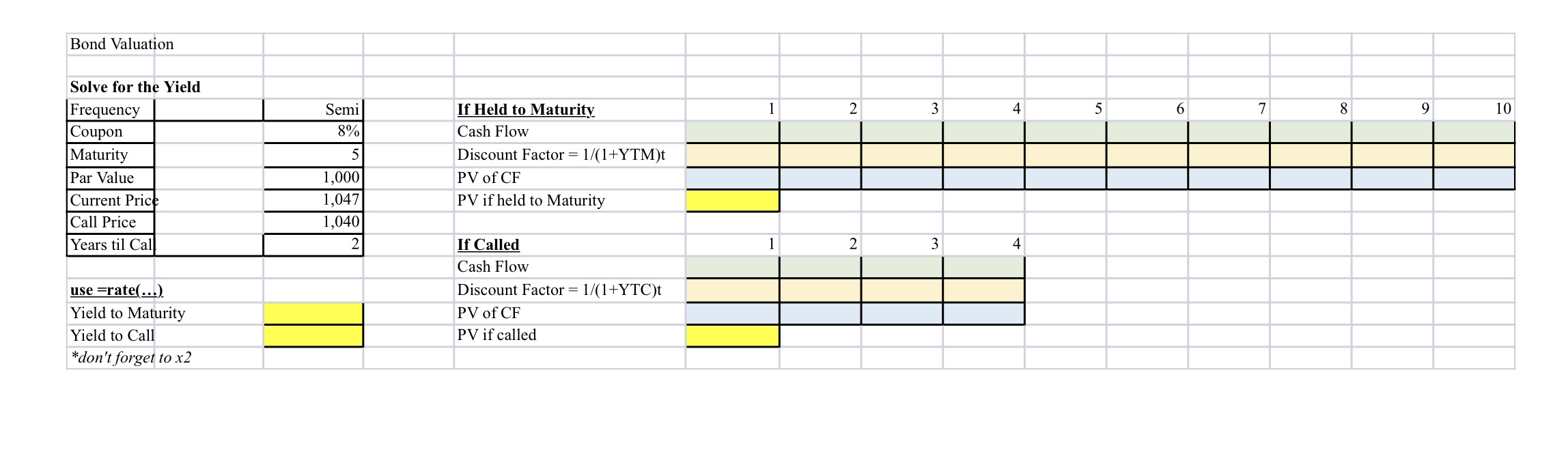

Bond Valuation Solve for the Yield Frequency Semi If Held to Maturity 2 3 4 5 6 7 8 9 10 Coupon 8% Cash Flow Maturity 5 Discount Factor = 1/(1+YTM)t Par Value 1,000 PV of CF Current Price 1,047 PV if held to Maturity Call Price 1,040 Years til Cal 2 If Called 1 2 3 4 Cash Flow use =rate(...) Discount Factor = 1/(1+YTC)t Yield to Maturity PV of CF Yield to Call PV if called *don't forget to x2

Bond Valuation Solve for the Yield Frequency Semi If Held to Maturity 2 3 4 5 6 7 8 9 10 Coupon 8% Cash Flow Maturity 5 Discount Factor = 1/(1+YTM)t Par Value 1,000 PV of CF Current Price 1,047 PV if held to Maturity Call Price 1,040 Years til Cal 2 If Called 1 2 3 4 Cash Flow use =rate(...) Discount Factor = 1/(1+YTC)t Yield to Maturity PV of CF Yield to Call PV if called *don't forget to x2

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock