Question: I need help with 22-25 e. 15.15%.91=(.1240.27) 22. The common stock of Flavorful Teas has an expected return of 21.15 percent. The return on the

I need help with 22-25

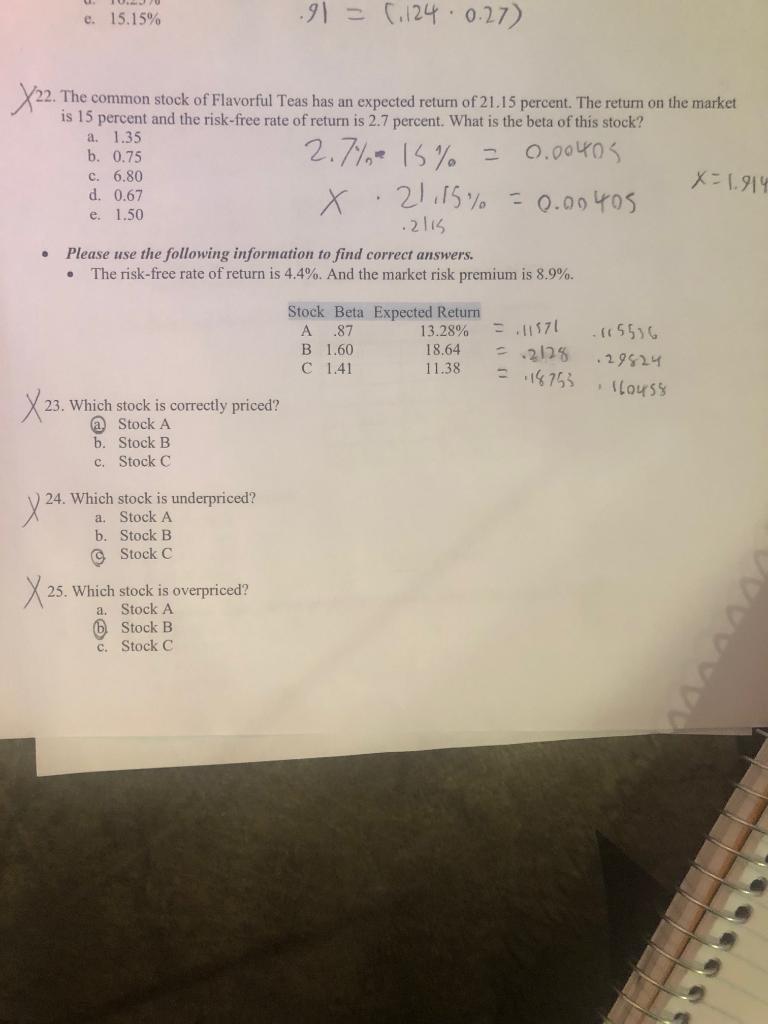

e. 15.15%.91=(.1240.27) 22. The common stock of Flavorful Teas has an expected return of 21.15 percent. The return on the market is 15 percent and the risk-free rate of return is 2.7 percent. What is the beta of this stock? a. 1.35 b. 0.75 c. 6.80 d. 0.67 e. 1.50 2.7%=15%=0.00405x.21.15%=0.00405.2115x=1.91 - Please use the following information to find correct answers. - The risk-free rate of return is 4.4%. And the market risk premium is 8.9%. StockBetaA.87B1.60C1.41ExpectedReturn13.28%18.6411.38.11571=.2128=.187531155)6.29824.160558 23. Which stock is correctly priced? (a) Stock A b. Stock B c. Stock C 24. Which stock is underpriced? a. Stock A b. Stock B (9) Stock C 25. Which stock is overpriced? a. Stock A (b.) Stock B c. Stock C e. 15.15%.91=(.1240.27) 22. The common stock of Flavorful Teas has an expected return of 21.15 percent. The return on the market is 15 percent and the risk-free rate of return is 2.7 percent. What is the beta of this stock? a. 1.35 b. 0.75 c. 6.80 d. 0.67 e. 1.50 2.7%=15%=0.00405x.21.15%=0.00405.2115x=1.91 - Please use the following information to find correct answers. - The risk-free rate of return is 4.4%. And the market risk premium is 8.9%. StockBetaA.87B1.60C1.41ExpectedReturn13.28%18.6411.38.11571=.2128=.187531155)6.29824.160558 23. Which stock is correctly priced? (a) Stock A b. Stock B c. Stock C 24. Which stock is underpriced? a. Stock A b. Stock B (9) Stock C 25. Which stock is overpriced? a. Stock A (b.) Stock B c. Stock C

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts