Question: I need help understanding how to do this Assume that the company uses variable costing. Compute the unit product cost for one barbecue grill. What

I need help understanding how to do this

![barbecue grills sold? [The following information applies to the questions displayed below.]](https://dsd5zvtm8ll6.cloudfront.net/si.experts.images/questions/2024/09/66ea6310c3b28_81666ea63105ab1d.jpg)

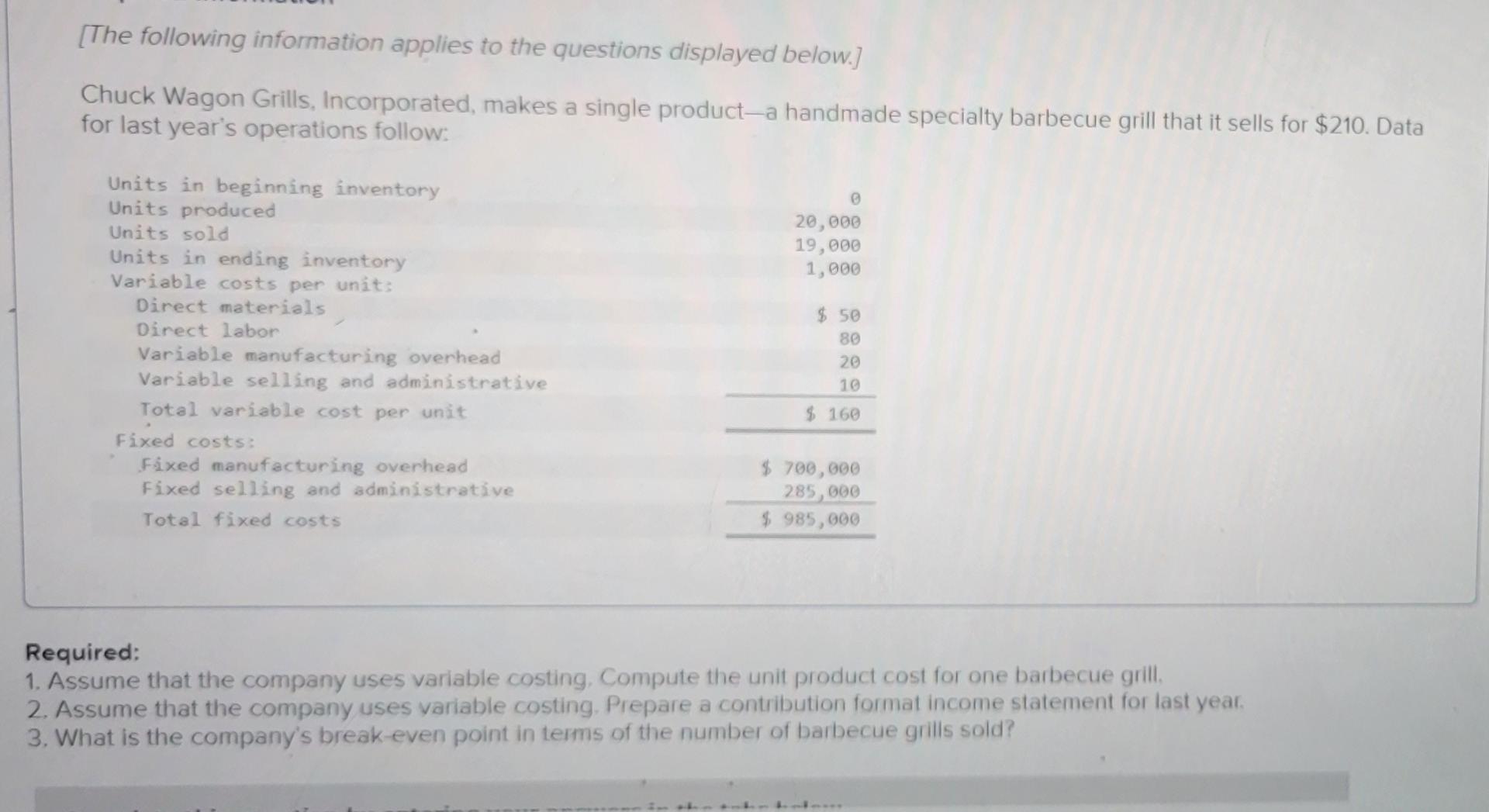

Assume that the company uses variable costing. Compute the unit product cost for one barbecue grill. What is the company's break-even point in terms of the number of barbecue grills sold? [The following information applies to the questions displayed below.] Chuck Wagon Grills, Incorporated, makes a single product-a handmade specialty barbecue grill that it sells for $210. Data for last year's operations follow: Required: Assume that the company uses variable costing. Compute the unit product cost for one barbecue grill. 2. Assume that the company uses variable costing. Prepare a contribution format income statement for last year. 3. What is the company's break-even point in terms of the number of barbecue grills sold? Assume that the company uses variahlo rnctinn n... i format income statement for last year

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts