Question: I need help with #3 and #5. QUESTION 3 What is year 2 depreciation of a $2,532,971 asset that is depreciated using the MACRS 3-year

I need help with #3 and #5.

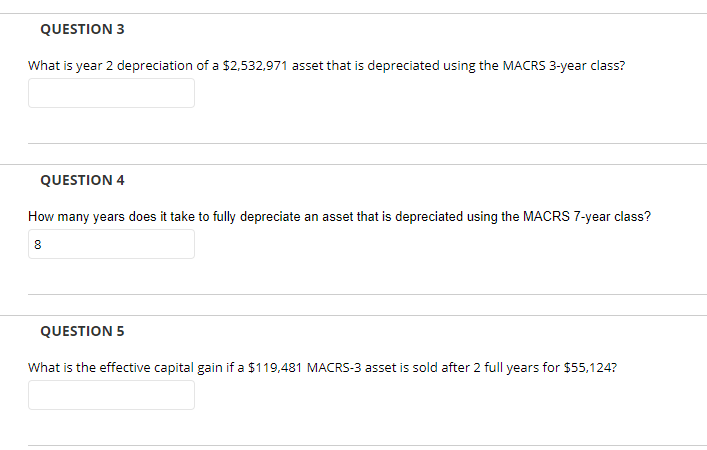

QUESTION 3 What is year 2 depreciation of a $2,532,971 asset that is depreciated using the MACRS 3-year class? QUESTION 4 How many years does it take to fully depreciate an asset that is depreciated using the MACRS 7-year class? 8 QUESTIONS What is the effective capital gain if a $119,481 MACRS-3 asset is sold after 2 full years for $55,124

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts