Question: I need help understanding question c. feel lile I have correct answers just dont know how to explain. ck-Scholes Option Pricing Model al Value of

I need help understanding question c. feel lile I have correct answers just dont know how to explain.

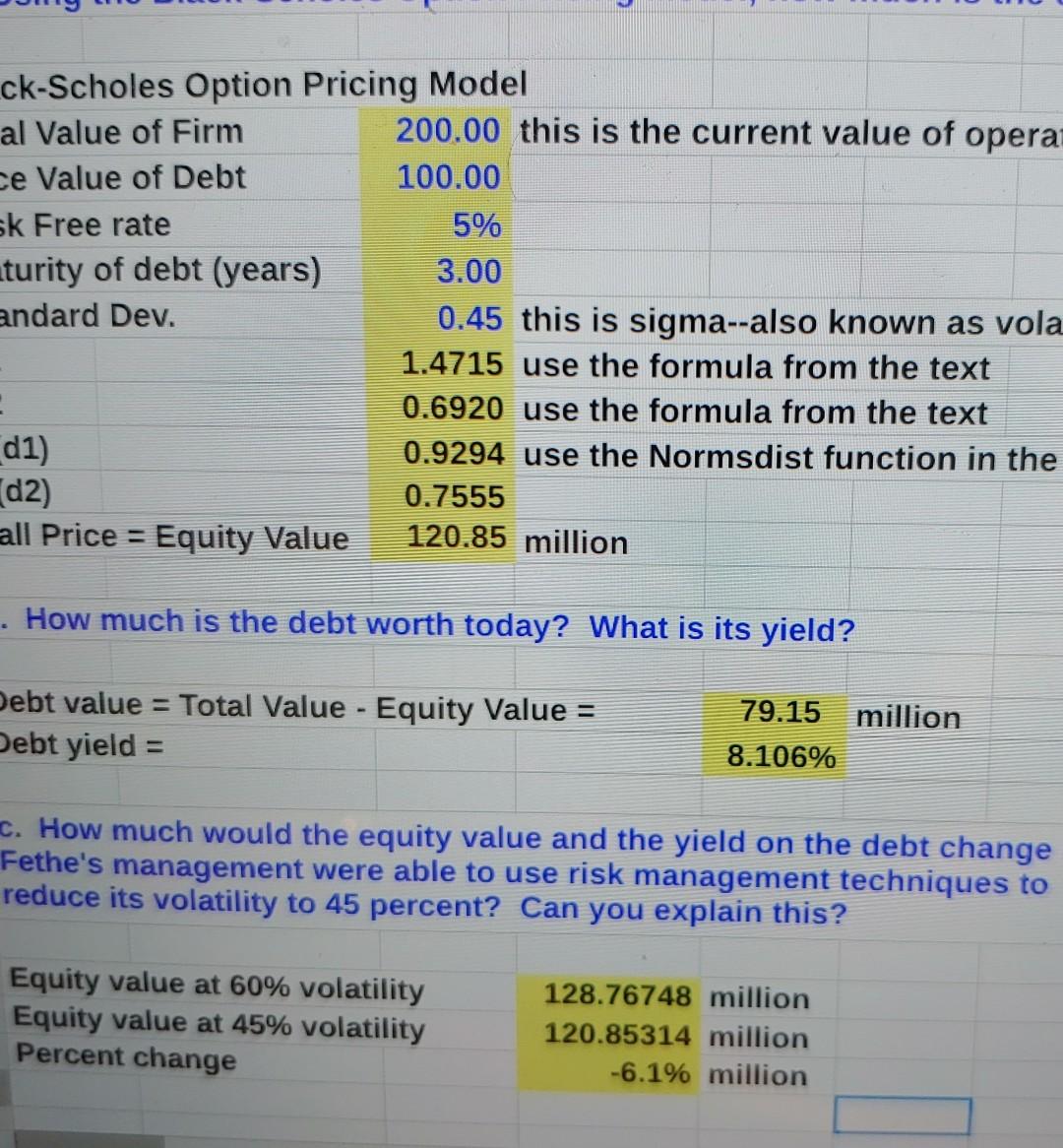

ck-Scholes Option Pricing Model al Value of Firm 200.00 this is the current value of opera ce Value of Debt 100.00 sk Free rate 5% turity of debt (years) 3.00 andard Dev. 0.45 this is sigma--also known as vola 1.4715 use the formula from the text . 0.6920 use the formula from the text d1) 0.9294 use the Normsdist function in the d2) 0.7555 all Price = Equity Value 120.85 million . How much is the debt worth today? What is its yield? Debt value = Total Value - Equity Value = Debt yield = 79.15 million 8.106% c. How much would the equity value and the yield on the debt change Fethe's management were able to use risk management techniques to reduce its volatility to 45 percent? Can you explain this? Equity value at 60% volatility Equity value at 45% volatility Percent change 128.76748 million 120.85314 million -6.1% million

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts