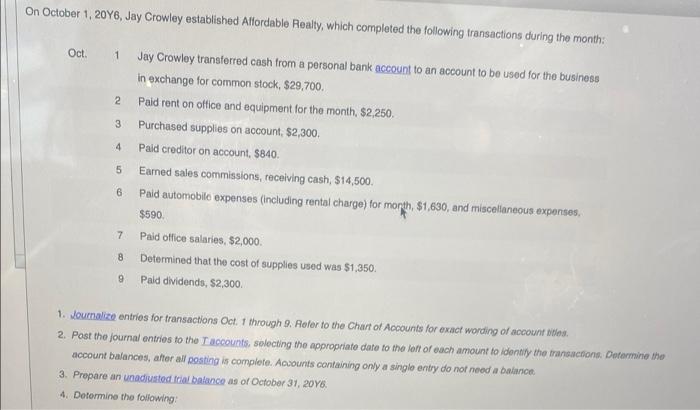

Question: i need help with 1 through 5 plz On October 1, 20Y6, Jay Crowley established Alfordable Realty, which completed the following transactions during the month:

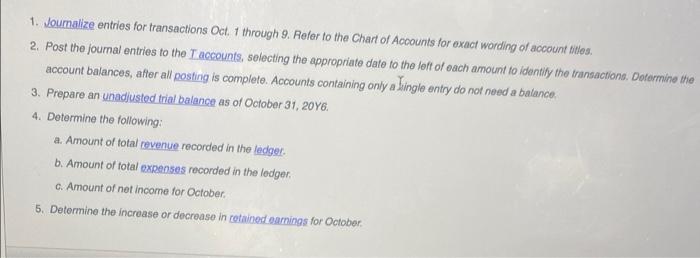

On October 1, 20Y6, Jay Crowley established Alfordable Realty, which completed the following transactions during the month: Oct 1 2 3 Jay Crowley transferred cash from a personal bank account to an account to be used for the business in exchange for common stock, $29,700. Paid ront on office and equipment for the month, $2,250 Purchased supplies on account, $2,300, Pald creditor on account, $840 Earned sales commissions, receiving cash, $14,500. Pald automobile expenses (including rental charge) for month, $1,630, and miscellaneous expenses $590 4 5 6 7 Paid office salaries. $2,000 8 Determined that the cost of supplies used was $1,350. Pald dividends, $2,300 9 1. Joumalize entries for transactions Oct. 1 through 9. Refer to the Chart of Accounts for exact wording of account thes 2. Post the journal entries to the accounts, selecting the appropriate date to the left of each amount to idently the transactions. Detamine the account balances, after all posting is complete. Accounts containing only a single entry do not need a balance 3. Prepare an unadiusted trial balance as of October 31, 2016, 4. Determine the following: a 1. Joumalize entries for transactions Oct. 1 through 9. Refer to the Chart of Accounts for exact wording of account titles 2. Post the journal entries to the accounts, selecting the appropriate date to the left of each amount to identilly the transactions. Determine the account balances, after all posting is completo. Accounts containing only a Single entry do not need a balance. 3. Prepare an unadjusted trial balance as of October 31, 20Y6. 4. Determine the following: a. Amount of total revenue recorded in the lediger b. Amount of total expenses recorded in the ledger C. Amount of net income for October 5. Determine the increase or decrease in retained osrnings for October

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts