Question: I need help with #3 A and B. and it also has to be done on excel. Contract # 1 2 3 Size 200,000 200,000

I need help with #3 A and B. and it also has to be done on excel.

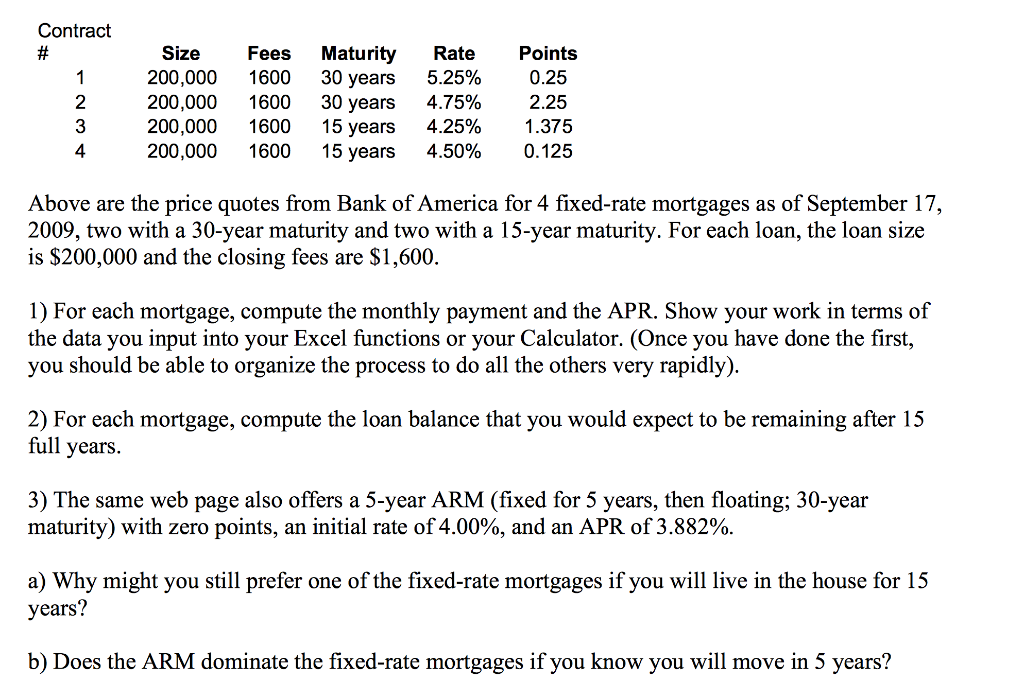

Contract # 1 2 3 Size 200,000 200,000 200,000 200,000 Fees 1600 1600 1600 1600 Maturity 30 years 30 years 15 years 15 years Rate 5.25% 4.75% 4.25% 4.50% Points 0.25 2.25 1.375 0.125 Above are the price quotes from Bank of America for 4 fixed-rate mortgages as of September 17, 2009, two with a 30-year maturity and two with a 15-year maturity. For each loan, the loan size is $200,000 and the closing fees are $1,600. 1) For each mortgage, compute the monthly payment and the APR. Show your work in terms of the data you input into your Excel functions or your Calculator. (Once you have done the first, you should be able to organize the process to do all the others very rapidly). 2) For each mortgage, compute the loan balance that you would expect to be remaining after 15 full years. 3) The same web page also offers a 5-year ARM (fixed for 5 years, then floating; 30-year maturity) with zero points, an initial rate of 4.00%, and an APR of 3.882%. a) Why might you still prefer one of the fixed-rate mortgages if you will live in the house for 15 years? b) Does the ARM dominate the fixed-rate mortgages if you know you will move in 5 years? Contract # 1 2 3 Size 200,000 200,000 200,000 200,000 Fees 1600 1600 1600 1600 Maturity 30 years 30 years 15 years 15 years Rate 5.25% 4.75% 4.25% 4.50% Points 0.25 2.25 1.375 0.125 Above are the price quotes from Bank of America for 4 fixed-rate mortgages as of September 17, 2009, two with a 30-year maturity and two with a 15-year maturity. For each loan, the loan size is $200,000 and the closing fees are $1,600. 1) For each mortgage, compute the monthly payment and the APR. Show your work in terms of the data you input into your Excel functions or your Calculator. (Once you have done the first, you should be able to organize the process to do all the others very rapidly). 2) For each mortgage, compute the loan balance that you would expect to be remaining after 15 full years. 3) The same web page also offers a 5-year ARM (fixed for 5 years, then floating; 30-year maturity) with zero points, an initial rate of 4.00%, and an APR of 3.882%. a) Why might you still prefer one of the fixed-rate mortgages if you will live in the house for 15 years? b) Does the ARM dominate the fixed-rate mortgages if you know you will move in 5 years

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts