Question: i need help with 1-8 i need help making these transactions into journal entries 1. March 1: Stockholder's invest $777,777 into the company in exchange

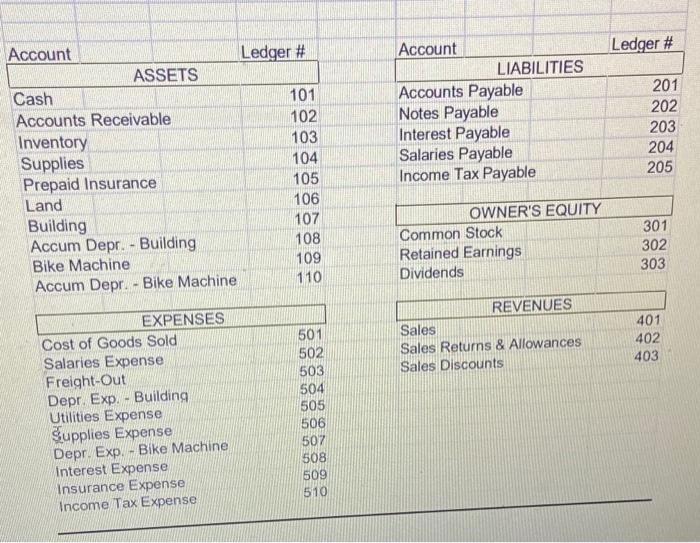

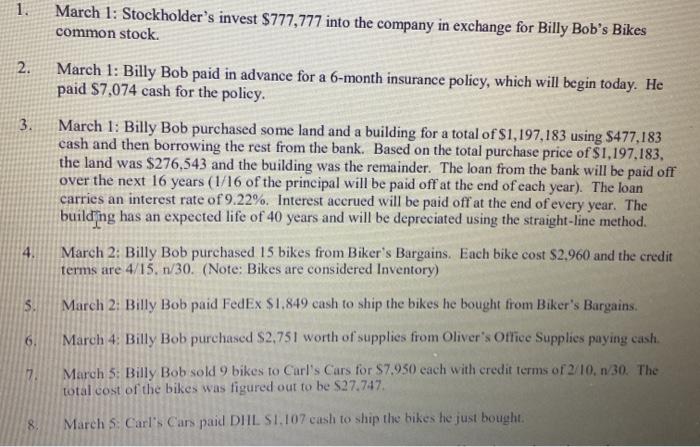

1. March 1: Stockholder's invest $777,777 into the company in exchange for Billy Bob's Bikes common stock. 2. 3. March 1: Billy Bob paid in advance for a 6-month insurance policy, which will begin today. He paid $7,074 cash for the policy. March 1: Billy Bob purchased some land and a building for a total of $1,197,183 using $477,183 cash and then borrowing the rest from the bank. Based on the total purchase price of $1,197,183, the land was $276.543 and the building was the remainder. The loan from the bank will be paid off over the next 16 years (1/16 of the principal will be paid off at the end of each year). The loan carries an interest rate of 9.22%. Interest accrued will be paid off at the end of every year. The building has an expected life of 40 years and will be depreciated using the straight-line method. March 2: Billy Bob purchased 15 bikes from Biker's Bargains. Each bike cost $2.960 and the credit terms are 4/15. n/30. (Note: Bikes are considered Inventory) March 2: Billy Bob paid FedEx $1.849 cash to ship the bikes he bought from Biker's Bargains. March 4: Billy Bob purchased $2,751 worth of supplies from Oliver's Office Supplies paying cash. 5. 6. March 5: Billy Bob sold 9 bikes to Carl's Cars for $7.950 each with credit terms of 2/10. n 30. The total cost of the bikes was figured out to be $27.747. 8. March 5. Carl's Cars paid DIIL SI,107 cash to ship the bikes he just bought

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts