Question: I need help understanding which formulas to use to solve these practice problems. 3. ROA, ROE and Financial Leverage : The following data pertain to

I need help understanding which formulas to use to solve these practice problems.

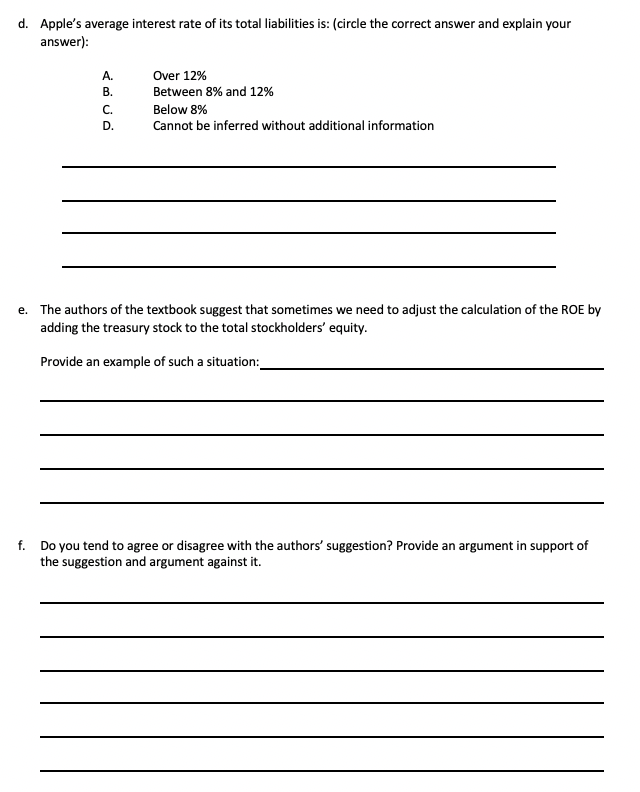

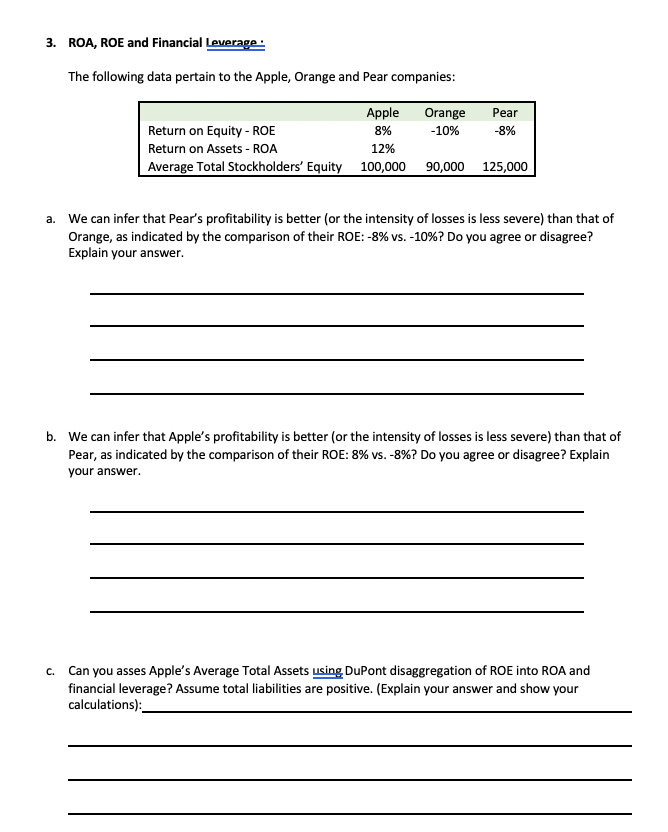

3. ROA, ROE and Financial Leverage : The following data pertain to the Apple, Orange and Pear companies: Apple Orange Pear Return on Equity - ROE 8% -10% -8% Return on Assets - ROA 12% Average Total Stockholders' Equity 100,000 90,000 125,000 a. We can infer that Pear's profitability is better (or the intensity of losses is less severe) than that of Orange, as indicated by the comparison of their ROE: -8% vs. -10%? Do you agree or disagree? Explain your answer. b. We can infer that Apple's profitability is better (or the intensity of losses is less severe) than that of Pear, as indicated by the comparison of their ROE: 8% vs. -8%? Do you agree or disagree? Explain your answer. C. Can you asses Apple's Average Total Assets using DuPont disaggregation of ROE into ROA and financial leverage? Assume total liabilities are positive. (Explain your answer and show your calculations):d. Apple's average interest rate of its total liabilities is: (circle the correct answer and explain your answer}: Over 12% Between 8% and 12% Below 8%. Cannot be inferred without additional information PPS\"? e. The authors of the textbook suggest that sometimes we need to adjust the calculation of the ROE by adding the treasury.' stock to the total stockholders' equity. Provide an example of such a situation: f. Do you tend to agree or dkagree with the authors' suggestion? Provide an argument in support of the suggestion and argument against it

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts