Question: I need help understanding how the answer is $838.40 Greshak Corp. plans to issue 33-year, $1,000 par value, 11.50% coupon bonds paid semi-annually in the

I need help understanding how the answer is $838.40

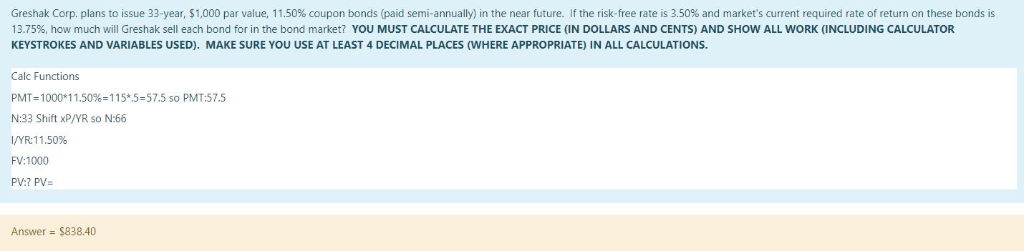

Greshak Corp. plans to issue 33-year, $1,000 par value, 11.50% coupon bonds paid semi-annually in the near future. If the risk-free rate is 3.5 % and market's current required rate of return on these bonds is 13.75%, how much will Greshak sell each bond for in the bond market? YOU MUST CALCULATE THE EXACT PRICE (IN DOLLARS AND CENTS) AND SHOW ALL WORK (INCLUDING CALCULATOR KEYSTROKES AND VARIABLES USED), MAKE SURE YOU USE AT LEAST 4 DECIMAL PLACES (WHERE APPROPRIATE) IN ALL CALCULATIONS Calc Functions PMT 1000 11.50%-115*.5-57.5 so PMT:57.5 N:33 Shift xP/YR so N:66 IAR 1 1.50% FV:1000 PV:7 PV Answer-$838.40

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts