Question: I need help with 6-9 please Plant assets arc: A. Held for sale. B. Tangible assets used in the operation of business that have a

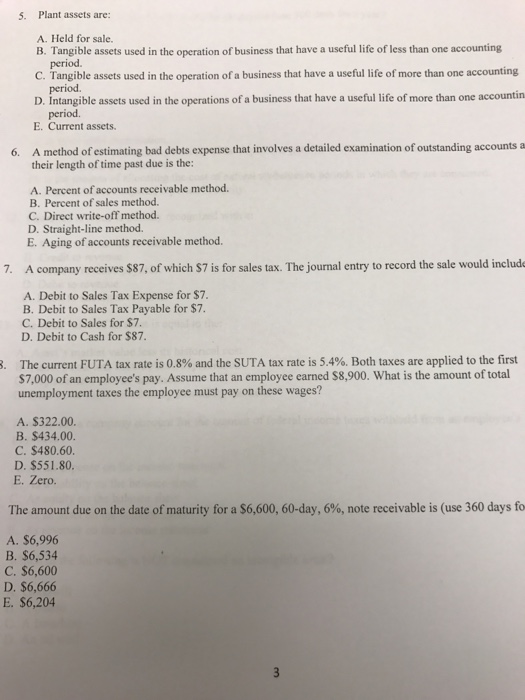

Plant assets arc: A. Held for sale. B. Tangible assets used in the operation of business that have a useful life of less than one accounting period. C. Tangible assets used in the operation of a business that have a useful life of more than one accounting period. D. Intangible assets used in the operations of a business that have a useful life of more than one accounting period. E. Current assets. A method of estimating bad debts expense that involves a detailed examination of outstanding accounts a their length of time past due is the: A. Percent of accounts receivable method. B. Percent of sales method. C. Direct write-oft" method. D. Straight-line method. E. Aging of accounts receivable method. A company receives $87, of which $7 is for sales tax. The journal entry to record the sale would include A. Debit to Sales Tax Expense for $7. B. Debit to Sales Tax Payable for $7. C. Debit to Sales for $7. D. Debit to Cash for $87. The current FUTA tax rate is 0.8% and the SUTA tax rate is 5.4%. Both taxes arc applied to the first $7,000 of an employee's pay. Assume that an employee earned $8, 900. What is the amount of total unemployment taxes the employee must pay on these wages? A. $322.00. B. $434.00. C. $480.60. D. $551.80. E. Zero. The amount due on the date of maturity for a $6, 600, 60-day, 6%, note receivable is (use 360 days for A. $6, 996 B. $6, 534 C. $6, 600 D. $6, 666 E. $6, 204

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts