Question: I need help wih problem C This year, the Tastee Partnership reported income before guaranteed payments of $193,000. Stella owns a 65% profits interest and

I need help wih problem C

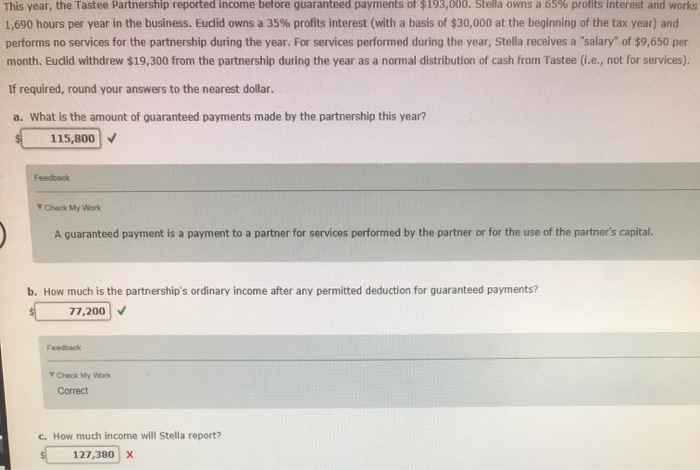

I need help wih problem CThis year, the Tastee Partnership reported income before guaranteed payments of $193,000. Stella owns a 65% profits interest and works 1,690 hours per year in the business. Euclid owns a 35% profits interest (with a basis of $30,000 at the beginning of the tax year) and performs no services for the partnership during the year. For services performed during the year, Stella receives a "salary" of $9,650 per month. Euclid withdrew $19,300 from the partnership during the year as a normal distribution of cash from Tastee (i.e., not for services). If required, round your answers to the nearest dollar. a. What is the amount of guaranteed payments made by the partnership this year? 115,800 Feedback Check My Work A guaranteed payment is a payment to a partner for services performed by the partner or for the use of the partner's capital. b. How much is the partnership's ordinary income after any permitted deduction for guaranteed payments? $ 77,200 Feedback Check My Work Correct C. How much income will Stella report? $ 127,380 X

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts