Question: I need help with 7-10 please :) Consider a ten-year, $1000 bond with an 6% coupon rate and annual coupons is trading with a YTM

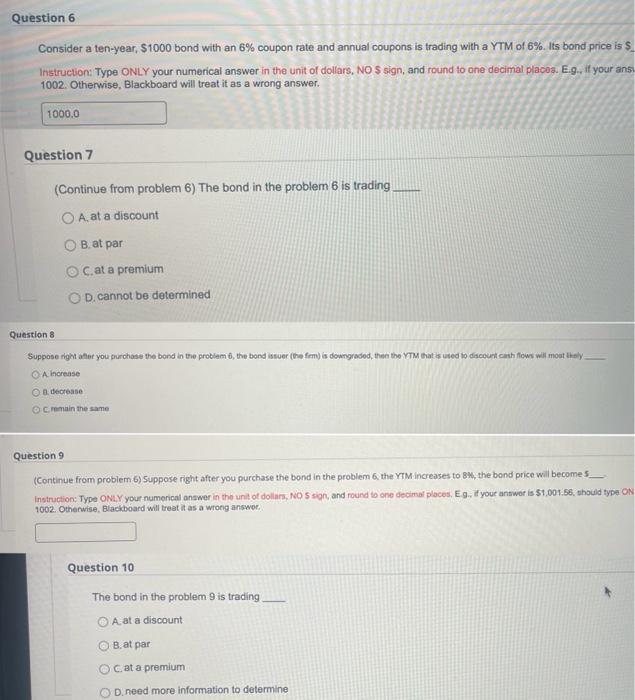

Consider a ten-year, $1000 bond with an 6% coupon rate and annual coupons is trading with a YTM of 6%. Its bond price is $ Instruction: Type ONLY your numerical answer in the unit of dollars, NOS sign, and round to one decimal placos. E.9., if your ans 1002. Otherwise, Blackboard will treat it as a wrong answer. Question 7 (Continue from problem 6 ) The bond in the problem 6 is trading A. at a discount B. at par C. at a premium D. cannot be determined Jestion 8 Suppose right aflet you purchase the bond in the problem 6 , the bond issuer (he femv) is downgraded, then the YTM that is uted is discourt cash flows will moat ihely. A increase a. dectease C. remain the same uestion 9 1002 . Othenwise, Blackboard will treat it as a wrong answor. Question 10 The bond in the problem 9 is trading A. at a discount B. at par C at a premium D. need more information to determine

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts