Question: I need help understanding the problems with the correct answers and excel/showing your work? The Trailer division of Baxter Bicycles makes bike trailers that attach

I need help understanding the problems with the correct answers and excel/showing your work?

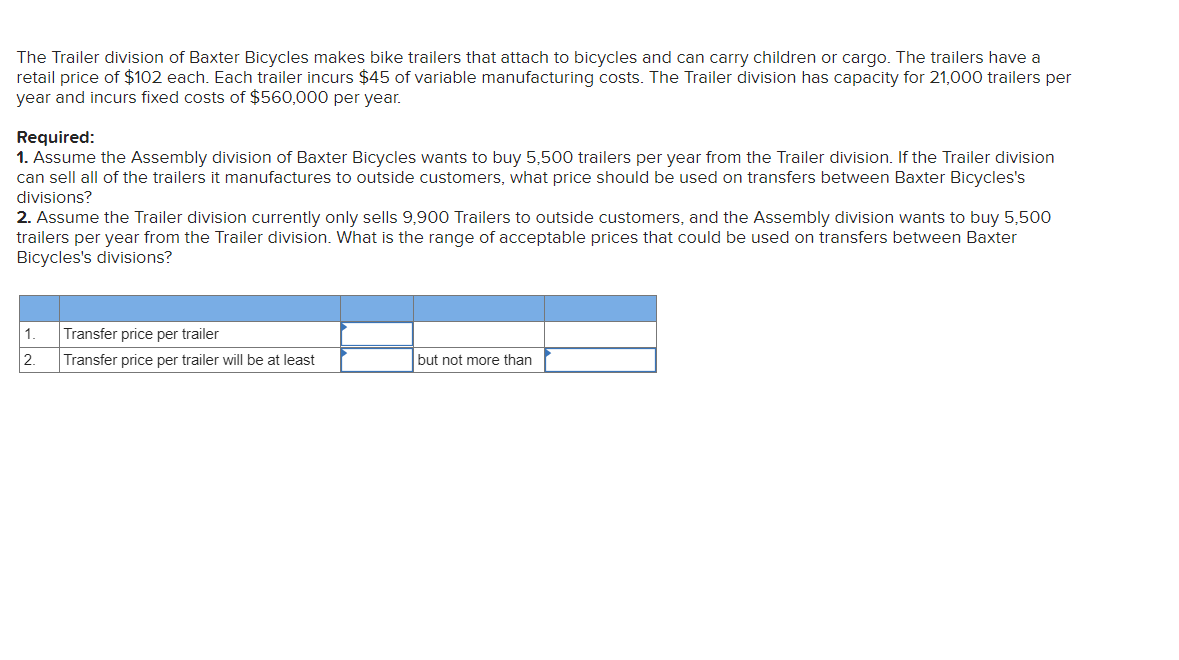

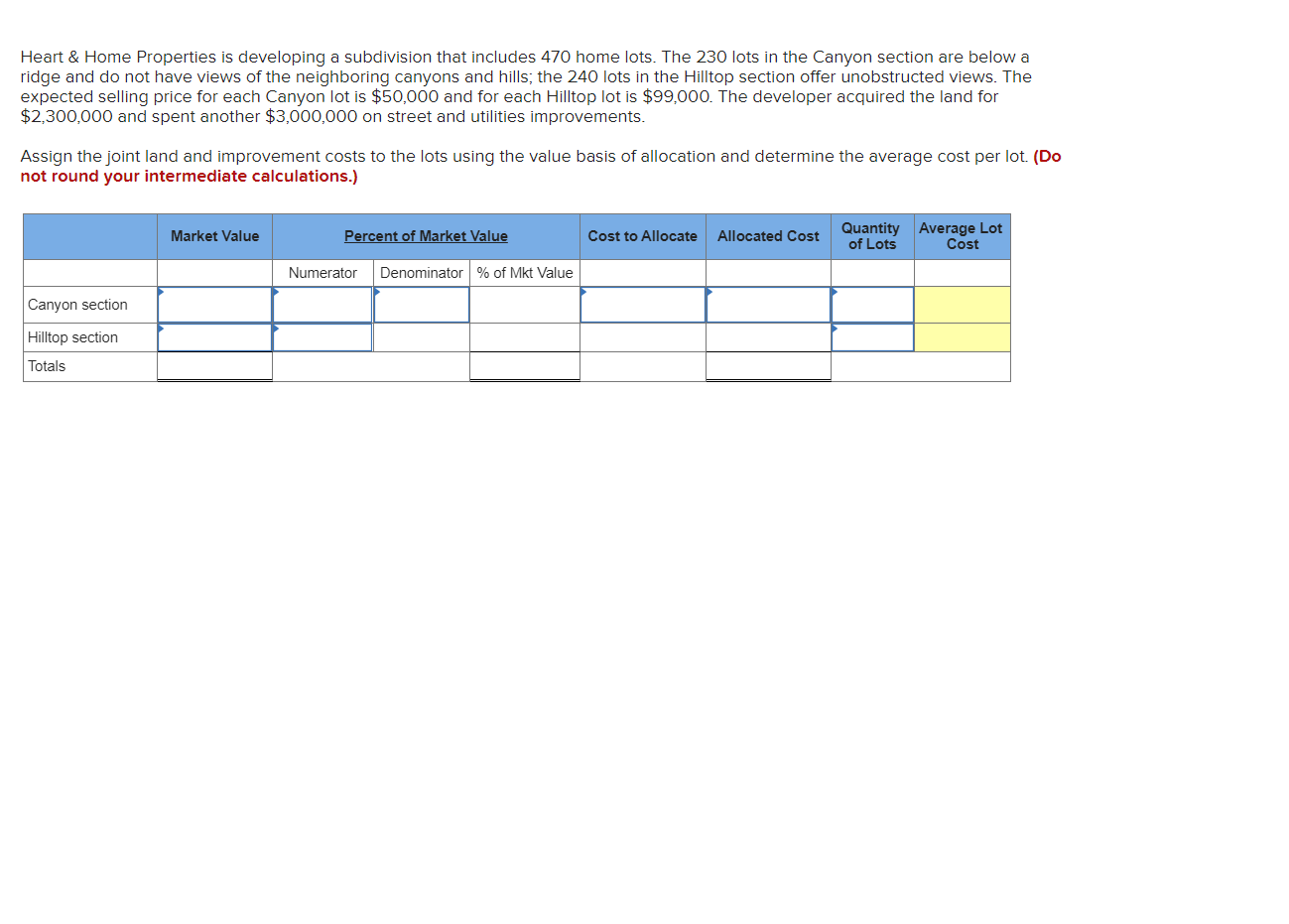

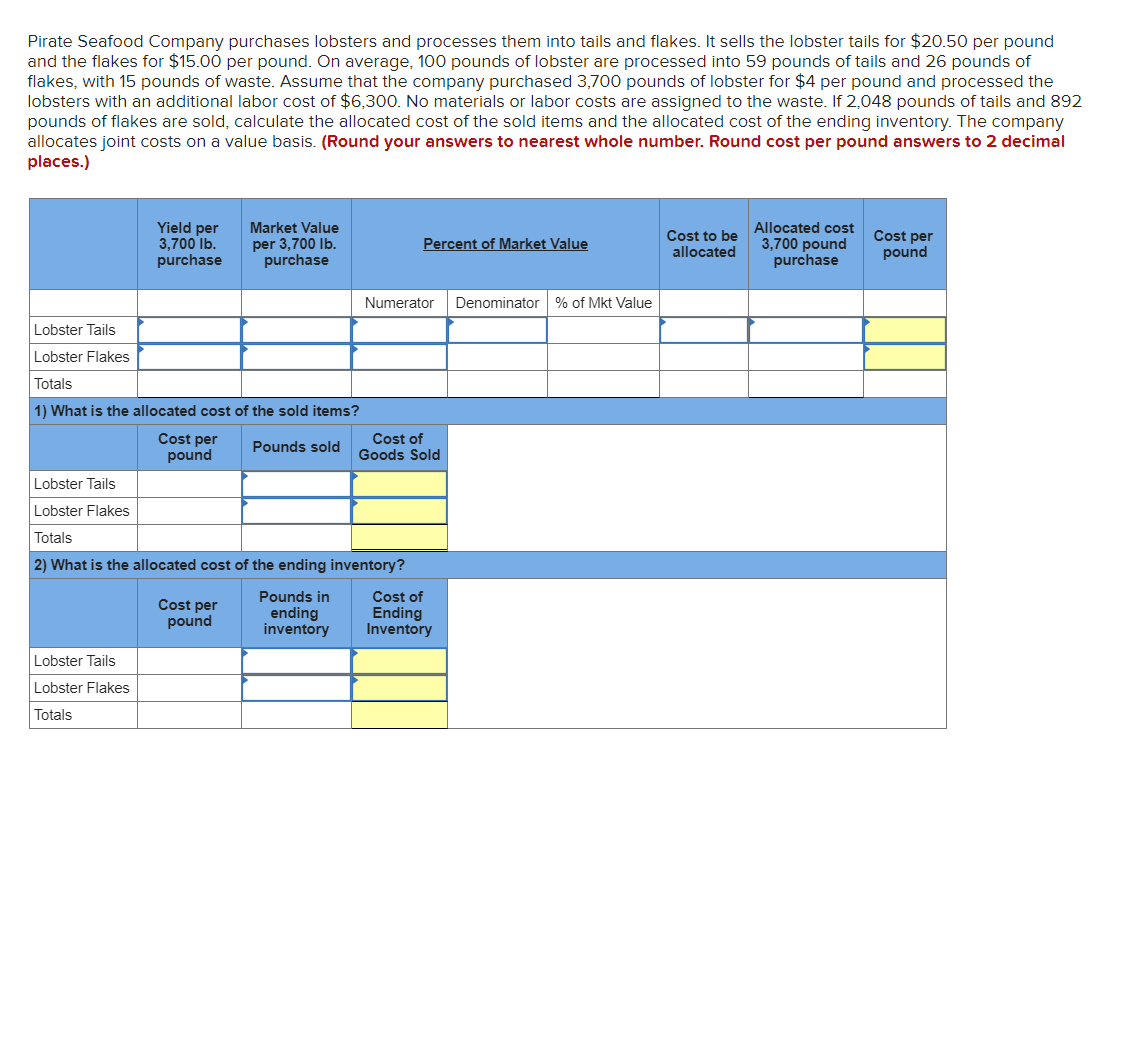

The Trailer division of Baxter Bicycles makes bike trailers that attach to bicycles and can carry children or cargo. The trailers have a retail price of $i02 each. Each trailer incurs $45 of variable manufacturing costs. The Trailer division has capacity for 21.000 trailers per year and Incurs fixed costs of$560,000 per year. Required: 1. Assume the Assembly division of Baxter Bicycles wants to buy 5.500 trailers per year from the Trailer division. lfthe Trailer division can sell all of the trailers it manufactures to outside customers, what price should be used on transfers between Baxter Bicycles's divisions? 2. Assume the Trailer division currently only sells 9,900 Trailers to outside customers, and the Assembly division wants to buy 5,500 trailers per year from the Trailer division. What is the range of acceptable prices that could be used 0h transfers between Baxter Bicyc es's divisions? Transfer price per trailer but not more than 2. Transfer price per trailer will be at lm Heart 8: Home Properties is developing a subdivision that includes 470 home lots. The 230 lots in the Canyon section are below a ridge and do not have views of the neighboring canyons and hills, the 240 lots in the Hilltop section offer unobstructed views. The expected selling price for each Canyon lot is $50,000 and for each Hilltop lot is $99,000, The developer acquired the land for $2,300,000 and spent another $3,000,000 on street and utilities improvements, Assign thejoint land and improvement costs to the lots using the value oasis ofallocation and determine the average cost per lot. (Do not round your intermediate calculations.) Denominator % of Mid Value Numerator Canyon seclion Hilltop section Totals Pirate Seafood Company purchases lobsters and processes them into tails and flakes. It sells the lobster tails for $20.50 per pound and the akes for $15.00 per pound. On average, 100 pounds of lobster are processed into 59 pounds oftails and 26 pounds of flakes, with 15 pounds of waste. Assume that the company purchased 3,700 pounds of lobster for $4 per pound and processed the lobsters with an additional labor cost of$6,300. No materials or labor costs are assigned to the waste. If 2,048 pounds oftails and 892 pounds ofakes are sold, calculate the allocated cost of the sold items and the allocated cost ofthe ending inventory. The company allocatesjoint costs on a value basis. (Round your answers to nearest whole number. Round cost per pound answers to 2 decimal places.) WW... Lobster Tails Lobster Flakes LobstnerTails Lobster Flakes Totals Lobster Tails Lobster Flakes Totals

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts