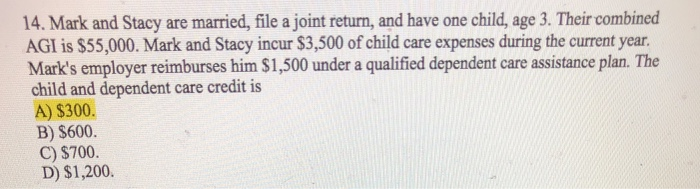

Question: I need help understanding how/why they got 300 as the answer. 14. Mark and Stacy are married, file a joint return, and have one child,

14. Mark and Stacy are married, file a joint return, and have one child, age 3. Their combined AGI is $55,000. Mark and Stacy incur $3,500 of child care expenses during the current year. Mark's employer reimburses him $1,500 under a qualified dependent care assistance plan. The child and dependent care credit is A) S300 B) S600. C) $700. D) $1,200

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts