Question: I need help understanding the Sources & Uses table provided below. I would like to know the formulas used to create this table. Thanks. Senior

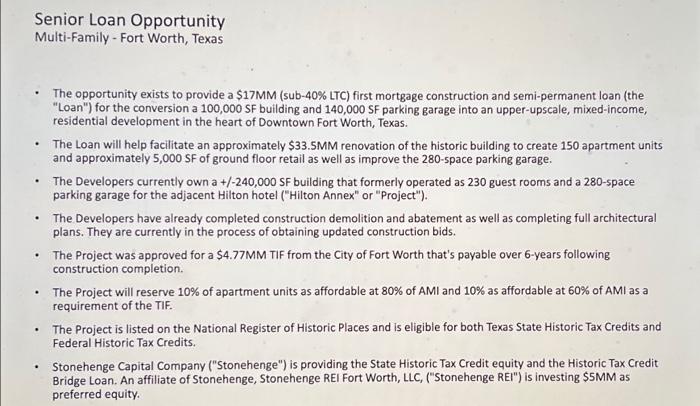

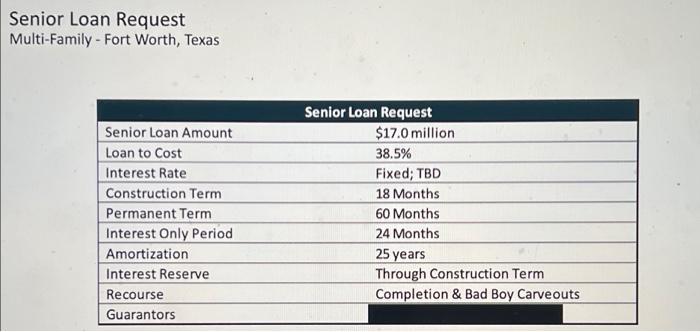

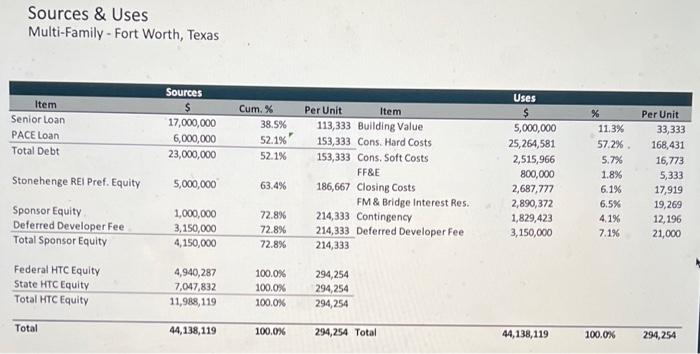

Senior Loan Opportunity Multi-Family - Fort Worth, Texas The opportunity exists to provide a $17MM (sub-40% LTC) first mortgage construction and semi-permanent loan (the "Loan") for the conversion a 100,000 SF building and 140,000 SF parking garage into an upper-upscale, mixed-income, residential development in the heart of Downtown Fort Worth, Texas. The Loan will help facilitate an approximately $33.5MM renovation of the historic building to create 150 apartment units and approximately 5,000 SF of ground floor retail as well as improve the 280-space parking garage. The Developers currently own a +/-240,000 SF building that formerly operated as 230 guest rooms and a 280-space parking garage for the adjacent Hilton hotel ("Hilton Annex" or "Project"). The Developers have already completed construction demolition and abatement as well as completing full architectural plans. They are currently in the process of obtaining updated construction bids. The Project was approved for a $4.77MM TIF from the City of Fort Worth that's payable over 6-years following construction completion The Project will reserve 10% of apartment units as affordable at 80% of AMI and 10% as affordable at 60% of AMI as a A requirement of the TIF The Project is listed on the National Register of Historic Places and is eligible for both Texas State Historic Tax Credits and Federal Historic Tax Credits. Stonehenge Capital Company ("Stonehenge") is providing the State Historic Tax Credit equity and the Historic Tax Credit Bridge Loan. An affiliate of Stonehenge, Stonehenge REI Fort Worth, LLC, ("Stonehenge REI") is investing $5MM as preferred equity Senior Loan Request Multi-Family - Fort Worth, Texas Senior Loan Amount Loan to Cost Interest Rate Construction Term Permanent Term Interest Only Period Amortization Interest Reserve Recourse Guarantors Senior Loan Request $17.0 million 38.5% Fixed; TBD 18 Months 60 Months 24 Months 25 years Through Construction Term Completion & Bad Boy Carveouts Sources & Uses Multi-Family - Fort Worth, Texas Sources Item Senior Loan PACE Loan Total Debt 17,000,000 6,000,000 23,000,000 Cum. % 38.5% 52.1% 52.1% Uses $ 5,000,000 25,264,581 2,515,966 800,000 2,687,777 2,890,372 1,829,423 3,150,000 Stonehenge REI Pref. Equity Per Unit Item 113,333 Building Value 153,333 Cons. Hard Costs 153,333 Cons. Soft Costs FF&E 186,667 Closing Costs FM & Bridge Interest Res. 214,333 Contingency 214,333 Deferred Developer Fee 214,333 % 11.3% 57.2% 5.7% 1.8% 6.1% 6.5% 4.1% 7.1% Per Unit 33,333 168,431 16,773 5,333 17,919 19,269 12, 196 21,000 5,000,000 63.4% Sponsor Equity Deferred Developer Fee Total Sponsor Equity 1,000,000 3,150,000 4,150,000 72.8% 72.8% 72.8% Federal HTC Equity State HTC Equity Total HTC Equity 4,940,287 7,047,832 11,988,119 100.0% 100.0% 100.0% 294,254 294,254 294,254 Total 44,138,119 100.0% 294,254 Total 44,138,119 100.0% 294,254 Senior Loan Opportunity Multi-Family - Fort Worth, Texas The opportunity exists to provide a $17MM (sub-40% LTC) first mortgage construction and semi-permanent loan (the "Loan") for the conversion a 100,000 SF building and 140,000 SF parking garage into an upper-upscale, mixed-income, residential development in the heart of Downtown Fort Worth, Texas. The Loan will help facilitate an approximately $33.5MM renovation of the historic building to create 150 apartment units and approximately 5,000 SF of ground floor retail as well as improve the 280-space parking garage. The Developers currently own a +/-240,000 SF building that formerly operated as 230 guest rooms and a 280-space parking garage for the adjacent Hilton hotel ("Hilton Annex" or "Project"). The Developers have already completed construction demolition and abatement as well as completing full architectural plans. They are currently in the process of obtaining updated construction bids. The Project was approved for a $4.77MM TIF from the City of Fort Worth that's payable over 6-years following construction completion The Project will reserve 10% of apartment units as affordable at 80% of AMI and 10% as affordable at 60% of AMI as a A requirement of the TIF The Project is listed on the National Register of Historic Places and is eligible for both Texas State Historic Tax Credits and Federal Historic Tax Credits. Stonehenge Capital Company ("Stonehenge") is providing the State Historic Tax Credit equity and the Historic Tax Credit Bridge Loan. An affiliate of Stonehenge, Stonehenge REI Fort Worth, LLC, ("Stonehenge REI") is investing $5MM as preferred equity Senior Loan Request Multi-Family - Fort Worth, Texas Senior Loan Amount Loan to Cost Interest Rate Construction Term Permanent Term Interest Only Period Amortization Interest Reserve Recourse Guarantors Senior Loan Request $17.0 million 38.5% Fixed; TBD 18 Months 60 Months 24 Months 25 years Through Construction Term Completion & Bad Boy Carveouts Sources & Uses Multi-Family - Fort Worth, Texas Sources Item Senior Loan PACE Loan Total Debt 17,000,000 6,000,000 23,000,000 Cum. % 38.5% 52.1% 52.1% Uses $ 5,000,000 25,264,581 2,515,966 800,000 2,687,777 2,890,372 1,829,423 3,150,000 Stonehenge REI Pref. Equity Per Unit Item 113,333 Building Value 153,333 Cons. Hard Costs 153,333 Cons. Soft Costs FF&E 186,667 Closing Costs FM & Bridge Interest Res. 214,333 Contingency 214,333 Deferred Developer Fee 214,333 % 11.3% 57.2% 5.7% 1.8% 6.1% 6.5% 4.1% 7.1% Per Unit 33,333 168,431 16,773 5,333 17,919 19,269 12, 196 21,000 5,000,000 63.4% Sponsor Equity Deferred Developer Fee Total Sponsor Equity 1,000,000 3,150,000 4,150,000 72.8% 72.8% 72.8% Federal HTC Equity State HTC Equity Total HTC Equity 4,940,287 7,047,832 11,988,119 100.0% 100.0% 100.0% 294,254 294,254 294,254 Total 44,138,119 100.0% 294,254 Total 44,138,119 100.0% 294,254

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts