Question: I need help understanding this problem Here is Debra's credit card statement for the month of December. Date Transaction Transaction amount December 1 Beginning balance

I need help understanding this problem

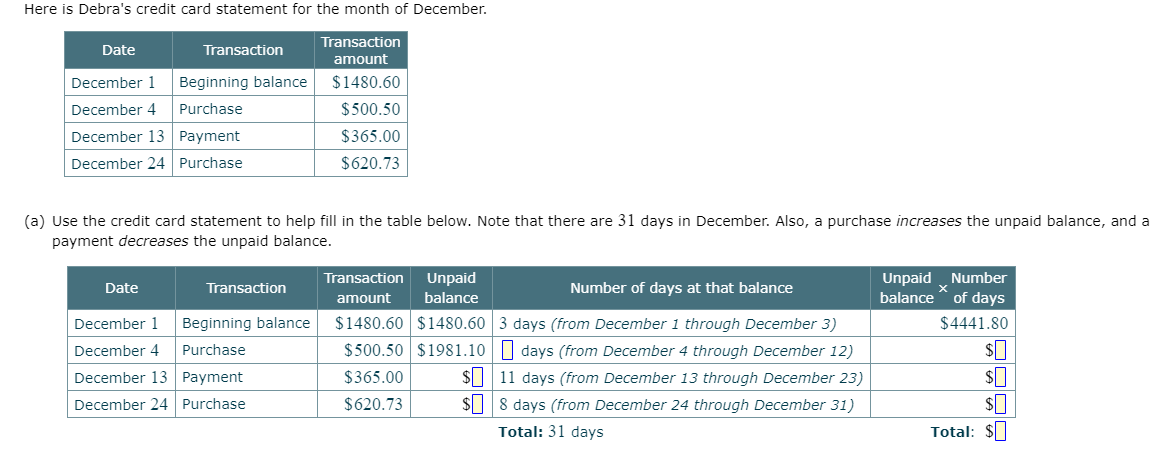

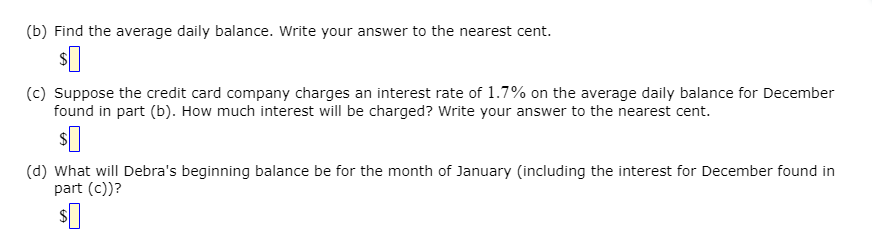

Here is Debra's credit card statement for the month of December. Date Transaction Transaction amount December 1 Beginning balance $1480.60 December 4 Purchase $500.50 December 13 Payment $365.00 December 24 Purchase $620.73 (a) Use the credit card statement to help fill in the table below. Note that there are 31 days in December. Also, a purchase increases the unpaid balance, and a payment decreases the unpaid balance. Date Transaction Transaction Unpaid Unpaid Number amount balance Number of days at that balance balance X of days December 1 Beginning balance $1480.60 $1480.60 3 days (from December 1 through December 3) $4441.80 December 4 Purchase $500.50 $1981.10 [ days (from December 4 through December 12) December 13 Payment $365.00 $ 11 days (from December 13 through December 23) $0 December 24 Purchase $620.73 $8 days (from December 24 through December 31) $0 Total: 31 days Total: ${b} Find the average daily balance. Write your answer to the nearest cent. $D (c) Suppose the credit card company charges an interest rate of 1.7% on the average daily balance for December found in part (b). How much interest will be charged? Write your answer to the nearest cent. $D {cl} what will Debra's beginning balance be for the month of January {including the interest for December found in Part (CD? $D

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts