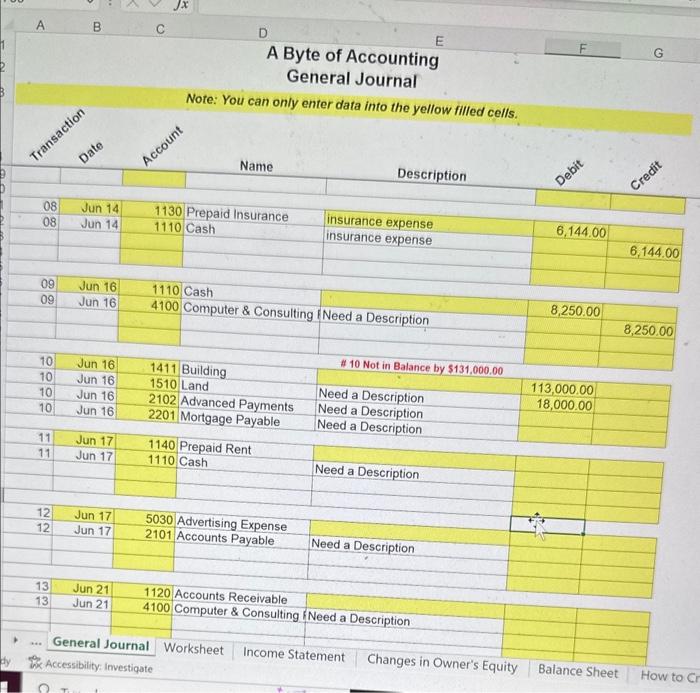

Question: I need help with 1. General Journal 2.worksheet 3.income statement 4.changes in owner's equity 5 balance sheet please and thank you help to complete this

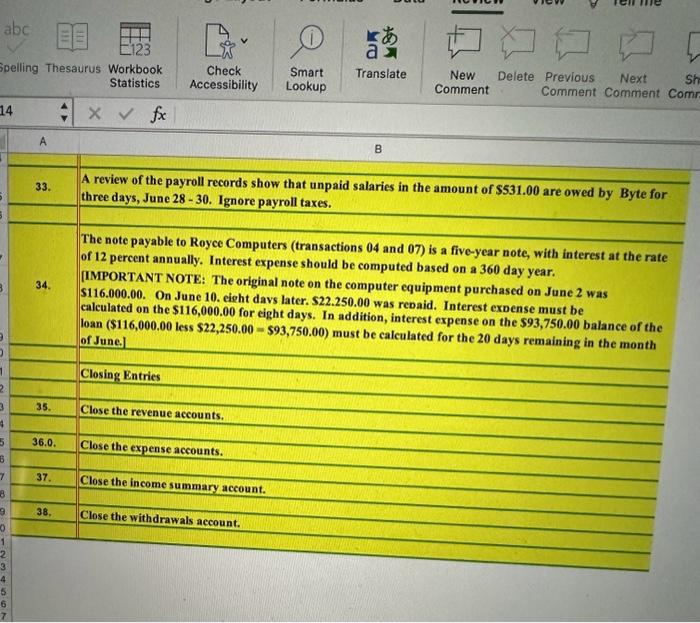

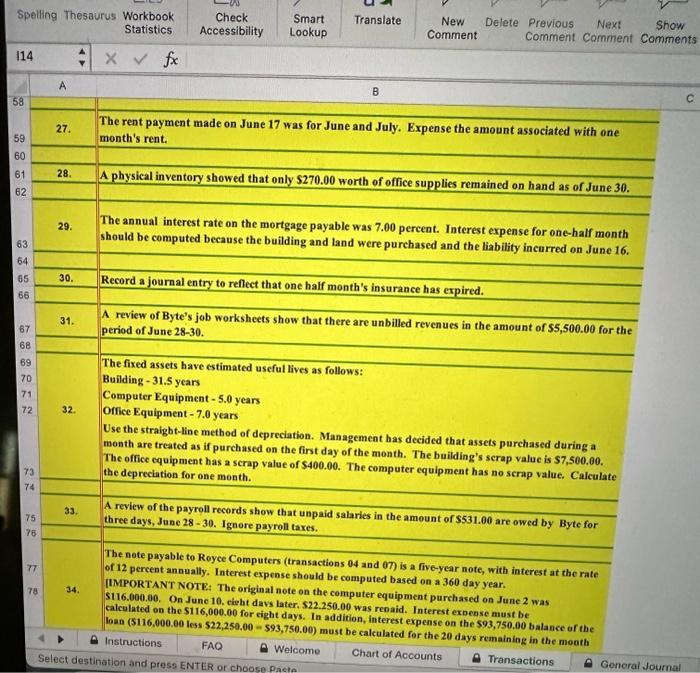

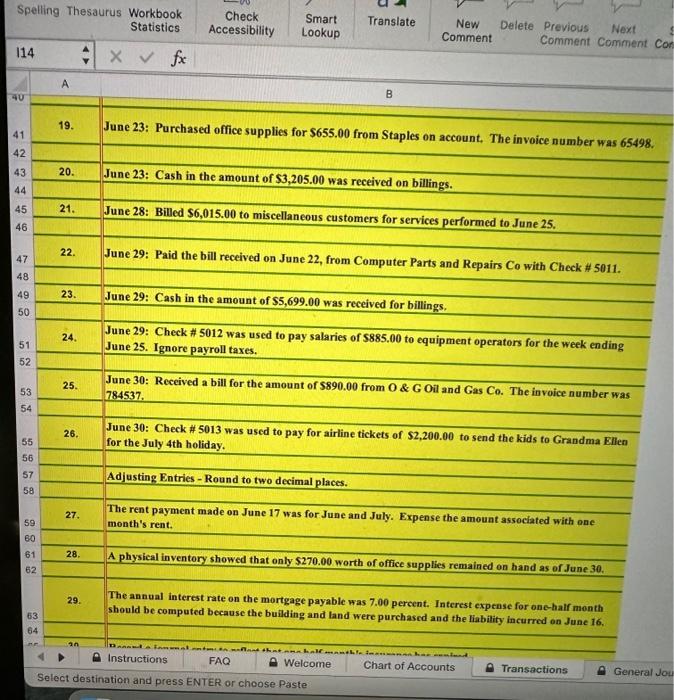

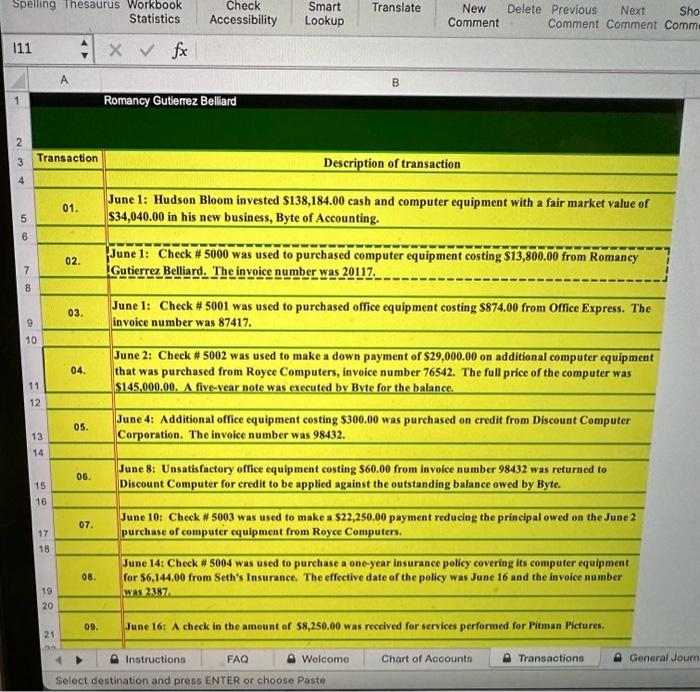

\begin{tabular}{|l|l|l|} \hline A & B \\ \hline 33. & A review of the payroll records show that unpaid salaries in the amount of $531.00 are owed by Byte for three days, June 2830. Ignore payroll taxes. \\ \hline \end{tabular} of 12 percent annually. Interest expense should be computed based on a 360 day year. [IMPORTANT NOTE: The original note on the computer equipment purchased on June 2 was \$116.000.00. On June 10. eight davs later. $22.250.00 was rebaid. Interest expense must be calculated on the $116,000.00 for eight days. In addition, interest expense on the $93,750.00 balance of the loan ($116,000.00 less $22,250.00=$93,750.00) must be calculated for the 20 days remaining in the month of June.] \begin{tabular}{|l|l|l} \hline & Closing Entries \\ \hline & \\ \hline 35. & Close the revenue accounts. \\ \hline & \\ \hline 36.0. & Close the expense accounts. \\ \hline & \\ \hline 37. & Close the income summary account. \\ \hline & \\ \hline 38. & Close the withdrawals account. \\ \hline & \\ \hline \end{tabular} Note: You man ank. w... \begin{tabular}{|l|l|l|} \hline A & B \\ \hline 33. & A review of the payroll records show that unpaid salaries in the amount of $531.00 are owed by Byte for three days, June 2830. Ignore payroll taxes. \\ \hline \end{tabular} of 12 percent annually. Interest expense should be computed based on a 360 day year. [IMPORTANT NOTE: The original note on the computer equipment purchased on June 2 was \$116.000.00. On June 10. eight davs later. $22.250.00 was rebaid. Interest expense must be calculated on the $116,000.00 for eight days. In addition, interest expense on the $93,750.00 balance of the loan ($116,000.00 less $22,250.00=$93,750.00) must be calculated for the 20 days remaining in the month of June.] \begin{tabular}{|l|l|l} \hline & Closing Entries \\ \hline & \\ \hline 35. & Close the revenue accounts. \\ \hline & \\ \hline 36.0. & Close the expense accounts. \\ \hline & \\ \hline 37. & Close the income summary account. \\ \hline & \\ \hline 38. & Close the withdrawals account. \\ \hline & \\ \hline \end{tabular} Note: You man ank. w

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts