Question: I need help understanding this problem. I got some of them right but I need a full breakdown on how to solve each question. Thank

I need help understanding this problem. I got some of them right but I need a full breakdown on how to solve each question. Thank you!!!!

![below.] Tent Master produces Pup tents and Pop-up tents. The company budgets](https://dsd5zvtm8ll6.cloudfront.net/si.experts.images/questions/2024/09/66f7e43795788_84766f7e4373fd28.jpg)

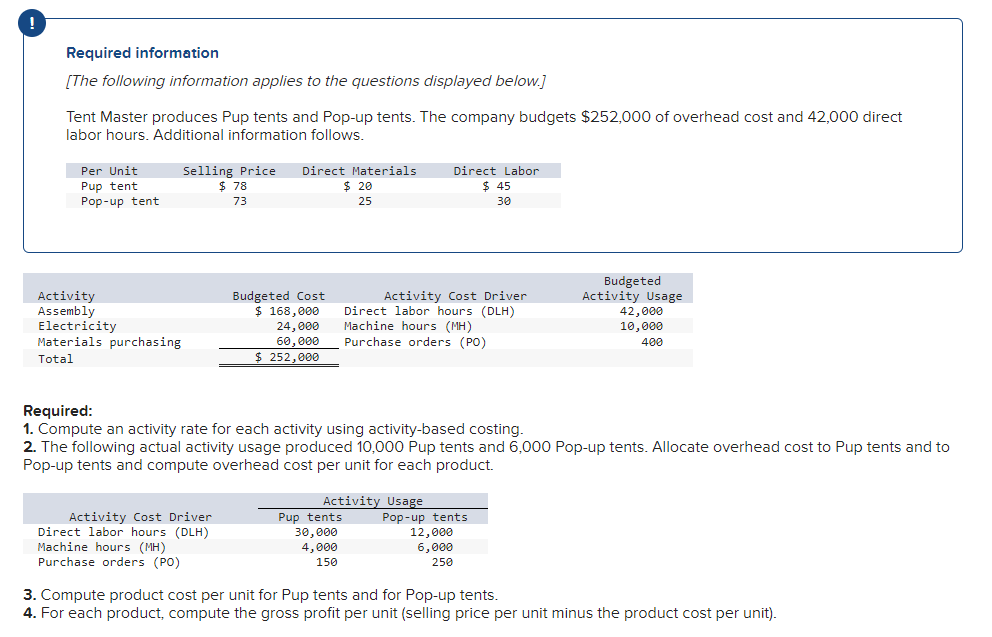

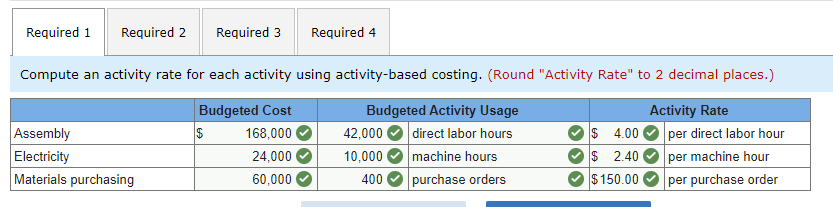

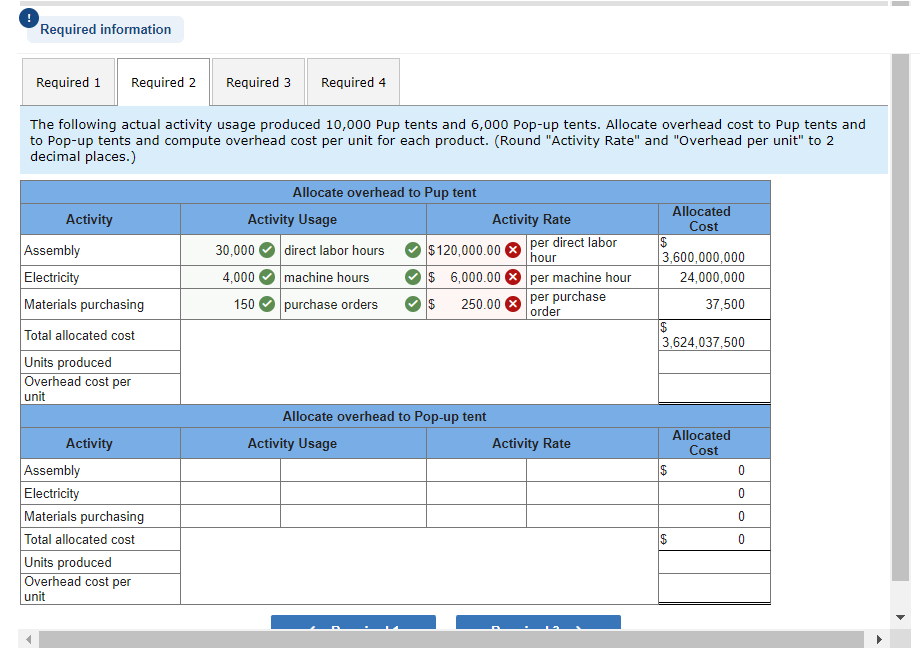

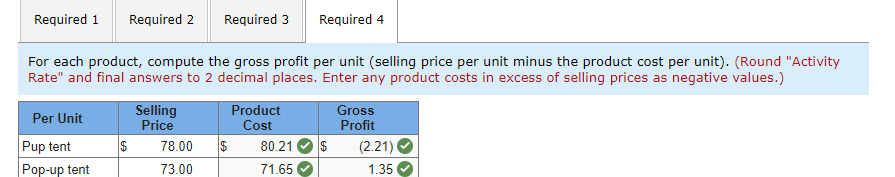

Required information [The following information applies to the questions displayed below.] Tent Master produces Pup tents and Pop-up tents. The company budgets $252,000 of overhead cost and 42,000 direct labor hours. Additional information follows. Required: 1. Compute an activity rate for each activity using activity-based costing. 2. The following actual activity usage produced 10,000 Pup tents and 6,000 Pop-up tents. Allocate overhead cost to Pup tents and to Pop-up tents and compute overhead cost per unit for each product. 3. Compute product cost per unit for Pup tents and for Pop-up tents. 4. For each product, compute the gross profit per unit (selling price per unit minus the product cost per unit). \begin{tabular}{|l|l|l|l|} \hline Required 1 & Required 2 & Required 3 & Required 4 \\ \hline \end{tabular} Compute an activity rate for each activity using activity-based costing. (Round "Activity Rate" to 2 decimal places.) The following actual activity usage produced 10,000 Pup tents and 6,000 Pop-up tents. Allocate overhead cost to Pup tents and to Pop-up tents and compute overhead cost per unit for each product. (Round "Activity Rate" and "Overhead per unit" to 2 decimal places.) Compute product cost per unit for Pup tents and for Pop-up tents. (Round "Activity Rate" and final answers to 2 decimal places.) For each product, compute the gross profit per unit (selling price per unit minus the product cost per unit). (Round "Activity Rate" and final answers to 2 decimal places. Enter any product costs in excess of selling prices as negative values.) Required information [The following information applies to the questions displayed below.] Tent Master produces Pup tents and Pop-up tents. The company budgets $252,000 of overhead cost and 42,000 direct labor hours. Additional information follows. Required: 1. Compute an activity rate for each activity using activity-based costing. 2. The following actual activity usage produced 10,000 Pup tents and 6,000 Pop-up tents. Allocate overhead cost to Pup tents and to Pop-up tents and compute overhead cost per unit for each product. 3. Compute product cost per unit for Pup tents and for Pop-up tents. 4. For each product, compute the gross profit per unit (selling price per unit minus the product cost per unit). \begin{tabular}{|l|l|l|l|} \hline Required 1 & Required 2 & Required 3 & Required 4 \\ \hline \end{tabular} Compute an activity rate for each activity using activity-based costing. (Round "Activity Rate" to 2 decimal places.) The following actual activity usage produced 10,000 Pup tents and 6,000 Pop-up tents. Allocate overhead cost to Pup tents and to Pop-up tents and compute overhead cost per unit for each product. (Round "Activity Rate" and "Overhead per unit" to 2 decimal places.) Compute product cost per unit for Pup tents and for Pop-up tents. (Round "Activity Rate" and final answers to 2 decimal places.) For each product, compute the gross profit per unit (selling price per unit minus the product cost per unit). (Round "Activity Rate" and final answers to 2 decimal places. Enter any product costs in excess of selling prices as negative values.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts