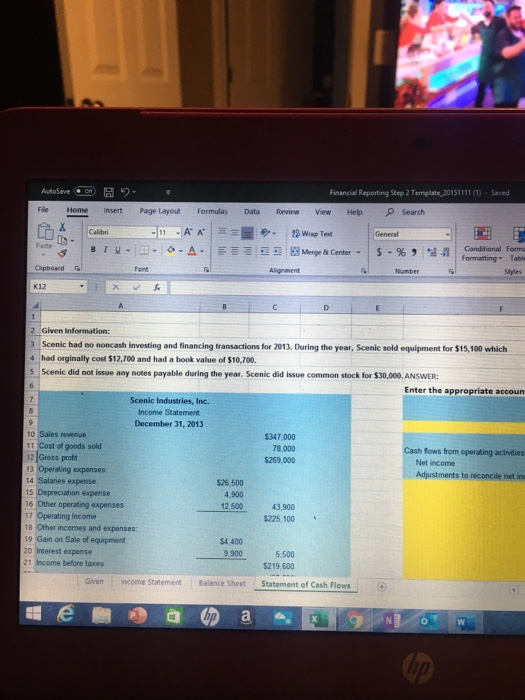

Question: I need help understanding how to construct a statement of cash flows with the given information. (the yellow boxes are where the responses are supposed

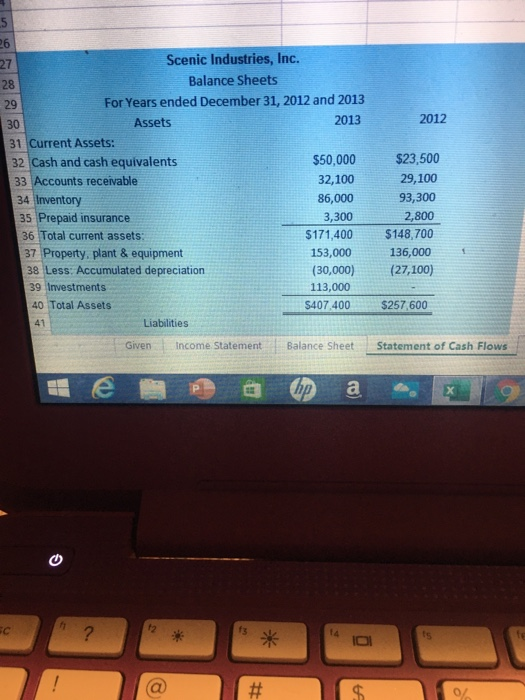

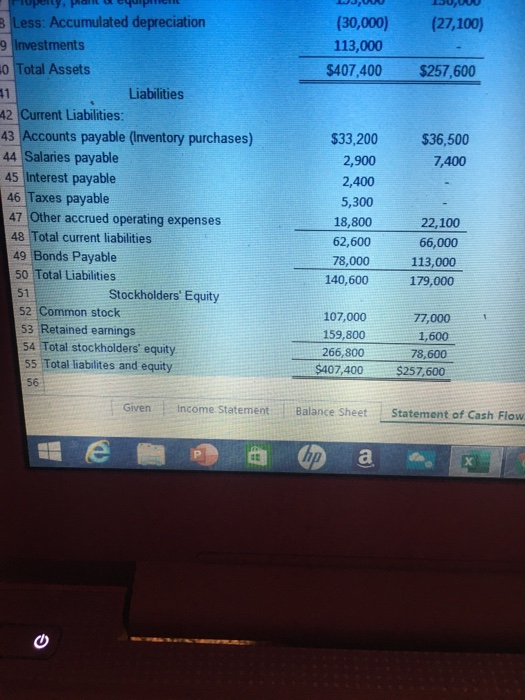

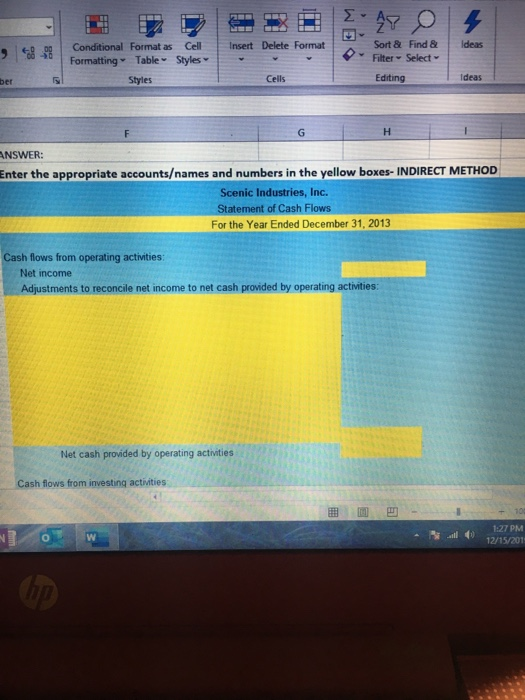

AutoSave Financial Reporting Step 2 Template 20151111 (1) - Saved File P Search Home Insert Page Layout Formulas Data Help Review View Calibri 11 - A A 3 Wrap Test General Paste Conditional forma BIU- - Merge & Center - E Formatting- Table Clipboard Font Alignment Number Styles K12 2 Given Information: 3 Scenic had no noncash investing and financing transactions for 2013. During the year, Scenic sold equipment for $15,100 which 4 had orginally cost $12,700 and had a book value of $10,700. 5 Scenic did not issue any notes payable during the year. Scenic did issue common stock for $30,000, ANSWER: Enter the appropriate accoun Scenic Industries, Inc. 7. Income Statement December 31, 2013 10 Sales revenue 11 Cost of goods sold 12 Gross profit 13 Operating expenses: 14 Salaries expense 15 Depreciation expense 16 Other operating expenses 17 Operating Income 18 Other incomes and expenses: $347,000 78.000 Cash fows from operating activities $269.000 Net income Adjustments to reconcile net ine $26.500 4,900 12.500 43.900 $225, 100 19 Gain on Sale of equipment $4.400 20 Interest exxpense 21 Income before taxes 9,900 5.500 $219,600 Given Income Statement Balance Sheet Statement of Cash Flows hp 26 Scenic Industries, Inc. 27 Balance Sheets 28 For Years ended December 31, 2012 and 2013 29 2013 2012 Assets 30 31 Current Assets: 32 Cash and cash equivalents 33 Accounts receivable 34 Inventory 35 Prepaid insurance $23,500 $50,000 32,100 29,100 93,300 86,000 3,300 2,800 $171,400 $148,700 36 Total current assets: 37 Property, plant & equipment 153,000 136,000 (30,000) (27,100) 38 Less: Accumulated depreciation 39 Investments 113,000 40 Total Assets $407.400 $257,600 41 Liabilities Given Balance Sheet Statement of Cash Flows Income Statement hp ts fe ! %23 8 Less: Accumulated depreciation 9 Investments (30,000) (27,100) 113,000 0 Total Assets $407,400 $257,600 41 Liabilities 42 Current Liabilities: 43 Accounts payable (Inventory purchases) 44 Salaries payable 45 Interest payable 46 Taxes payable 47 Other accrued operating expenses 48 Total current liabilities 49 Bonds Payable 50 Total Liabilities $33,200 $36,500 7,400 2,900 2,400 5,300 18,800 22,100 62,600 66,000 78,000 113,000 140,600 179,000 51 Stockholders' Equity 52 Common stock 53 Retained earnings 54 Total stockholders' equity 55 Total liabilites and equity 107,000 77,000 159,800 1,600 266,800 $407,400 78,600 $257,600 56 Given Income Statement Balance Sheet Statement of Cash Flow P. hp Ideas Sort & Find & Insert Delete Format Conditional Format as Cell Filter- Select Formatting Table Styles Editing Ideas Cells Styles ber ANSWER: Enter the appropriate accountsames and numbers in the yellow boxes- INDIRECT METHOD Scenic Industries, Inc. Statement of Cash Flows For the Year Ended December 31, 2013 Cash flows from operating activities: Net income Adjustments to reconcile net income to net cash provided by operating activities: Net cash provided by operating activities Cash flows from investing activities 10 1:27 PM all 0 12/15/2015 Sign in 2 Template 20151111 (1) - Saved P Com A Share Search 47 Sort & Find & Ideas Insert Delete Format Cell Conditional Format as Filter Select - Formatting Table Styles Ideas Editing Cells Styles Number Net cash provided by operating activities Cash flows from investing activities: Net cash used for investing activities Cash flows from financing activities: Net cash used for financing activities Cash balance, December 31, 2013 1:27 P 12/15/2 Styles Filter Select - Cells Editing Ideas Insurance Expense Supplies Expense Advertising Expense Utilities Expense Depreciation Expense- Building Depreciation Expense- Equipment Other expenses $890 $23,958 $9,830 $6,000 $13,300 $7,580 $113,558.00 $ 38,442.00 Net income WELLS MOBILE APPS AND ACCE! Statement of Retained Earnings For Year Ended December 31, 2 $60,000.00 Retained earnings, December 31, 2012 $ 38,442.00 Plus: Net income $98,442.00 Total $ 24,000.00 Less: Dividends $74,442.00 Retained earnings, December 31, 2013 100% 603 PM all 1/2/2020 AutoSave Financial Reporting Step 2 Template 20151111 (1) - Saved File P Search Home Insert Page Layout Formulas Data Help Review View Calibri 11 - A A 3 Wrap Test General Paste Conditional forma BIU- - Merge & Center - E Formatting- Table Clipboard Font Alignment Number Styles K12 2 Given Information: 3 Scenic had no noncash investing and financing transactions for 2013. During the year, Scenic sold equipment for $15,100 which 4 had orginally cost $12,700 and had a book value of $10,700. 5 Scenic did not issue any notes payable during the year. Scenic did issue common stock for $30,000, ANSWER: Enter the appropriate accoun Scenic Industries, Inc. 7. Income Statement December 31, 2013 10 Sales revenue 11 Cost of goods sold 12 Gross profit 13 Operating expenses: 14 Salaries expense 15 Depreciation expense 16 Other operating expenses 17 Operating Income 18 Other incomes and expenses: $347,000 78.000 Cash fows from operating activities $269.000 Net income Adjustments to reconcile net ine $26.500 4,900 12.500 43.900 $225, 100 19 Gain on Sale of equipment $4.400 20 Interest exxpense 21 Income before taxes 9,900 5.500 $219,600 Given Income Statement Balance Sheet Statement of Cash Flows hp 26 Scenic Industries, Inc. 27 Balance Sheets 28 For Years ended December 31, 2012 and 2013 29 2013 2012 Assets 30 31 Current Assets: 32 Cash and cash equivalents 33 Accounts receivable 34 Inventory 35 Prepaid insurance $23,500 $50,000 32,100 29,100 93,300 86,000 3,300 2,800 $171,400 $148,700 36 Total current assets: 37 Property, plant & equipment 153,000 136,000 (30,000) (27,100) 38 Less: Accumulated depreciation 39 Investments 113,000 40 Total Assets $407.400 $257,600 41 Liabilities Given Balance Sheet Statement of Cash Flows Income Statement hp ts fe ! %23 8 Less: Accumulated depreciation 9 Investments (30,000) (27,100) 113,000 0 Total Assets $407,400 $257,600 41 Liabilities 42 Current Liabilities: 43 Accounts payable (Inventory purchases) 44 Salaries payable 45 Interest payable 46 Taxes payable 47 Other accrued operating expenses 48 Total current liabilities 49 Bonds Payable 50 Total Liabilities $33,200 $36,500 7,400 2,900 2,400 5,300 18,800 22,100 62,600 66,000 78,000 113,000 140,600 179,000 51 Stockholders' Equity 52 Common stock 53 Retained earnings 54 Total stockholders' equity 55 Total liabilites and equity 107,000 77,000 159,800 1,600 266,800 $407,400 78,600 $257,600 56 Given Income Statement Balance Sheet Statement of Cash Flow P. hp Ideas Sort & Find & Insert Delete Format Conditional Format as Cell Filter- Select Formatting Table Styles Editing Ideas Cells Styles ber ANSWER: Enter the appropriate accountsames and numbers in the yellow boxes- INDIRECT METHOD Scenic Industries, Inc. Statement of Cash Flows For the Year Ended December 31, 2013 Cash flows from operating activities: Net income Adjustments to reconcile net income to net cash provided by operating activities: Net cash provided by operating activities Cash flows from investing activities 10 1:27 PM all 0 12/15/2015 Sign in 2 Template 20151111 (1) - Saved P Com A Share Search 47 Sort & Find & Ideas Insert Delete Format Cell Conditional Format as Filter Select - Formatting Table Styles Ideas Editing Cells Styles Number Net cash provided by operating activities Cash flows from investing activities: Net cash used for investing activities Cash flows from financing activities: Net cash used for financing activities Cash balance, December 31, 2013 1:27 P 12/15/2 Styles Filter Select - Cells Editing Ideas Insurance Expense Supplies Expense Advertising Expense Utilities Expense Depreciation Expense- Building Depreciation Expense- Equipment Other expenses $890 $23,958 $9,830 $6,000 $13,300 $7,580 $113,558.00 $ 38,442.00 Net income WELLS MOBILE APPS AND ACCE! Statement of Retained Earnings For Year Ended December 31, 2 $60,000.00 Retained earnings, December 31, 2012 $ 38,442.00 Plus: Net income $98,442.00 Total $ 24,000.00 Less: Dividends $74,442.00 Retained earnings, December 31, 2013 100% 603 PM all 1/2/2020

Step by Step Solution

There are 3 Steps involved in it

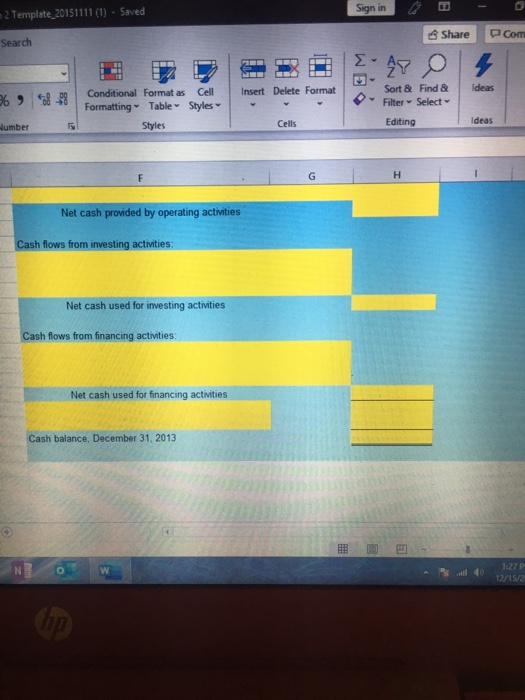

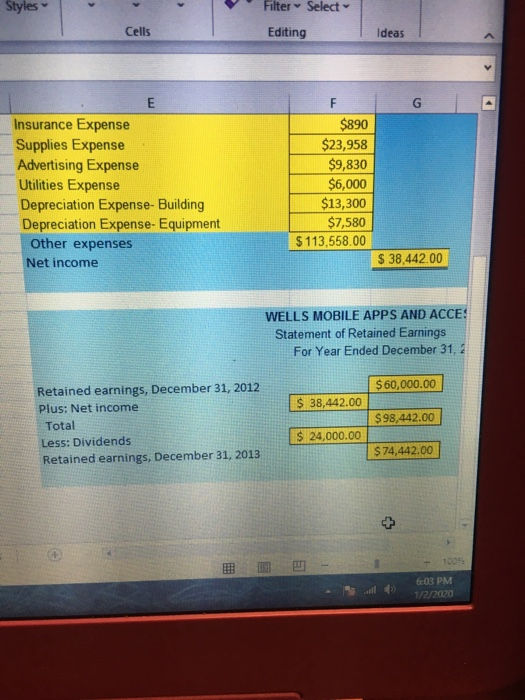

Get step-by-step solutions from verified subject matter experts