Question: I need help with #2 and #4 please QUESTION 2 Calculate the opportunity cost of capital for a firm with the following capital structure: 30%

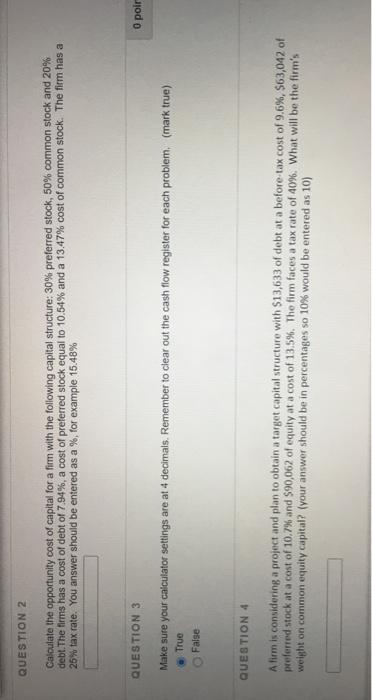

QUESTION 2 Calculate the opportunity cost of capital for a firm with the following capital structure: 30% preferred stock, 50% common stock and 20% debt. The firm has a cost of debt of 7.94%, a cost of preferred stock equal to 10.54% and a 13.47% cost of common stock. The firm has a 25% tax rate. You answer should be entered as a %, for example 15.48% QUESTION 3 o poir Make sure your calculator settings are at 4 decimals. Remember to clear out the cash flow register for each problem. (mark true) True False QUESTION 4 A firm is considering a project and plan to obtain a target capital structure with $13,633 of debt at a before tax cost of 9.6%, $63,042 of preferred stock at a cost of 10.7% and $90,062 of equity at a cost of 13.5%. The firm faces a tax rate of 40%. What will be the firm's weight on common equity capital? (your answer should be in percentages so 10% would be entered as 10)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts